Ethereum [ETH] sharks and whales are not backing away from the coin, here’s why

![Ethereum [ETH] sharks and whales are not backing away from the coin, here's why](https://ambcrypto.com/wp-content/uploads/2023/04/po-2023-04-28T092633.412.png)

- Addresses holding more than 1,000 ETH accumulated more of the altcoin.

- ETH nears $2,000 but overall activity on the network reduced.

Despite being 33.93% down in the last year, Ethereum [ETH] whales and sharks seem to have found no good reason to deter from accumulating the coin. According to on-chain data, the number of addresses holding 1,000, or more ETH increased to 7091, representing a 5.7% rise.

Realistic or not, here’s ETH’s market cap in BTC terms

Furthermore, this action suggested that this group of holders has a long-term bullish outlook, even amid short-term price fluctuations.

Up to the daunting task

Although the price remained relatively stable over the past few months, the Ethereum blockchain itself was involved in a series of significant upgrades.

And usually, when investors perceive that a particular development depicts remarkable improvement, they tend to stick with the project and contribute more. So, this could have also enabled the decision to accumulate.

However, data from Santiment showed that Ethereum’s development activity has subdued. At press time, the metric was down to 53.

For context, the development activity measures the commitment of developers to polish the working system of a project. Therefore, the value mentioned above implies that major innovation around the Ethereum blockchain has slowed down.

But it was an entirely different scenario with the Market Value to Realized Value Ratio (MVRV). At press time, the 365-day MVRV ratio of Ethereum was at 22.79%. This means that the sharks who were committed to buying ETH made more in profits over the last year.

At the same time, the current metric condition could serve as an obstruction to a further hike if ETH pushes upwards. However, there were talks of a bull market resumption which could negate speculation around ETH being overvalued at the MVRV spot.

Sometimes, appearances are deceptive

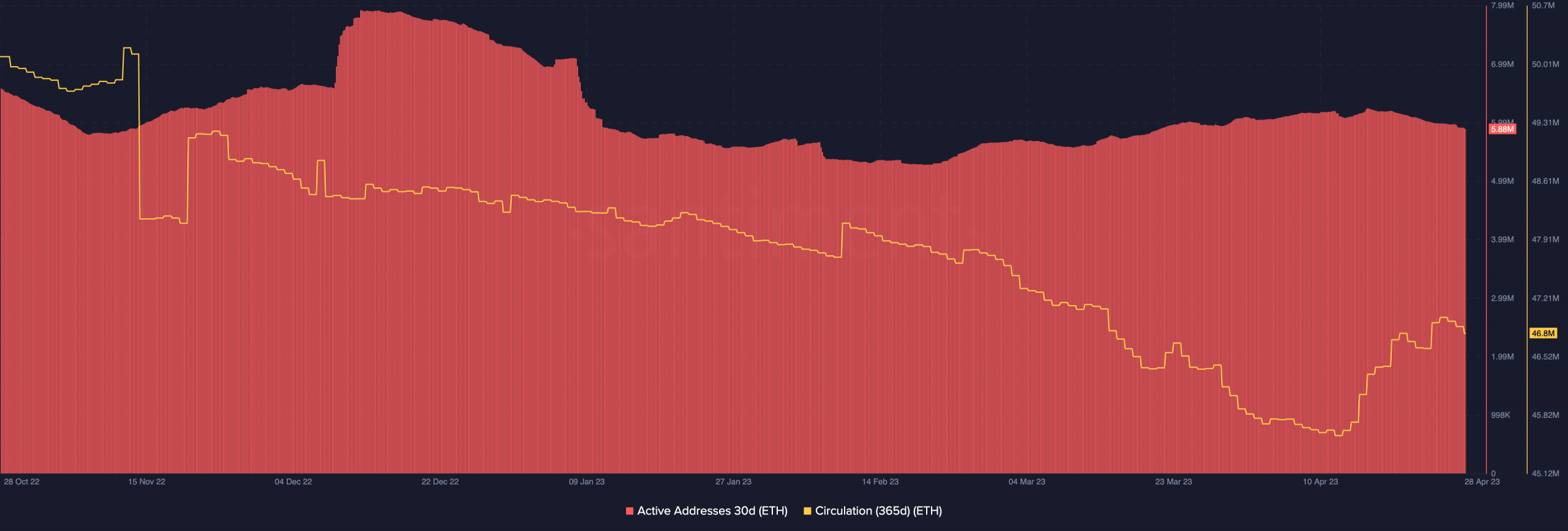

While whales have turned to spot buying opportunities, the overall market did not share the same sentiment. This was because the active addresses in the last 30 days dropped from 7.9 million to 5.8 million.

Active addresses indicate the daily level of participation and speculation around a token. Therefore, the decrease is a reliable indication that activity has slowed down on the Ethereum network. Often time, this serves as a signal that the general interest in a cryptocurrency is low.

Read Ethereum’s [ETH] Price Prediction 2023-2024

With respect to circulation, it was not surprising that ETH tremendously fell for most of 2022. However, the condition at the time of writing showed an improvement.

At 46.8 million, the rise in circulation signifies an increase in the use of ETH. The coin exchanged hands at $1,800, a 4.41% increase in the last 24 hours.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)