Ethereum [ETH] whales stack up, but is this enough for a level retest?

- ETH whales lead the charge in recent rally.

- Short squeeze turbocharges ETH’s momentum after exiting bear trap.

Ethereum [ETH] concluded a bearish second week of February, but the tide was changing at press time. The crypto market delivered a bullish performance over the last two days and ETH was not left behind.

Read Ethereum’s [ETH] Price Prediction 2023-24

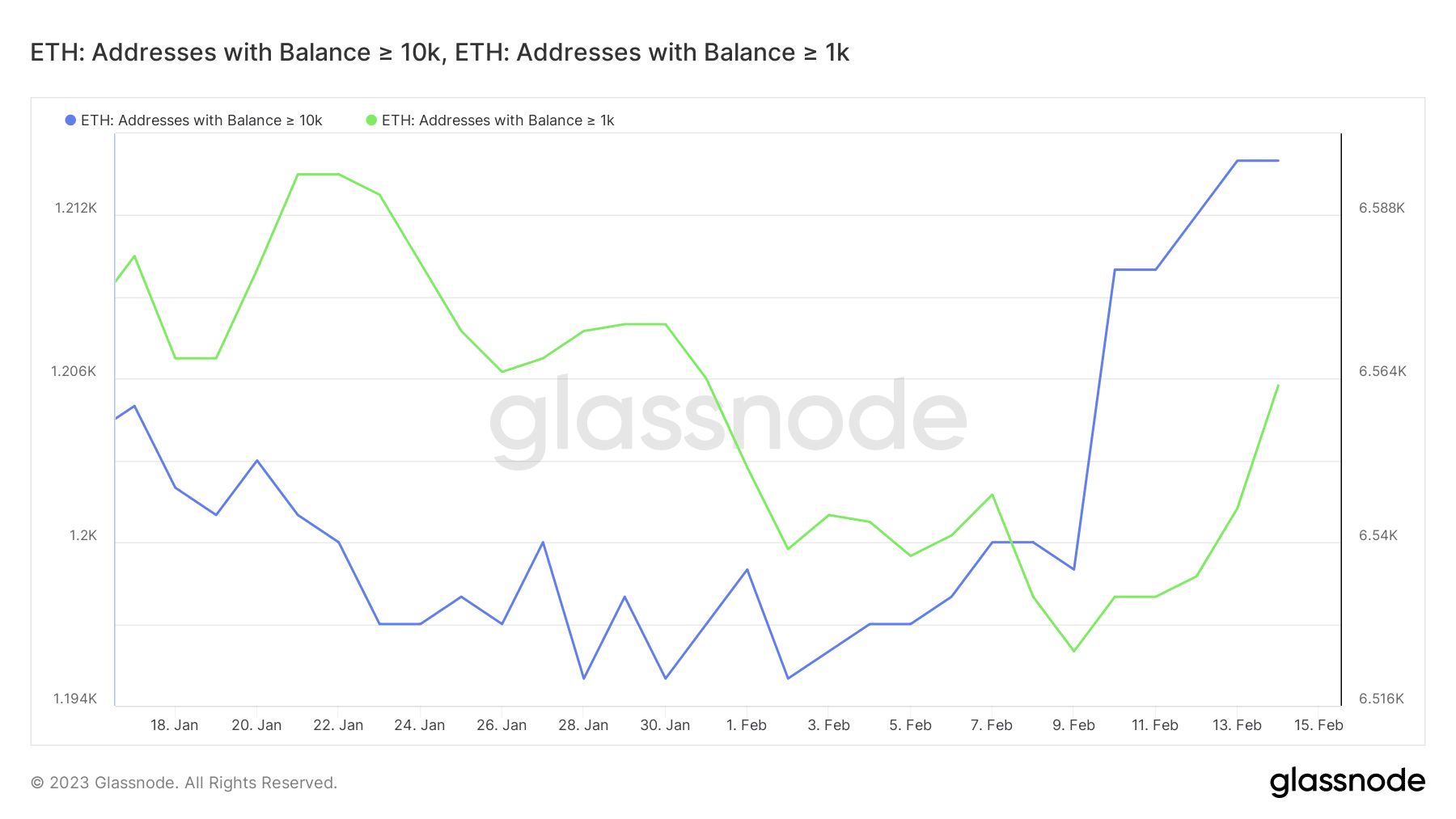

While ETH bulls have reclaimed dominance, latest alerts have revealed the grip that they had over the market at the time of writing. As per Glassnode, the number of addresses holding a minimum of 10,000 ETH reached a four-week peak on 15 February. In other words, ETH whales have kicked their accumulation into high gear.

