After $3K, can Ethereum’s price fall to $2000 next?

- ETH has corrected as much as 17% over the week, and could fall further below $2,400.

- The market sentiment for ETH was neutral as of this writing.

Ethereum [ETH] dipped below $3,000 in the last 24 hours, following a 3.24% fall in its price, according to CoinMarketCap.

The second-largest cryptocurrency has corrected as much as 17% over the week, as bulls struggled to overcome the downward volatility in the broader market.

However, market participants seem to be reacting differently to the ongoing slump, with some profit-taking on their investments while others accumulating ETH at lowered prices.

To buy or to sell?

According to on-chain tracking data platform Lookonchain, a whale known for dip-buying, purchased 3,279 ETH, worth $9.75 million at prevailing prices, on Wednesday.

The influential investor has been doubling on their ETH investments lately, and held a whopping 86,457 ETH tokens as of the 17th of April.

To the contrary, a whale who was an active participant in the initial coin offering (ICO) in 2o15, sold 2,000 ETH at a selling price of $2,997, data from Spot On Chain showed.

The whale received 33,213 ETH as part of the ICO, at a price of $0.31. The latest sale, therefore, multiplied their returns by orders of magnitude.

How did the broader market react?

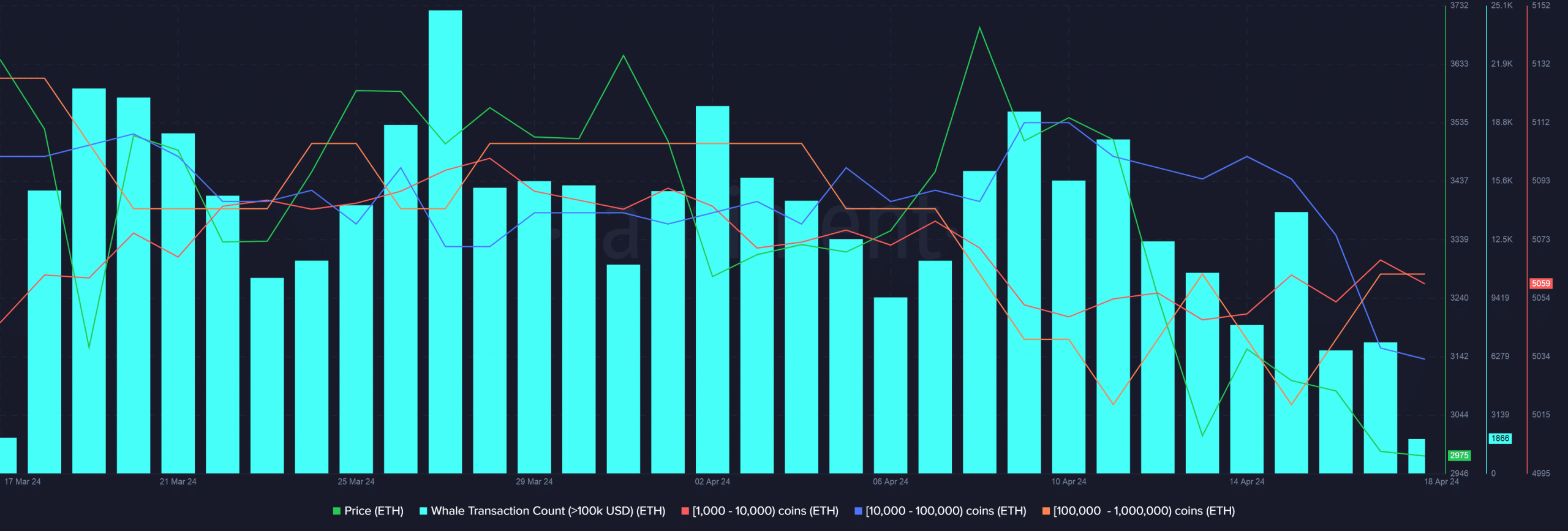

To better understand the market reaction to ETH’s slump, AMBCrypto examined Santiment’s whale metrics.

Notably, the two whale cohorts — 1,000 to 10,000 and 100,000–1 million — increased in number over the week, suggesting that they were accumulating.

However, the wallets holding between 10,000–100,000 ETH dropped in the same time, a sign of sell-offs.

The aforementioned indicators strengthened the “mixed” reaction narrative made earlier in the article.

Is your portfolio green? Check out the ETH Profit Calculator

Gauging ETH’s next moves

The Ethereum Fear and Greed Index alluded to the deductions made above to some extent. According to the last update, the market sentiment for ETH was neutral, with no clear bias towards buying and selling.

AMBCrypto previously reported that ETH was at the risk of falling further to the $2,000 — $2,400 level.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)