Ethereum [ETH] stuck at $1,700 as bulls need to overcome this Fib level

![Ethereum [ETH] stuck at $1,700 as bulls need to overcome this Fib level](https://ambcrypto.com/wp-content/uploads/2023/02/shubham-dhage-geJHvrH-CgA-unsplash-scaled.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH has been rejected at $1,743 and faces OB at a 78.6% Fib level.

- Fluctuating open interest (OI) could keep the above challenge going.

After the release of US CPI, investors’ risk-on approach has seen Ethereum [ETH] post a 17% hike in the past four days. It reached a new high of $1,743 after Bitcoin [BTC] hit the $25k mark.

However, a sharp correction occurred after BTC lost the psychological $25,000 mark. Although the bulls of ETH found steady support at the 61.8% Fib level, the obstacle remained at the 78.6% Fib level.

Read Ethereum [ETH] Price Prediction 2023-24

The hurdle of the 78.6% Fib level: Are further gains unlikely?

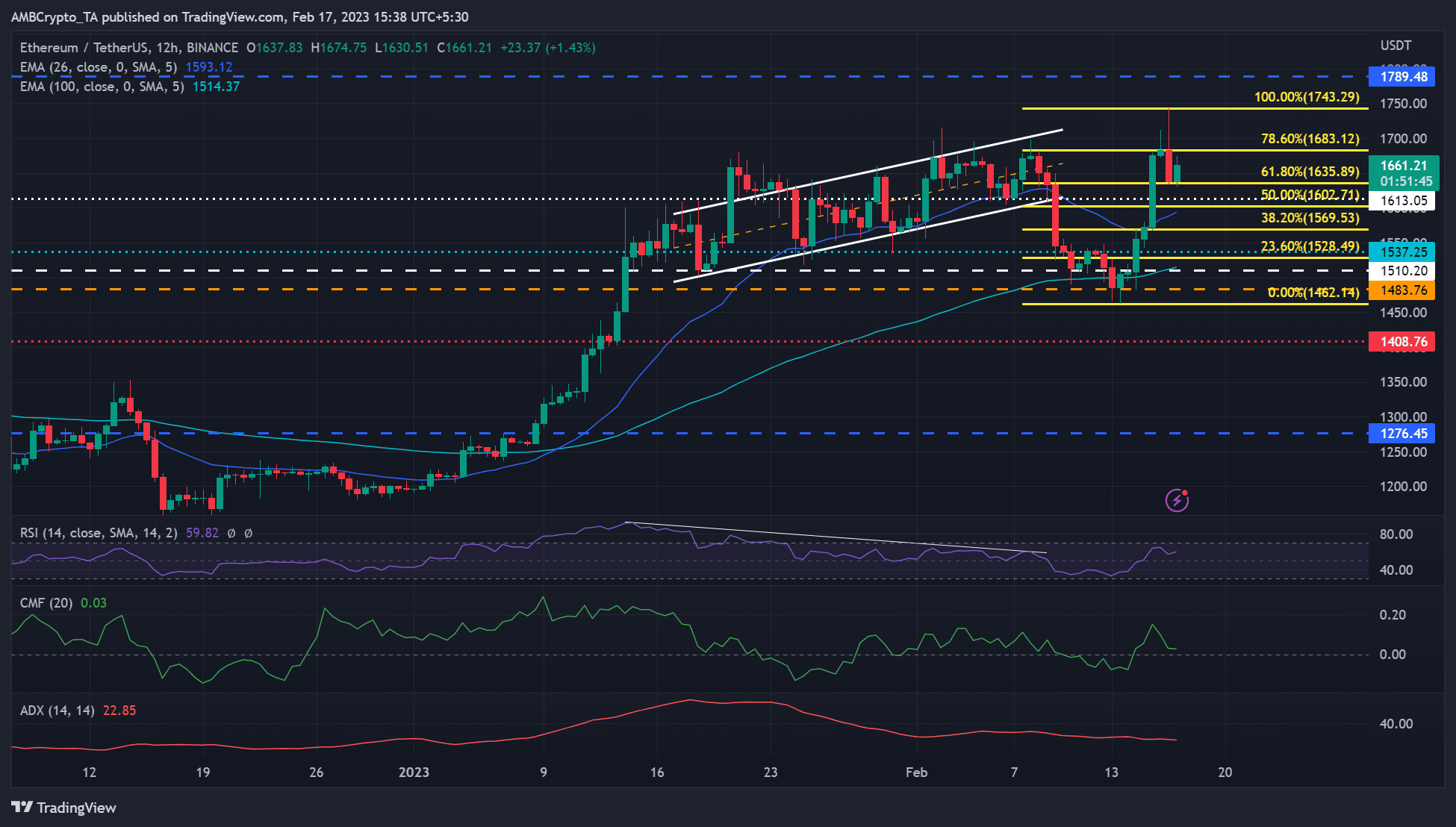

Despite an extended rally after 10 January, the upward momentum of ETH has weakened on the 12-hour chart. This is highlighted by the bearish RSI divergence and the falling Average Directional Movement Index (ADX).

The sharp decline from the ascending channel (white) turned the market into bearish, but the zone between $1,483 and $1,510 kept the drop in check, allowing the bulls to post a 17% gain. ETH could target the overhead resistance of $1,743 if BTC holds the $23.5k support and continues to rise.

However, the bulls need to overcome the bearish order block (OB) at the 78.6% Fib level of $1,683 – near $1,700. This level has blocked the further uptrend of ETH since mid-January. Another critical resistance level to watch out for if ETH clears this hurdle is the September high of $1,790.

