Ethereum [ETH]: To avoid being a part of exit liquidity, read this

![Ethereum [ETH]: To avoid being a part of exit liquidity, read this](https://ambcrypto.com/wp-content/uploads/2022/11/eth.jpg)

- Ethereum whales begin coin distribution as alt’s price continues to fall.

- Most ETH holders have held at a loss since the FTX collapse, and investors have since lost conviction of any positive price growth in the interim.

As the general cryptocurrency market makes an attempt to recover following FTX’s sudden collapse, top whale addresses holding the leading altcoin Ethereum [ETH], have begun coin distribution.

Read Ethereum’s price prediction 2023-24

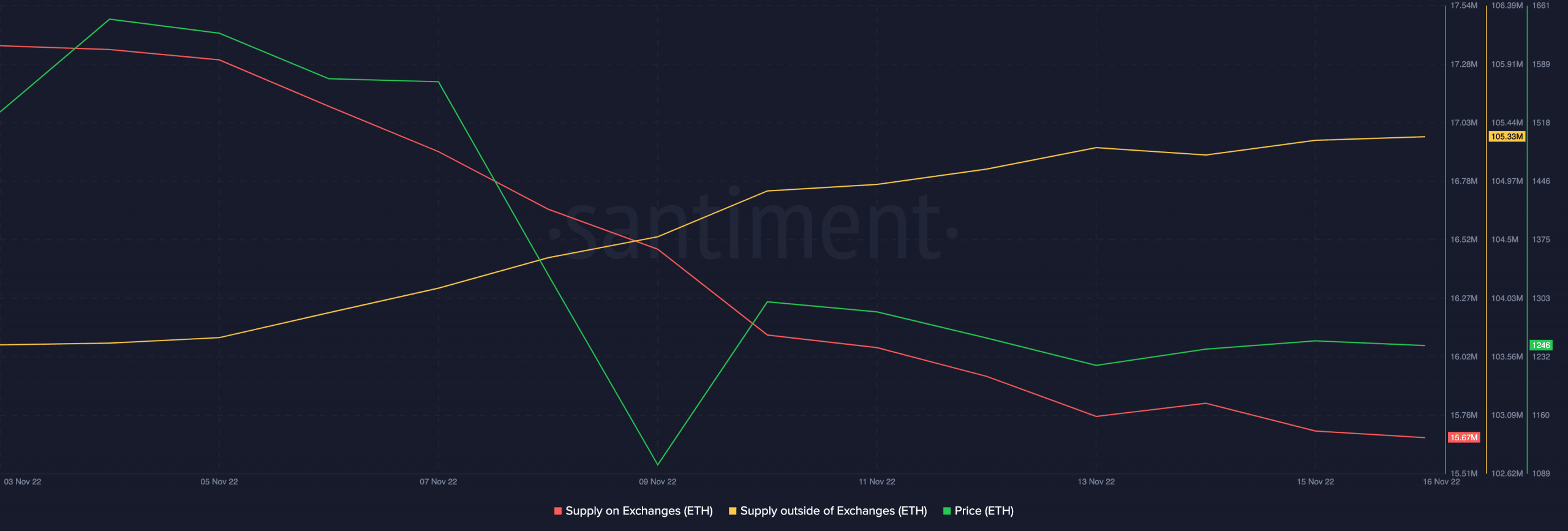

Data from the on-chain analytics platform Santiment revealed that ETH addresses holding more than 100,000 ETH coins have collectively dropped their holdings since 4 November.

As of this writing, this cohort of ETH investors was down to 41.64% for the first time in nine months.

What else has happened since 4 November?

Between 4 November and 7 November, the alt’s price rallied by 5%. However, the unfortunate incident that followed due to the collapse of FTX caused ETH’s price to spiral downwards. It traded for as low as $1,083 on 10 November, data from CoinMarketCap revealed.

At press time, the alt exchanged hands at $1,250.05, having suffered an 18% price decline since 4 November.

Interestingly, as the alt’s price fell, on-chain activity revealed that coin accumulation climbed. According to data from Santiment, ETH’s supply on exchanges declined by 10% since 4 November. Conversely, the alt’s supply outside of exchanges climbed by 1% within the same period. This showed an accumulation trend as coin distribution reduced.

