Ethereum [ETH] nosedives as Shanghai Upgrade gets pushed to April

![Ethereum [ETH] nosedives as Shanghai Upgrade gets pushed to April](https://ambcrypto.com/wp-content/uploads/2023/03/Ethereum-1.jpg.webp)

- The test on Goerli will be the last dress rehearsal for the upcoming Shanghai Upgrade.

- ETH recorded a steep fall on the news of the postponement at press time.

The much-anticipated Shanghai Upgrade that would enable the withdrawal of staked Ethereum [ETH] has been pushed to the second week of April, as decided during the network’s core developers’ call.

Much to the disappointment of stakers who were eagerly looking for an end to the two-year wait, the developers arrived at the consensus that the mainnet launch for the upgrade would happen a month after the Goerli testnet launch which was fixed for 14 March during the call.

One of the developers suggested an earlier date for the Goerli launch as it will allow more time between Goerli and the mainnet launch.

There was a proposal to have Goerli launch on 16 March but it was dropped in favor of 14 March so as to have enough time to analyze and discuss the outcomes on the next core developers call which would fall on 16 March.

The test on Goerli will be the last dress rehearsal for the upcoming Shanghai Upgrade. According to the developers, the Sepolia testnet launch went smoothly barring a few infrastructure-level issues.

Read Ethereum’s [ETH] Price Prediction 2023-24

State of Staking

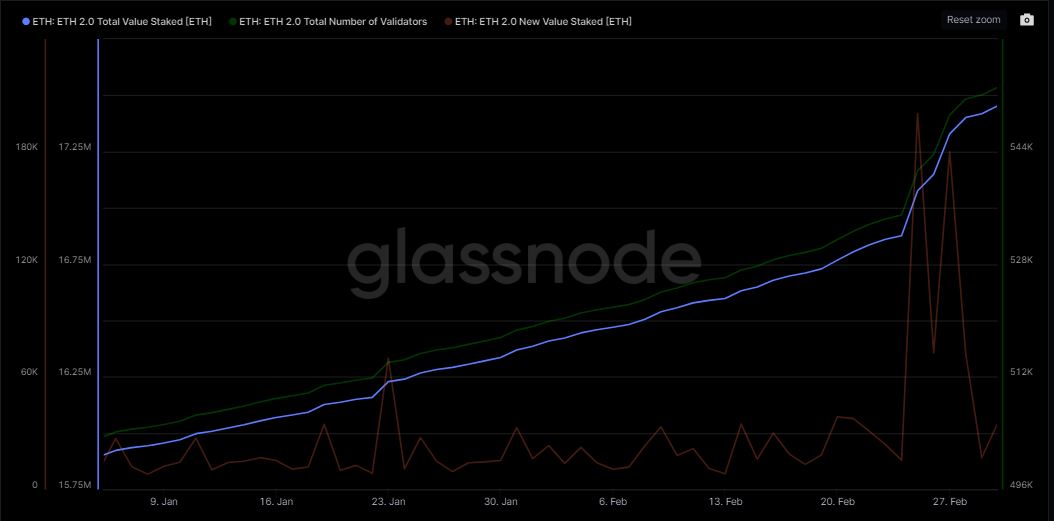

As per data from Glassnode, the overall staking activity on Ethereum saw decent growth over the previous week. At the time of writing, nearly 17.5 million ETH was locked in the network’s smart contracts, representing a week-over-week growth of 3%.

The growth in the total number of validators followed the same trajectory.

However, the rate at which new ETH was being staked plunged 82% over the previous week. This could have been due to a lack of clarity around the Shanghai Upgrade mainnet launch date.

As per Staking Rewards, the total amount of ETH staked at press time represented more than 14% of ETH’s total circulating supply.

Is your portfolio green? Check out the Ethereum Profit Calculator

Negative sentiment steps in

The news of the delay pulled ETH to its lowest value in over two weeks, as per CoinMarketCap. The king of the altcoins plunged 4.64% in the last 24 hours to trade below $1600.

ETH’s Long/Short Ratio dipped below one. Thus, indicating that the number of long positions dropped. This could be due to investors’ bearish outlook toward the coin.