Ethereum [ETH] takes a bigger-than-ever hit amid its recent capitulation

Ethereum is going the other way again after its latest drop today. The largest altcoin dropped below $1,800 for the second time this month and is looking to further dive into the proceeding support level. The tough love comes at a testing time with the major cryptocurrencies in disarray.

Ethereum has continued the trip down south and has broken through the support level of $1,800 again in May. Currently trading at $1,727, it is down by more than 10.5% at press time. The last time ETH dropped below $1,800 was back in July 2021.

The crypto market is itself in a frenzy right now with $520 million being liquidated yesterday. This points to growing insecurities in the market with macro headwinds sailing into the “red” zone. With Bitcoin itself below $30k, a negative threshold is already set for the crypto market. The stock market officially entered bear territory for the first time since early 2020.

As per Time, experts say the crypto market is reflecting heightened volatility that comes with war, continued surging inflation, and shifting U.S monetary policy. Experts also point to other factors like the crypto market tracking the stock market, more mainstream adoption, and slumping prices in recent months as contributing to what we’re seeing with crypto prices right now.

The warning signs cannot be ignored with metrics also suggesting a period of extended turmoil for Ethereum. The investor sentiment is becoming more transparent recently through transaction activities among other signals.

ETH busted

The worrying signs are for everyone to see in the metrics for Ethereum. The Relative Strength Index (RSI) is showing a developing trend of bearish activity. The index value here stands at a lowly 29.4 which effectively puts Ethereum in the “oversold” category. Despite the blemishes, this is an ideal time for accumulation with the asset available at discounted prices.

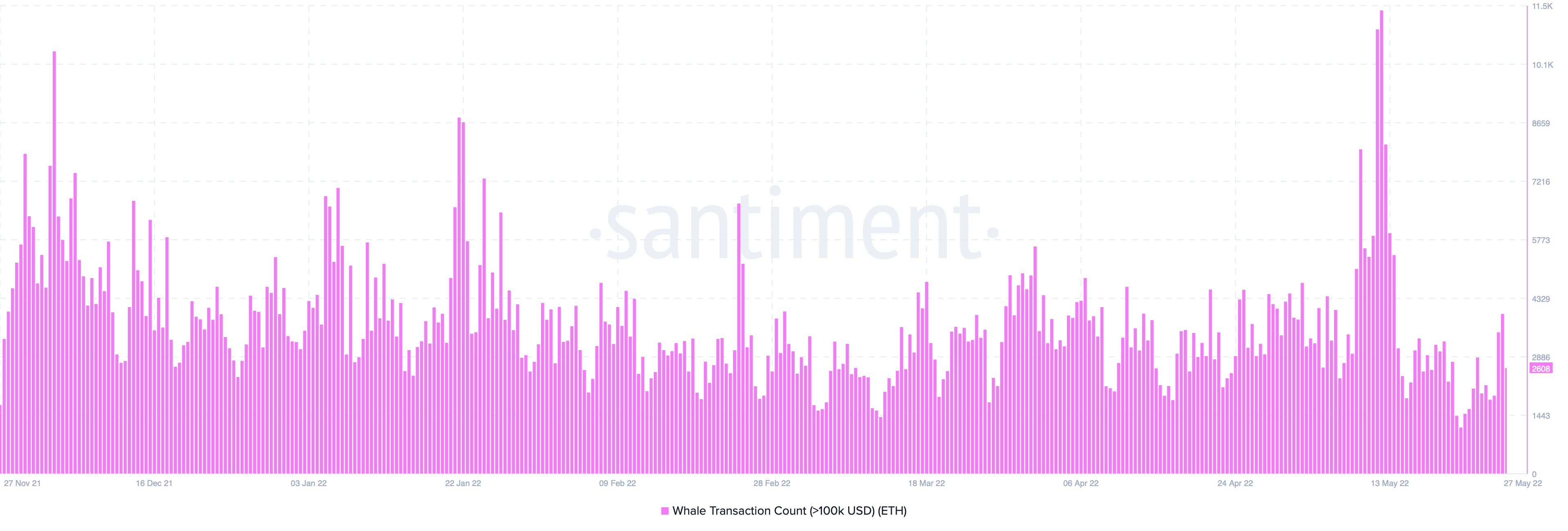

There was high activity observed on the network with the on-chain volume up by more than 100% in the past 24 hours. One reason for this is the extremely low volume seen in past days. Another reason is the whale activity, which has started to gain momentum in recent days after shooting up to new highs during the Terra collapse.

Finally, the MVRV Ratio (30 days) is also showing signs of a downtrend on the Ethereum blockchain. The ratio is far into the oversold zone with a possible recovery still distant.

Investors must now hold on to their seats and of course, their assets as they sail through these harsh times of volatility.