Ethereum hits $2700 – Will Peter Brandt’s bullish projection play out now?

- ETH has crossed $2700 and could trigger a bullish reversal.

- Should ETH eye $4K, the current value could offer a great buy opportunity.

Ethereum [ETH] logged 11% gains last week, crossing $2700, a crucial level renowned analyst Peter Brandt had projected could trigger a bullish reversal.

Brandt maintained the outlook as ETH crossed the neckline resistance ($2700) of a bullish inverse head-shoulder pattern.

“$ETH closing price chart inverted H&S pattern. I am flat in ETH.”

Will the ETH uptrend extend?

Another market analyst, Crypto McKenna, shared a similar ETH bullish ETH projection.

He cited that reclaiming $2850 (Q2/Q3 support) could set the altcoin towards $3600, especially if Trump wins the upcoming elections.

“Here $ETH really does looked bottomed and primed for a move higher. A reclaim of $2850 and this is the signal for me to be risk-on.”

The above outlook was also supported by increasing whale interest for the past few weeks.

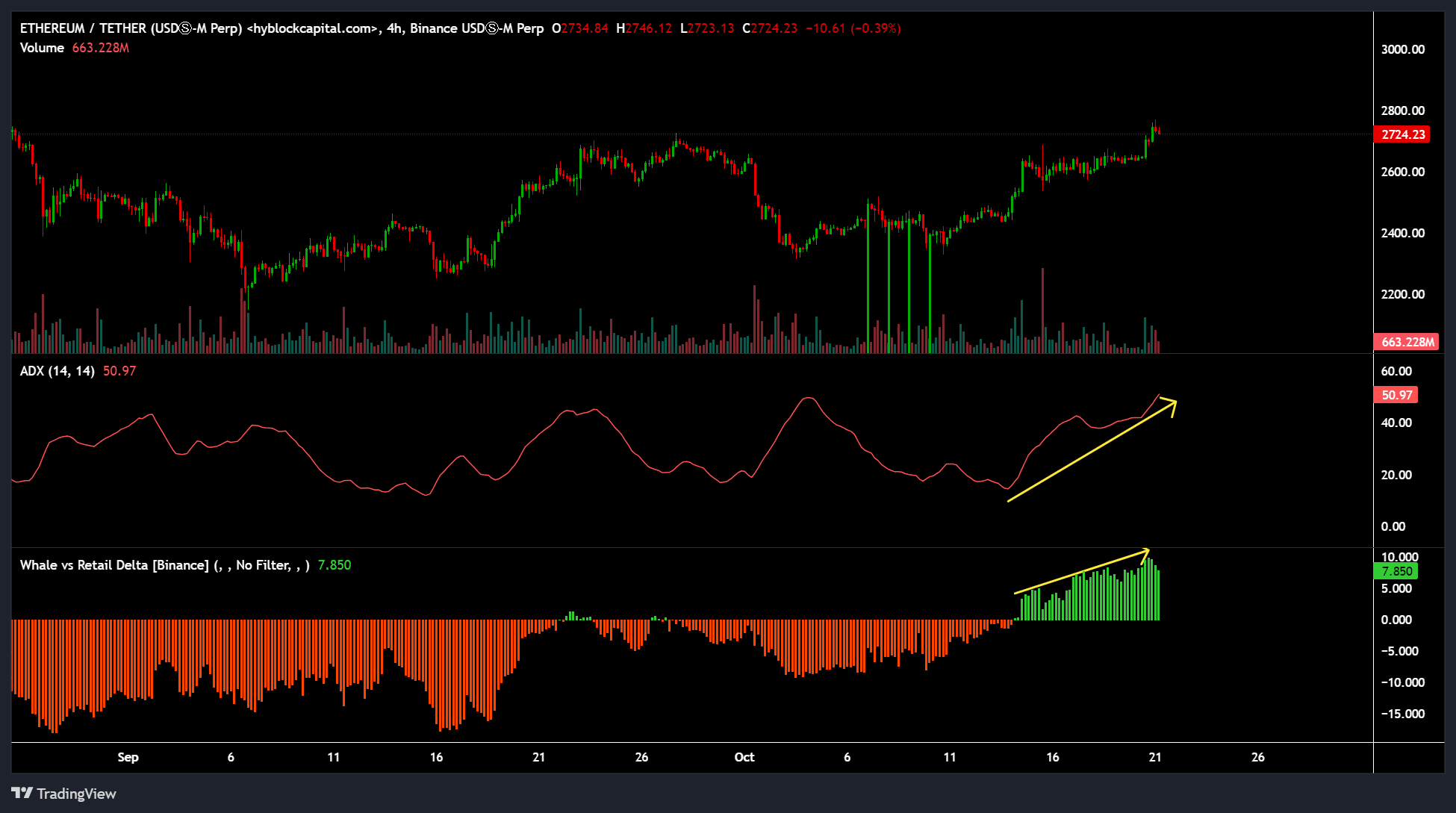