A break below the swing low of $1,483 would invalidate the bullish thesis above. This could lead the bears to devalue ETH towards $1,400 or $1,276.

ETH saw a short-term accumulation, but OI fluctuations could complicate things

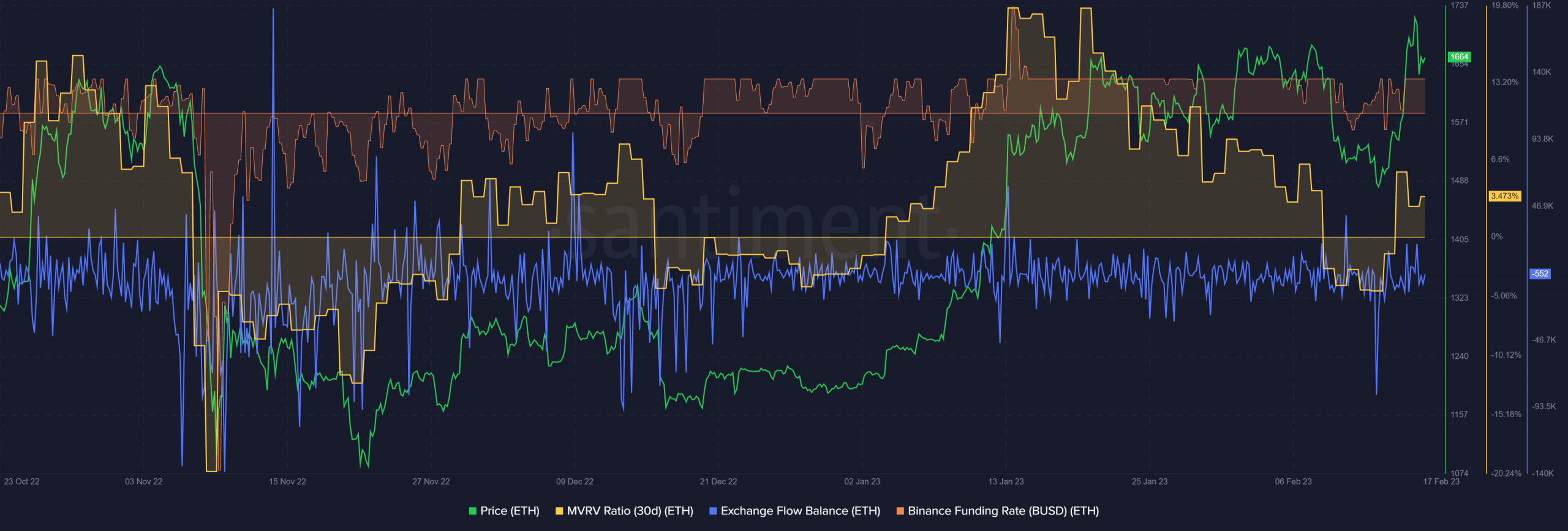

At press time, more ETH was out of the exchanges than in, as shown by the negative exchange flow balance. This indicates that there was less ETH for sale on the exchanges, so there was short-term accumulation.

In addition, the recent Ethereum upswing has reduced holder losses as the 30-day MVRV turned from positive to negative. The demand described above is also reinforced by a positive Funding Rate, indicating bullish sentiment in the derivatives market.

Is your portfolio green? Check out the ETH Profit Calculator

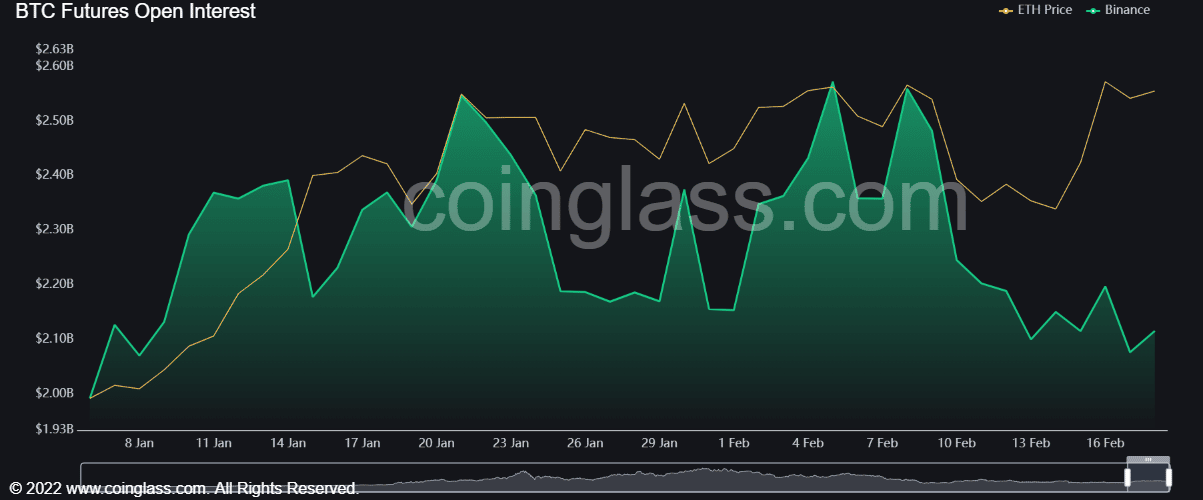

However, the open interest (OI) fluctuations highlighted by Coinglass could complicate the bulls’ efforts. In contrast to the January rally, which was accompanied by a steady rise in OI, the recent upswing has been characterized by fluctuations.

A steady rise in OI and a break above the 78.6% Fib level could signal strong upside momentum capable of retesting the $1,743 and other resistance levels.