Ethereum gains as Open Interest surges: What’s driving the momentum?

- ETH started the week with positive moves.

- The ETH open interest is now over $11 billion.

The approval of Ethereum [ETH] ETFs has significantly bolstered interest in Ethereum, as evidenced by key market indicators. Additionally, the current uptick in Ethereum’s price has positively influenced sentiment among futures traders.

Ethereum sees open interest increase

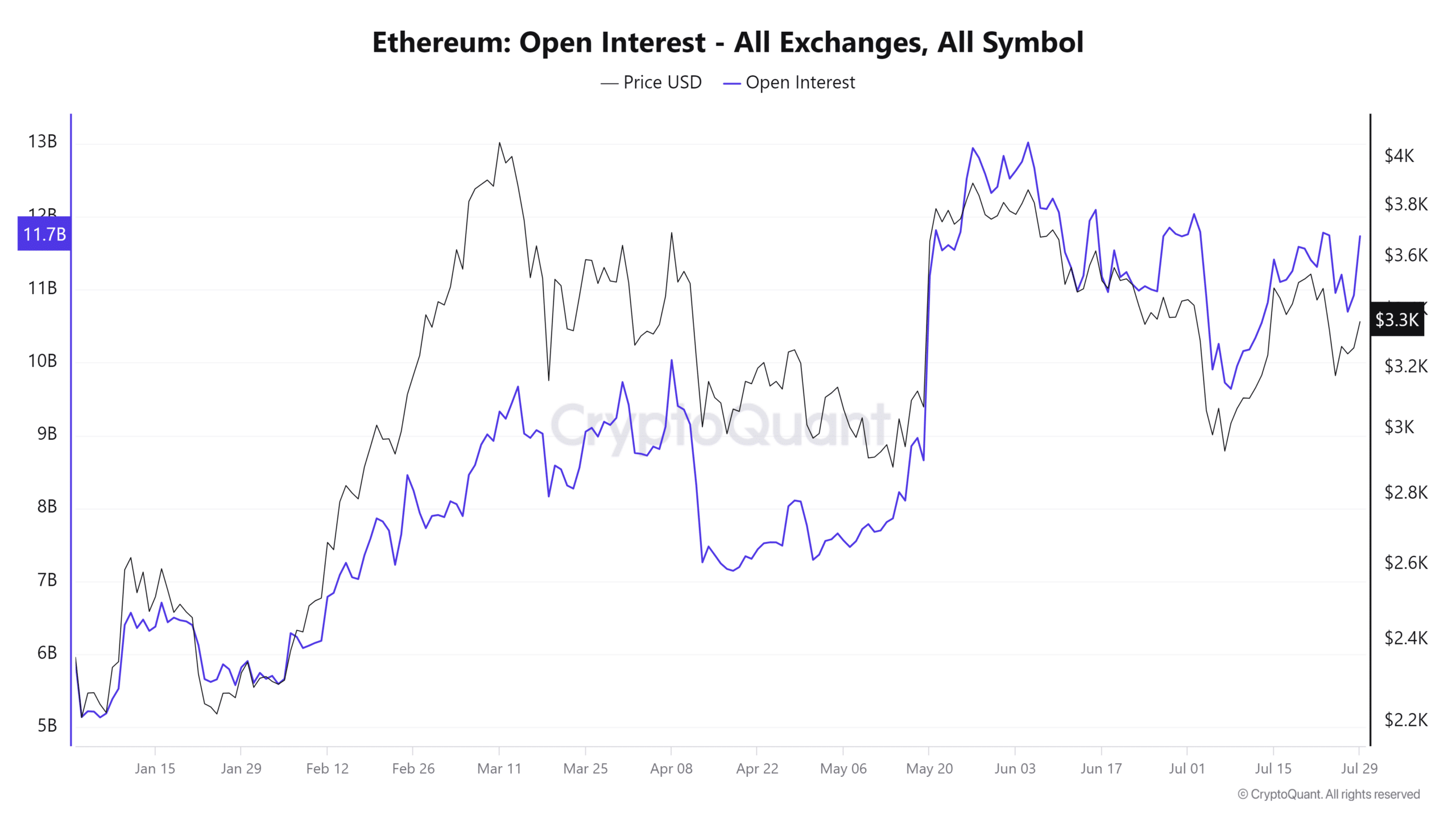

According to data from CryptoQuant, Ethereum’s open interest volume experienced a significant fluctuation recently. From 2nd July to 8th, open interest in ETH dropped from approximately $12 billion to around $9 billion.

