Ethereum [ETH]: Whales swim away as selling pressure rises

![Ethereum [ETH]: Whales swim away as selling pressure rises](https://ambcrypto.com/wp-content/uploads/2023/02/kanchanara-vu13QDlTQyU-unsplash-scaled-e1677055153930.jpg)

- Ethereum whales move away from ETH as MVRV ratio increased.

- Validators and retail investors continued to support Ethereum.

According to a 22 February tweet by Glassnode, large addresses have started selling their Ethereum [ETH]. New data suggested that addresses holding over 1000 ETH reached a one-month low.

? #Ethereum $ETH Number of Addresses Holding 1k+ Coins just reached a 1-month low of 6,507

View metric:https://t.co/iDNXAbbLRt pic.twitter.com/Xbq7RFNExY

— glassnode alerts (@glassnodealerts) February 21, 2023

Read Ethereum’s [ETH] Price Prediction 2023-2024

Selling pressure rises

Large addresses selling their Ethereum may be a good thing, as it could make the network more decentralized. However, if this trend of large addresses exiting their positions was to continue, it could impact ETH’s prices negatively.

One reason why whales were observed to be selling their ETH could be due to the high MVRV ratio of Ethereum at press time. According to Glassnode’s data, the MVRV ratio for Ethereum reached a one-month-high.

? #Ethereum $ETH MVRV (1d MA) just reached a 9-month high of 1.251

View metric:https://t.co/6HtdqX8ILX pic.twitter.com/gCLFjm9q8F

— glassnode alerts (@glassnodealerts) February 21, 2023

A high MVRV ratio suggested that most ETH holders would make a profit if they sold their holdings. This would create selling pressure on a lot of addresses. Even though the selling pressure was high, retail investors continued to HODL.

Along with that, there was high activity on the network as well. This was showcased by the increasing fees paid off on the Ethereum network.

? #Ethereum $ETH Total Fees Paid (7d MA) just reached a 8-month high of $290,421.82

View metric:https://t.co/ck7taVmbWM pic.twitter.com/nN7nOSIOde

— glassnode alerts (@glassnodealerts) February 20, 2023

ETH investors stay hopeful

Another reason why the retail investors were interested in Ethereum could be due to its negative issuance. A negative net issuance indicates that the total supply of the cryptocurrency has decreased over a time period. A negative net issuance may lead to a scarcity of coins and potentially increase the value of the cryptocurrency in the future.

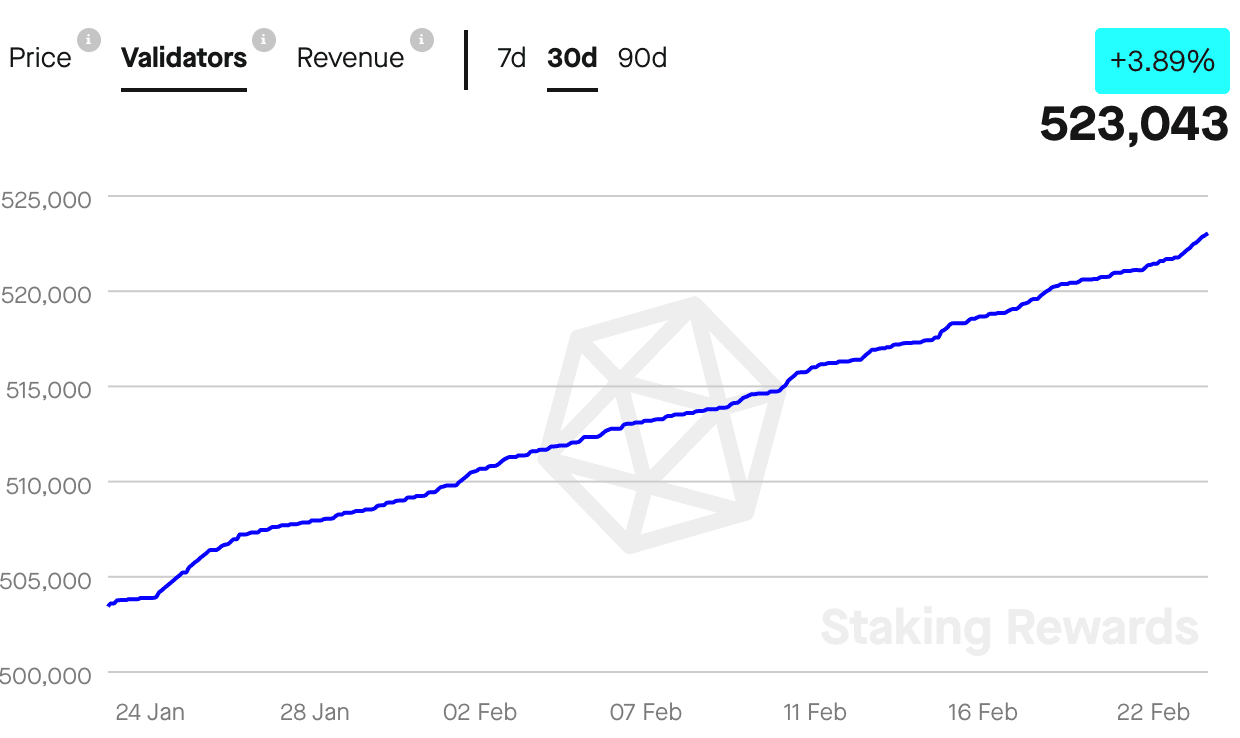

Along with the retail investors, the number of validators on the Ethereum network increased as well. According to Staking Rewards, the number of validators on the Ethereum network grew by 3.89% in the last 30 days. The high number of validators on the network would be due to the revenue being generated by them.

How much are 1,10,100 ETHs worth today?

Over the last month, the revenue generated by Ethereum validators increased by 38.08%, which translated to $1.91 billion worth of revenue at press time.

Overall, despite whales moving away from ETH, retail and staker interest continued to stay strong.