? #Ethereum $ETH Number of Addresses Holding 10k+ Coins just reached a 1-month high of 1,216

View metric:https://t.co/paW9ojeWBw pic.twitter.com/UNk8h5T8Z2

— glassnode alerts (@glassnodealerts) February 15, 2023

Addresses holding at least 1,000 ETH also demonstrated something similar, as the metric grew to its highest point since the start of February 2023. This confirmed that whales were accumulating, thus sustaining the trend observed in January 2023.

The state of ETH demand

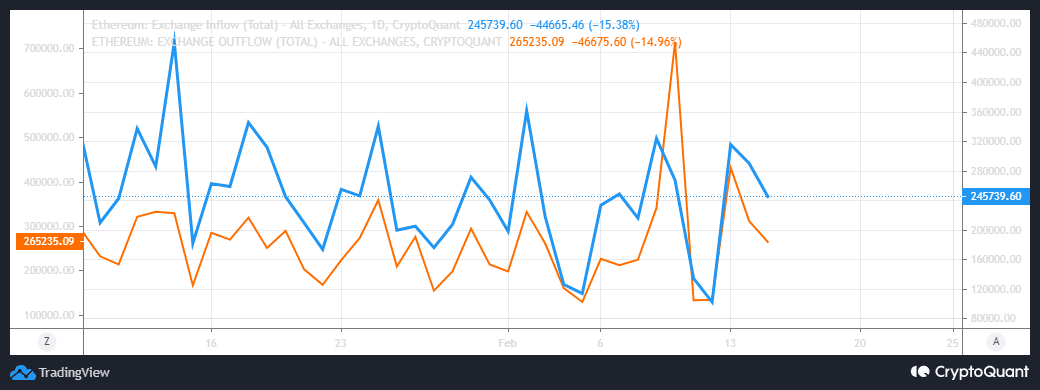

A look at ETH’s exchange flows revealed that there was still significant sell pressure at press time, implying that several investors were bearish. But, the overall situation, as far as exchanges were concerned, was that there was a higher net outflow.

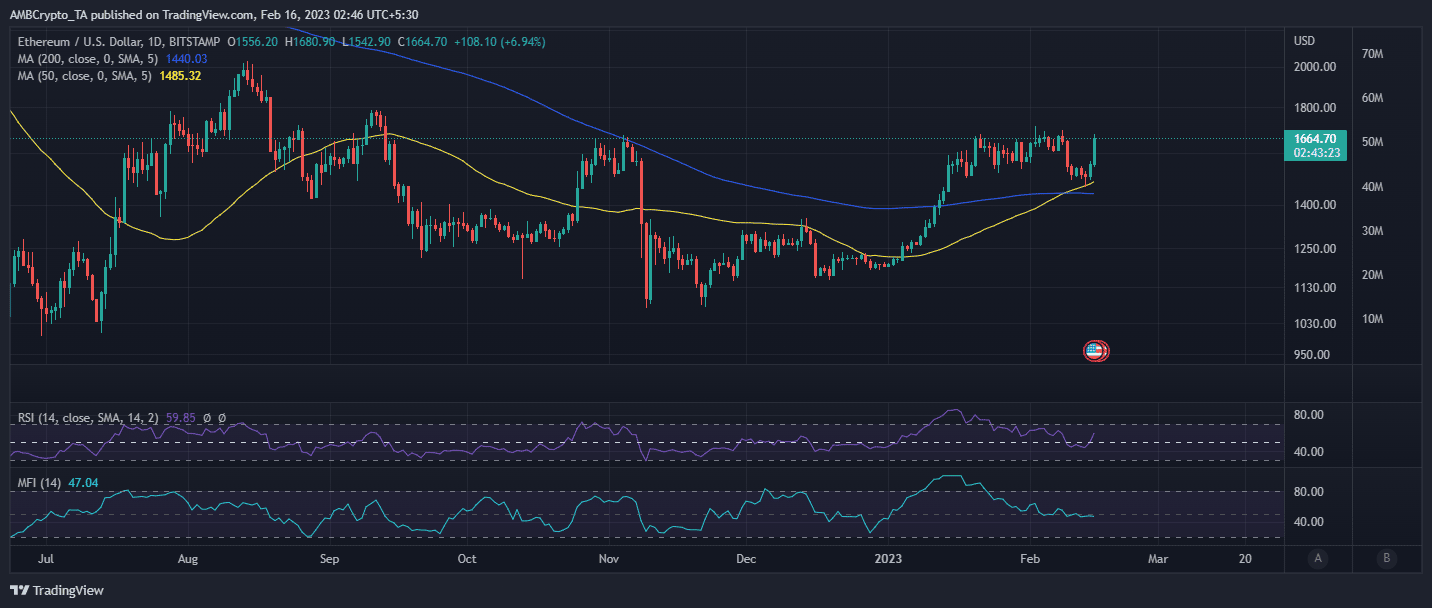

The higher exchange outflows coupled with strong demand from whales have yielded a noteworthy impact on ETH’s price. It pulled off an 11.48% rally to its press time price of $1665.30. However, this upside puts it within the same range as the resistance level, where it has failed to break through in the last three weeks.