Open interests represent the total number of outstanding derivative contracts that have not been settled, such as futures and options.

However, there has been a noticeable resurgence in the past few weeks, with open interest climbing by more than $1.5 billion. The latest figures showed that the open interest was over $11.8 billion.

This resurgence was evident in the previous trading session alone, which increased from over $10.9 billion.

This increase in open interest could signify a growing interest or a return of confidence among traders. Market developments such as the anticipation or aftermath of significant events like ETF approvals often stimulate this.

A rising open interest indicates that new money is entering the market, which could be a bullish signal.

Ethereum funding rate jumps to record-high

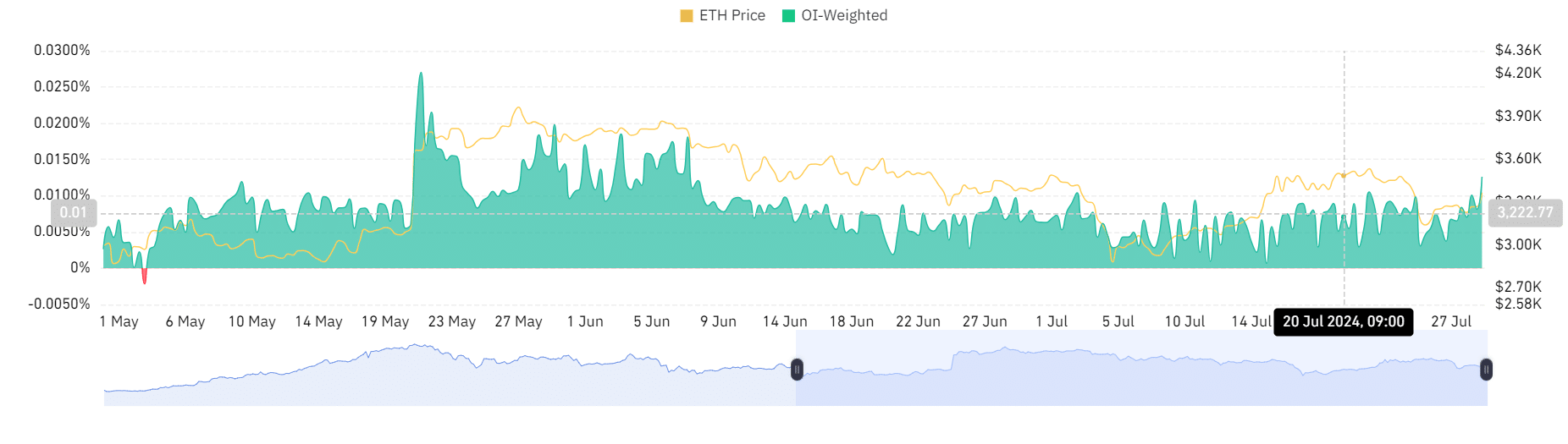

According to data from Coinglass, there has been a notable spike in the Ethereum futures funding rate over the last 24 hours.

The rate spiked, reaching about 0.0126% as of this writing. This is the highest since 8th August, marking a significant uptick after over a month.

A higher funding rate typically indicates that the demand to hold long positions is strong. It shows traders are willing to pay more to maintain their positions, suggesting a bullish sentiment towards Ethereum.

This increase can be seen as a positive signal, indicating that traders expect the ETH price to rise. Therefore, they are more inclined to buy into futures contracts at a premium.