According to Hyblock’s Whale vs. Retail Delta, the metric turned green and hit levels last seen during the July approval of US spot ETFs.

This meant that whales added more long positions than retail on the Futures’ perpetual market. This underscored smart money’s appetite and upside expectation for ETH.

Additionally, the recent uptrend was strong, as indicated by the Average Direction Index (ADX) reading of 50.

If the uptrend extended, it could push ETH forward, especially amid a surge in recent exchange netflow.

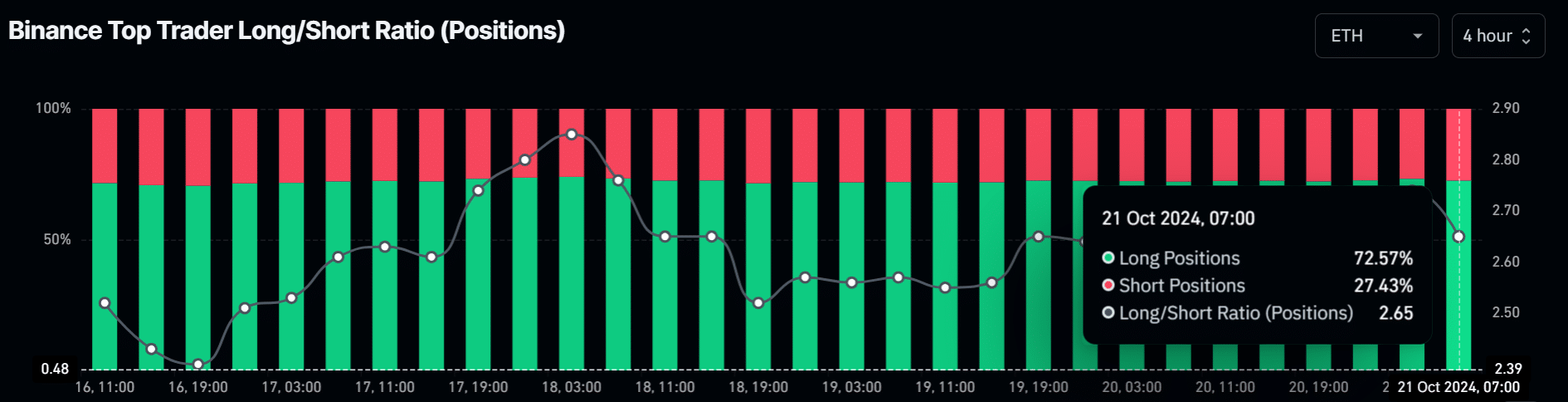

The smart money bullish sentiment on ETH was further supported by the Binance Top Trader Long/Short ratio. At press time, the metric’s reading showed nearly 73% of positions were long on ETH.

Read Ethereum [ETH] Price Prediction 2024-2025

This meant that top traders on the exchange expected ETH’s rally to continue, echoing Mckenna and Brandt’s bullish outlook.

At press time, ETH was valued at $2,723, about 48% away from this cycle high of $4K. That meant that ETH’s current value offered a great risk-reward ratio and an asymmetric opportunity if the uptrend eyes the March high of $4K.