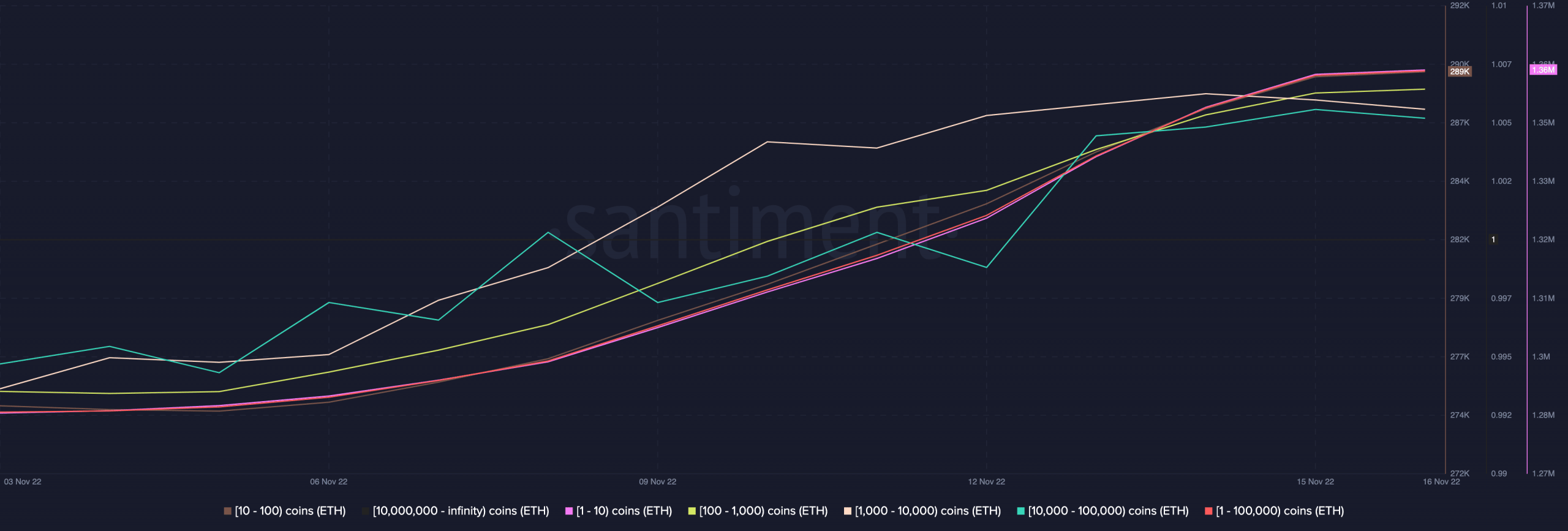

While ETH whales (+100,000) have continuously let go of their holdings since 4 November, data from Santiment revealed that most of the coin accumulation since then has been by addresses that hold between one to 100,000 ETH coins.

As of this writing, the count of these addresses sat at 1.69 million, having grown by 5% in the last 12 days. While this is notable, it might not be enough to effectively prop up the alt’s price amid the general decline in the cryptocurrency market.

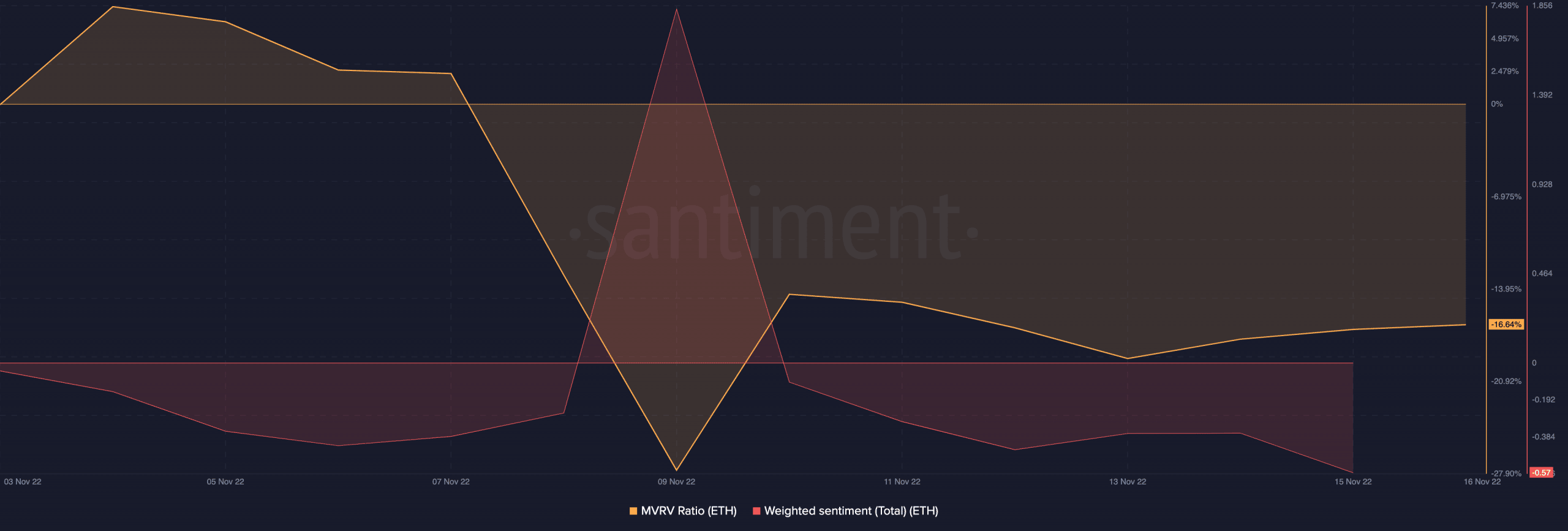

With worsening conditions in the broader cryptocurrency market, negative sentiment continued to trail the leading alt. At press time, ETH’s weighted sentiment was -0.57. A few days after FTX collapsed, investors’ convictions dwindled, and market sentiment immediately turned negative.