ETH jumps by 3%

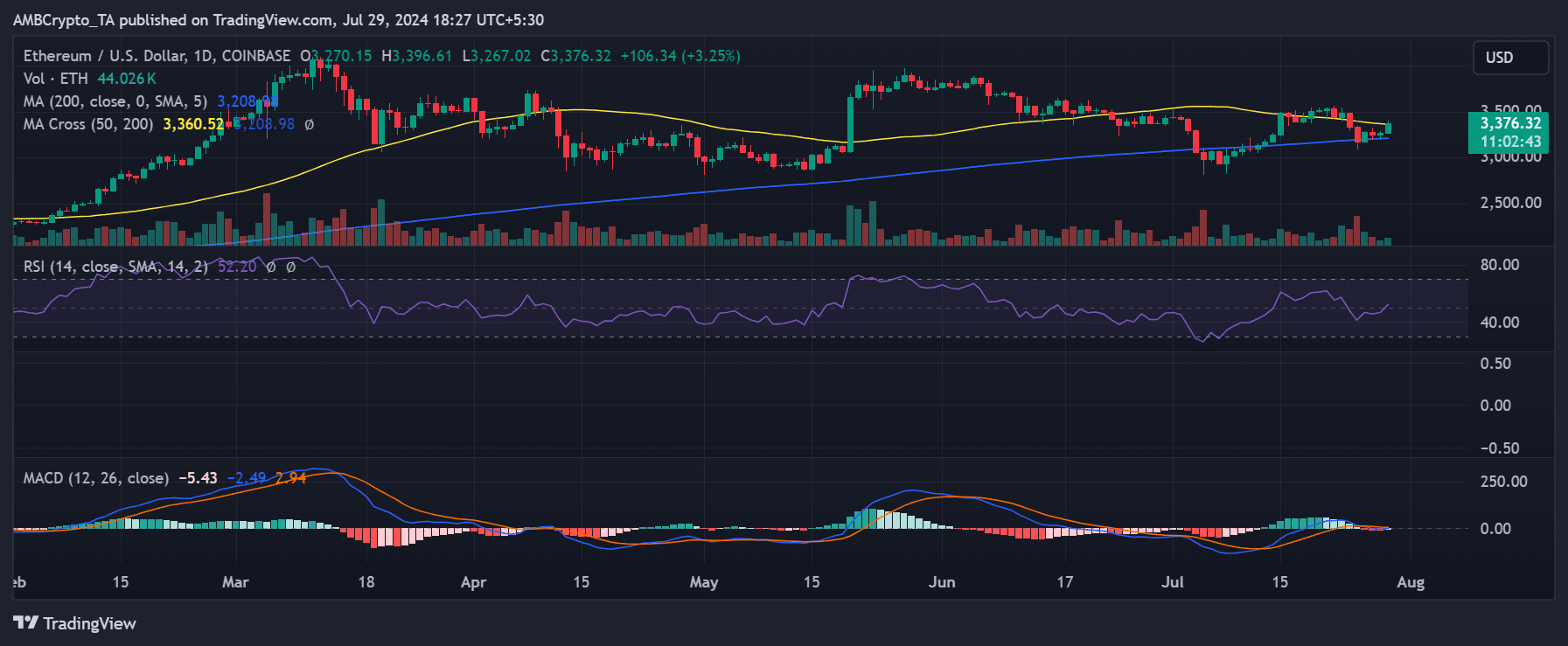

The recent analysis of Ethereum’s price trend indicates a notable increase, with the cryptocurrency gaining over 3% in the last 24 hours.

Read Ethereum (ETH) Price Prediction 2024-25

According to the daily time frame chart analyzed by AMBCrypto, Ethereum was trading at around $3,375, marking a 3.3% rise from previous levels.

This recent uptick in price has nudged Ethereum slightly into a bullish trend. Analysis of the Relative Strength index showed it was above the neutral line as of this writing.