Ethereum

Ethereum faces downward pressure as whale dumps $12 mln ETH

What’s next for ETH price amid intense selling from ICO-era whale?

- An ICO-era whale has dumped $12 million ETH on Kraken.

- ETH’s market sentiment and demand were still weak.

Ethereum [ETH] recorded key sell pressure from a notable whale from the 2017 ICO (initial coin offering) era.

According to analyst EmberCN, the whale received 150,000 ETH (worth) through the ICO.

However, on the 8th of October, the entity transferred 5K ETH ($12.22 mln). Since September, the whale has reportedly dumped over $113 million ETH (45K coins), per the analyst.

“The whale who received 150,000 ETH through the ICO transferred another 5,000 ETH ($12.22M) to Kraken 4 hours ago. He has sold 45,000 ETH ($113.2M) in the past two weeks, with an average price of $2,516.”

Despite the latest sell-off, the whale still held over $200 million worth of ETH.

ETH’s price reaction

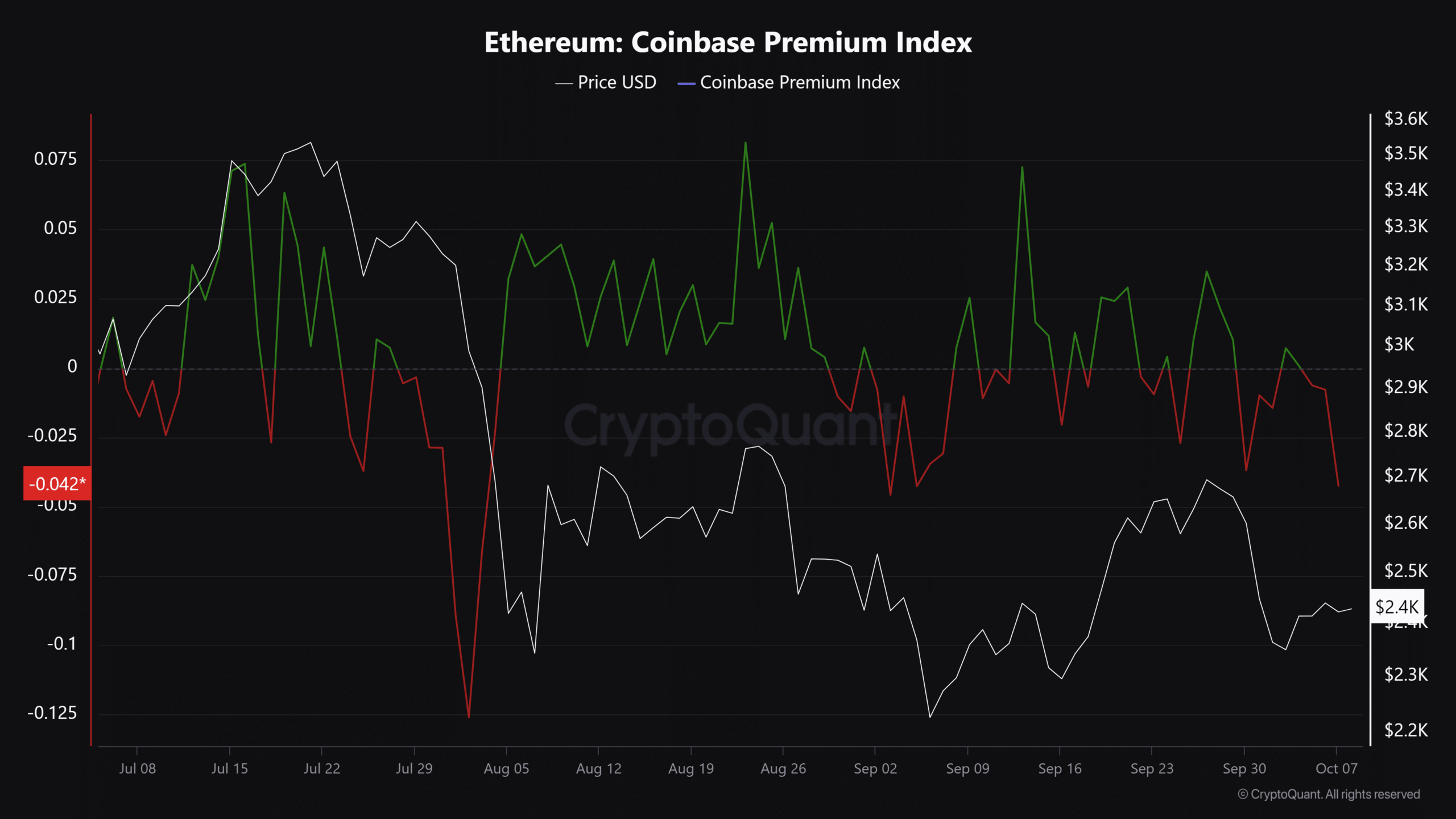

Interestingly, the whale’s dump mirrored the overall weak demand for ETH from U.S. investors. As illustrated by the negative reading on the Coinbase Premium Index, there was little interest in ETH at press time.

That said, the low demand could delay the expected strong rebound for ETH following the recent plunge below $2500.

In the short term, whale order data and liquidation heatmaps suggested that $2400 and $2550 were crucial targets to watch.

If a liquidity grab ensued, considerable long positions at $2400 could be liquidated (bright cluster). This could attract price action.

On the other hand, significant overhead short positions were building near $2450 and $2550.

Whale order analysis data supported the above liquidation data. Notably, at press time, the Binance exchange had a sell wall at $2500-$2520 (red lines) and a buy wall at $2400 (green lines).

On lower timeframe charts, ETH has dropped to short-term support just above $2400. At press time, it was valued at $2.42K, down 8% in the past seven days of trading.

However, technical indicators’ readings were weak. With RSI toiling below average and a dip in trading volume, ETH’s short-term rebound could depend on staying above $2400 and reclaiming the $2500 level.