In addition, holders have since logged losses on their investments, as ETH’s MVRV ratio showed. At press time, this was pegged at -16.64%.

Look out for this in the meantime

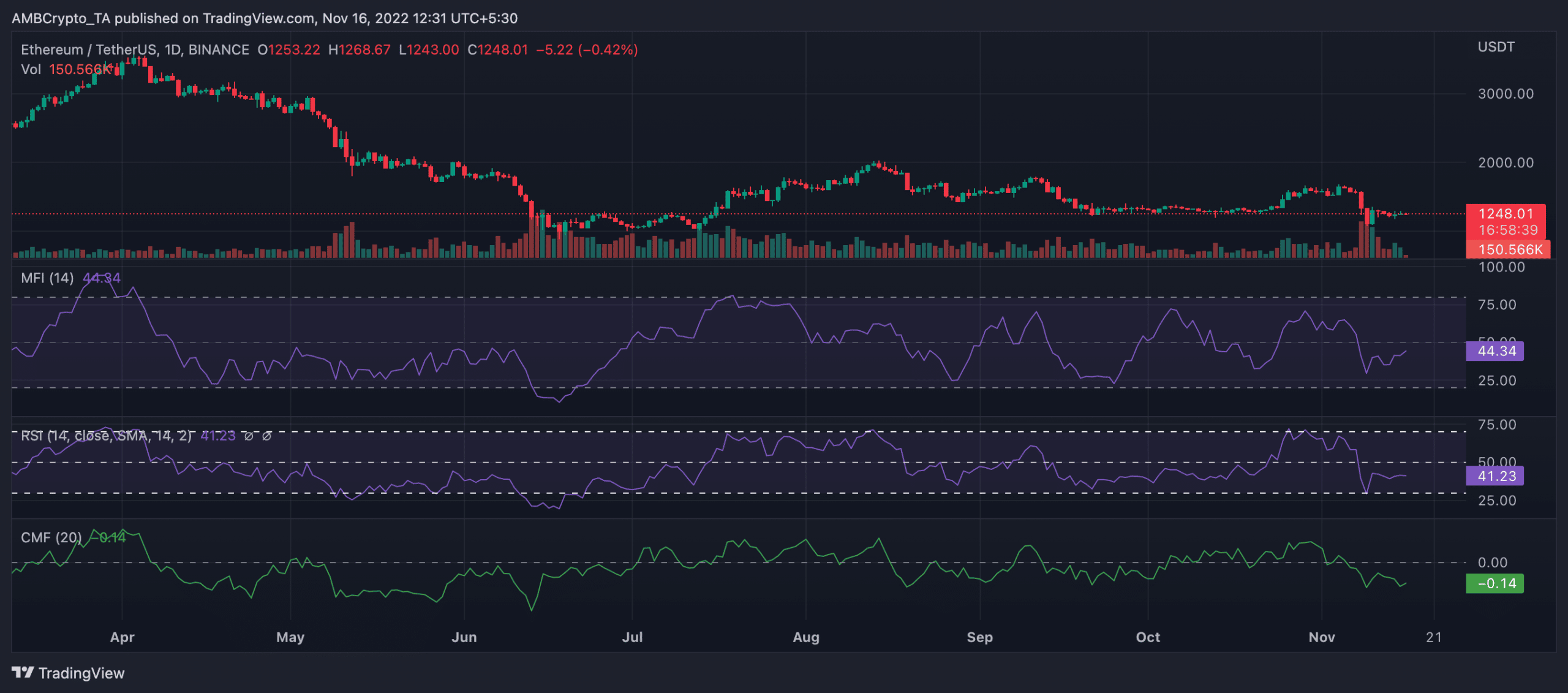

At the time of writing, ETH exchanged hands at $1,250.05. However, its price dropped by 1% in the last 24 hours, and trading volume was also down 21%.

On a daily chart, price movements revealed a decline in buying pressure. ETH’s Relative Strength Index (RSI) and Money Flow Index (MFI) were positioned beneath their respective neutral zones in downtrends. The RSI was 41.23, while the MFI was 44.34.

The dynamic line (green) of ETH’s Chaikin Money Flow (CMF) was also stationed beneath the center line at -0.14, showing that selling pressure rallied as more investors sought safety.