ETH’s ability to sustain the bullish momentum will depend on whether it can maintain the demand. An increase in sell pressure near the resistance will signify a higher probability of a sell wall forming again. On the other hand, the bulls may aim to push higher by sustaining strong demand.

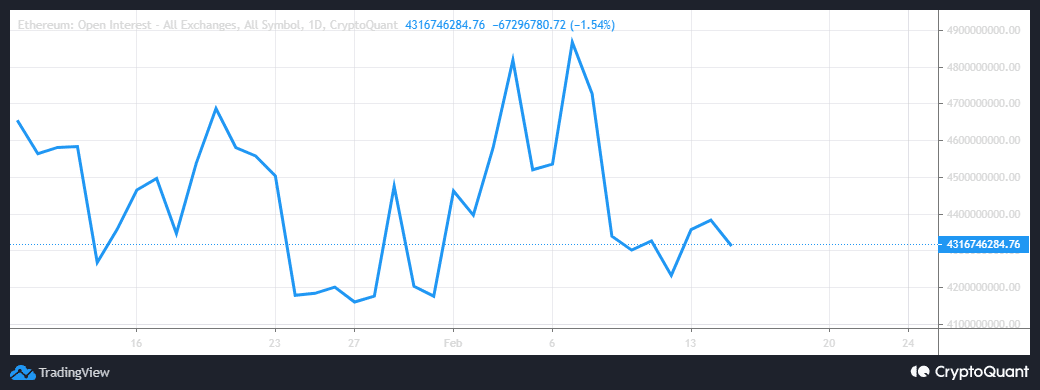

One of the ways to track demand is to look into the demand from the derivatives market. ETH’s open interest metric registered an uptick between 12 – 14 February. It has since reverted to the downside, suggesting that derivatives demand was slowing down at the time of writing.

Another bearish retracement might be on the cards for ETH if the spot market mimics the above observation in the derivatives market. On the other hand, ETH’s performance so far this month underscores a bear trap which may explain the current rally.

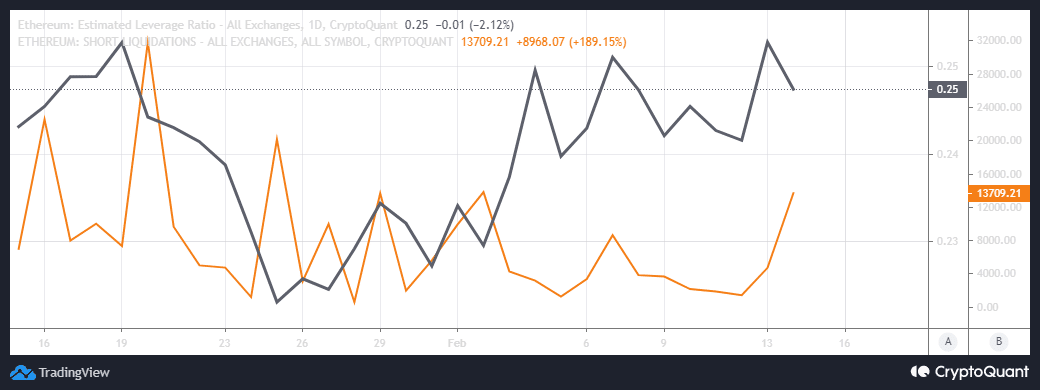

ETH’s bearish price action in the second week of February was bearish. This may have created a false expectation of more downside, hence an increase in leveraged short positions.

Is your portfolio green? Check out the ETH Profit Calculator

The chart above signified a surge in the estimated leverage ratio, which peaked on 13 February before pivoting. This pivot marked the end of the recent bearish pullback, after which traders exited their leveraged positions. This confirmed that leveraged short traders were exiting their positions, and that is why short liquidations were on the rise.

The above observation also confirmed that the momentum in the market was partly fueled by a short squeeze at press time. Thus, the jury is still out on whether ETH would sustain its momentum.