Ethereum headed to ‘the grave’ if SEC rejects ETH ETFs, say analysts

- ETH faces immense odds as the ETF deadline approaches

- Analysts predict BTC or SOL as potential beneficiaries of ETH woes

Ethereum [ETH] could face a bumpy ride and even a massive bloodbath if recent analysts’ outlook comes true.

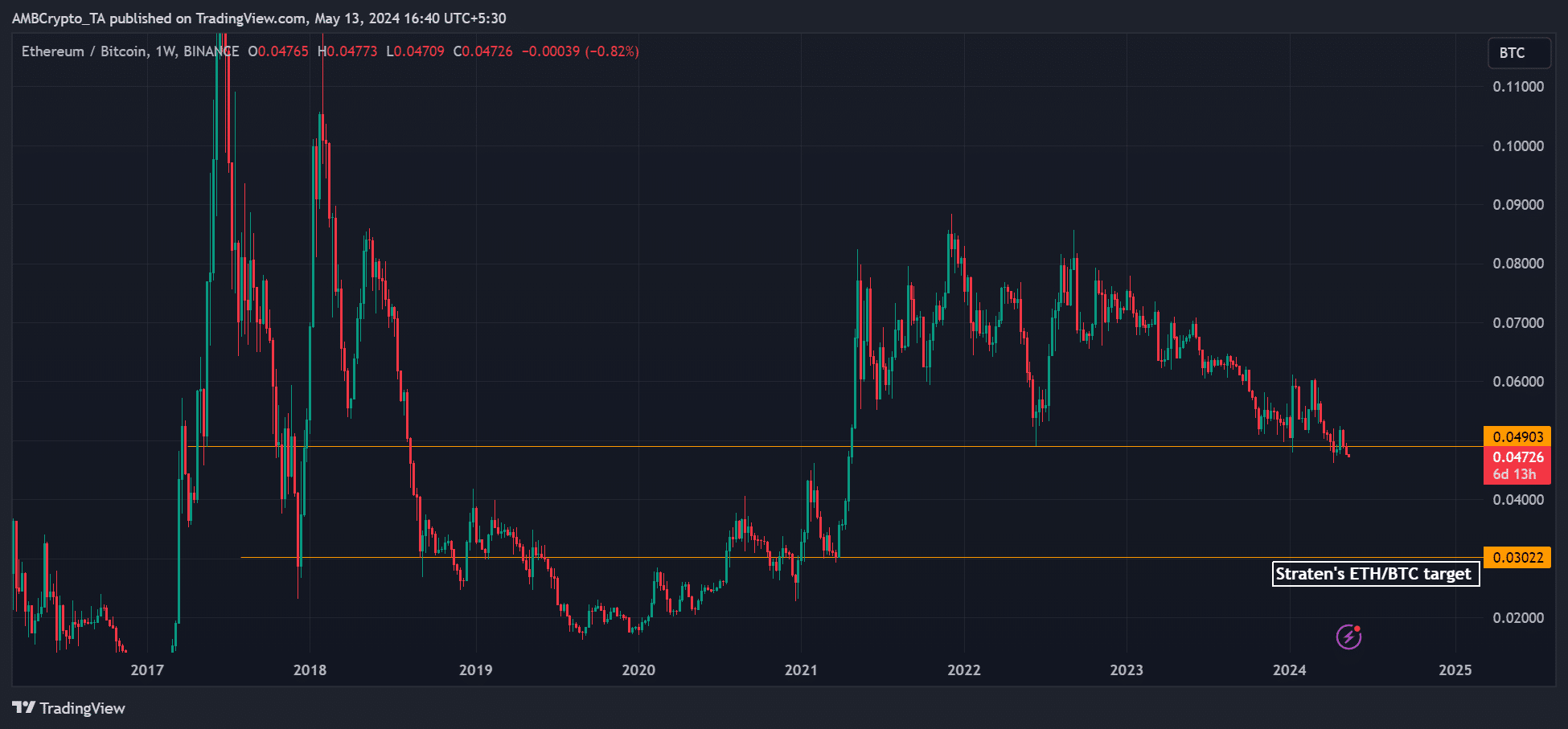

According to crypto analyst James Van Straten, ETH could lose more ground against Bitcoin [BTC] if the SEC rejects spot ETH ETF applications at the end of May.

“Ethereum looks like it’s going to the grave. A rejection of the spot ETF sends the ETHBTC ratio lower from 0.047 to 0.03 as a long-term projection.”

The SEC’s decisions on most ETH ETF filings are due between late May and August. VanEck and Hashdex’s decisions are due on the 23rd and the 30th of May, respectively.

These are the immediate dates the markets are tracking from next week. Straten projects that an ETF rejection could further lower the ETHBTC ratio.

The ratio tracks the value of ETH against BTC. If the ratio is 0.047, it means ETH is worth 0.047 BTC.

In an ETF rejection scenario, negative market sentiment and sell pressure could make ETH worth less in BTC terms.

Ethereum’s inflationary ‘state’ could worsen price prospects

Ethereum is currently “issuing” more ETH than it “burns,” making it inflationary. This is the complete opposite of BTC’s fixed supply of 21 million coins.

Straten added that ETH’s inflationary nature and a dip in transaction fees after the Dencun upgrade tipped Bitcoin to lead on the fees front,

“Bitcoin fees continue to outpace ETH, with very little activity occurring on BTC. ETH has now transitioned into an inflationary state (lol). Dencun upgrade reduces transaction fees, and the ETH burn rate increases the supply.”

AMBCrypto evaluated ETH’s inflationary state using Ultra Sound data. It showed that 4.2K ETH was burnt in the past seven days, but 17.6K ETH was issued over the same period.

That means Ethereum issued four times the token burnt last week, a massive surge in supply that could drag ETH prices down.

Bitcoin maximalist Fred Krueger shared the same sentiment. Krueger stated that ETH was “headed lower” after Solana [SOL] outcompeted it through lower fees.

“But then, they (Ethereum) get clobbered by Solana with the low fees. So, enter Phase 2. The new upgrade lowers fees and makes ETH inflationary again.”

Bloomberg ETF analyst Eric Balchunas maintained a pessimistic view on May approval for ETH ETF filings.

If rejection plays out, ETH could witness a massive bloodbath on the price charts and affect its long-term holders, who are yet to book profit.

It remains to be seen how BTC or SOL will benefit from ETH woes if the SEC rejects the ETFs starting next week.