Ethereum haunted by sell pressure: What it means for you

- The negative on-chain volume in profit could trigger a rise to $2,000.

- Analysts argued about the possibility of ETH flipping BTC.

Ethereum [ETH] experienced significant profit-taking after its slight uptick in the last seven days, Santiment disclosed. With market dynamics and investor sentiment impacting its price, the altcoin crossed the $1,900 market.

? #Ethereum is getting a large amount of profit taking transactions after a mild +5% price jump the past week. Typically, we want to see a lot of traders #hodling, and if this ratio comes down to earth, it would be a signal $ETH is on its way to $2,000. https://t.co/lQyVya3rqj pic.twitter.com/F2QvD5gpno

— Santiment (@santimentfeed) June 3, 2023

However, as mentioned above, holders did not hesitate to convert unrealized gains into taken profits. This selling pressure has caused the ETH price to decrease while exchanging hands at $1,894 at press time.

ETH: In a tight situation

As it stands, the ratio of daily on-chain transaction volume in profit and those in loss were on opposing sides. While the latter increased, the former fell into the negative region.

Needless to say, these metrics show the aggregate amount of coins or tokens that have moved in profit or loss within an interval.

When the profit ratio is negative, it means that loss-taking volumes have now overwhelmed realized profit-takers.

Hence Santiment noted such a trend could indicate how FOMOers have given up on the uptick. In turn, the coins could end up in the hands of holders with a strong conviction. This could then set the bullish ride to $2,000.

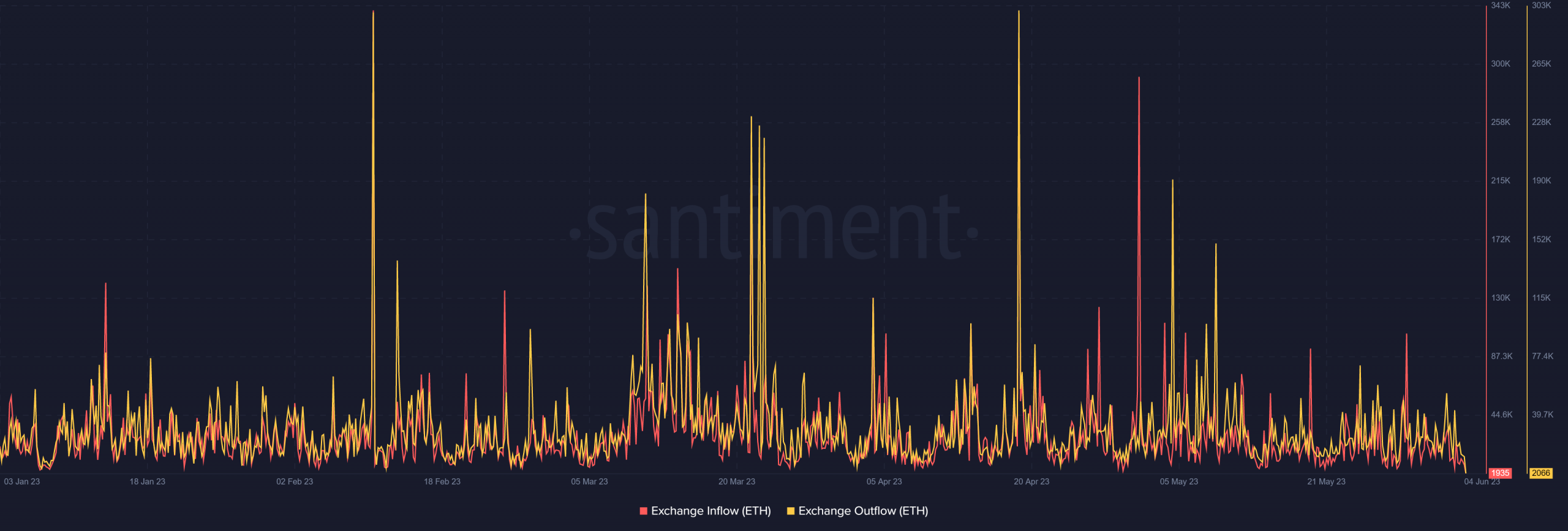

Nonetheless, it could be too soon to assume that a resurgence is on the radar due to the exchange flow. At press time, on-chain data showed that the ETH exchange inflow was 1,935. On the other hand, the exchange outflow, which points to the coins leaving exchanges, was 2,066.

Then, a slight difference, as displayed above, suggests a close call between holders with the intent to sell and those sending into wallets for a possible long-term hold. Therefore, ETH could remain consolidating unless one significantly outpaces the other.

Not one-way traffic

Concerning the long-term, crypto analyst Morgan Benett tweeted that ETH had the tendency to flip Bitcoin [BTC] in the next two to three years.

He explained that the flippening would be gentle and could begin in 2025. Subsequently, trading volumes, high volatility, and BTC holders’ “nervousness” could contribute to the event. In conclusion, Bennett pointed out:

“ETH replaces BTC, but the “digital gold” meme is scorched earth. What happened to BTC can now happen to ETH any time. Permanent loss of trust.”

Read Ethereum’s [ETH] Price Prediction 2023-2024

However, Chris Blec, a decentralized finance researcher, objected to Benett’s analysis, noting that he skipped the historical performance of both cryptocurrencies. Blec tweeted:

“I don’t disagree that the flippening could happen but that line is really ridiculous… you just completely ignored all the data points between 2016 and today.”