Ethereum [ETH] surges dramatically since Shapella, but how long will the party last

- ETH has gained more than 9% since the Shapella Upgrade went live.

- The share of staked ETH in profit was more than 50% at the time of writing, bound to increase further.

The successful launch of the Shapella Upgrade was an important milestone in the growth trajectory of Ethereum [ETH]. By allowing stakers to withdraw their staked ETH, the development closed the loop on the key aspects of the proof-of-stake (PoS) transition that couldn’t make it to the Merge last year.

Read Ethereum’s [ETH] Price Prediction 2023-24

However, unlike the Merge, which was followed by a significant price drop, Shapella put fears of sell-off at bay as ETH has gained over 9% since the event at the time of writing, per blockchain analytics firm Kaiko.

#TheMerge was more of a sell the news event with traders buying before and selling after.

#Shapella seems to be the other way around, #ETH is up more than 10% over the past two days. pic.twitter.com/ZbewyTJiyn

— Kaiko (@KaikoData) April 14, 2023

Bullish sentiment strengthens

Since the Shapella Upgrade, ETH’s derivatives market became a beehive of activity. As per Kaiko, the trading on options market surged with call volumes comprehensively exceeding puts. Investors purchase calls when they anticipate an increase in the price of ETH.

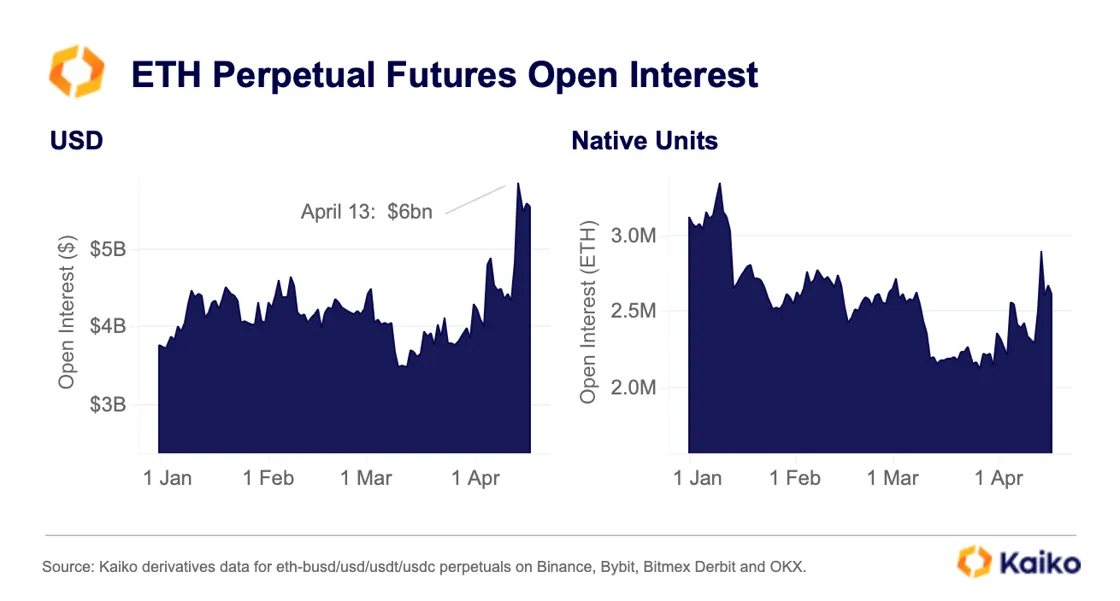

Similarly, the demand on futures exchanges also increased as the Open Interest (OI) reached a multi-year high of over $6bn, just a day after the upgrade.

Moreover, the funding rate, or the value required to hold bullish long or bearish short positions, was positive for ETH across most exchanges, as per data from Coinalyze. This added more strength to ETH’s bullish narrative.

Will sell pressure increase?

Kaiko, in its analysis, noted that the ETH-USD pair on Coinbase has seen more sell orders than buys, indicating that users cashed out their redeemed ETH.

Moreover, the share of staked ETH in profit was more than 50% at the time of writing, data from Dune revealed. With a continuing rise in ETH’s price, a bigger share of deposited ETH will become profitable, which could then lay the ground for mass selling.

As of this writing, the staking ratio of ETH was 14.5% as per Nansen, down from 15% at the time of the upgrade. In the last 24 hours, ETH saw net staking inflow of more than 57k with over 37k ETH getting withdrawn.

Is your portfolio green? Check out the Ethereum Profit Calculator

Another dynamic which required attention was Ethereum’s correlation with Bitcoin [BTC], which plunged to a three-month low after the Upgrade.

For most of the past year, the correlation between the two was near 90%. This suggested that ETH was being seen as a fundamentally different asset, and could be shielded from the fluctuations of the king coin in the future.