Ethereum hits $3.7K as whales accumulate, but there’s a problem

- Ethereum’s price increased by over 25% in the last seven days.

- Most metrics hinted at a price correction in the short-term.

Ethereum [ETH] witnessed a massive price increase over the last week as its price sat comfortably above the $3.7k mark.

While the token’s price gained bullish momentum, whales acted in an interesting manner as signs of high accumulation emerged.

Ethereum whales are stockpiling

CoinMarketCap’s data revealed ETH had quite a few less volatile days last week. Things changed on the 21st of May as ETH turned bullish. The token’s price increased by more than 25% over the last seven days.

At the time of writing, ETH was trading at $3,789.10 with a market capitalization of over $455 billion.

Apart from price, the number of ETH transactions also increased.

As per a recent tweet from IntoTheBlock, the number of ETH transactions larger than $100k spiked strongly, reaching its highest point since late March. A lot of the transactions were made by whales.

The tweet also mentioned that ETH addresses holding more than 0.1% of the supply showed the highest daily accumulation in more than a month, suggesting that whales were buying ETH.

AMBCrypto then checked Ethereum’s on-chain metrics to find whether buying sentiment was overall dominant in the market.

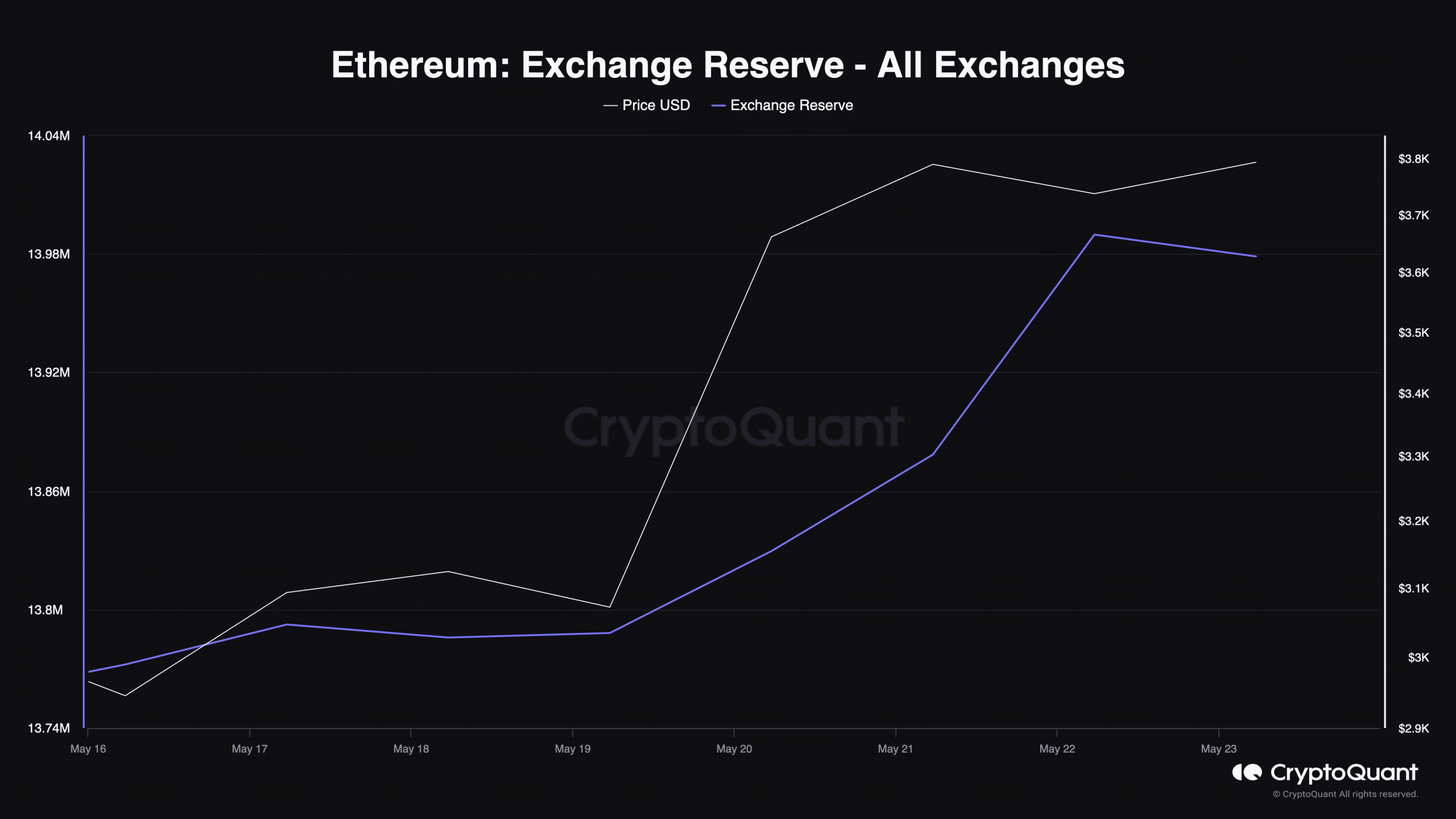

We found that after a spike on the 22nd of May, ETH’s exchange reserve started to drop.

As per CryptoQuant, ETH’s net deposit on exchanges was low compared to the last seven-day average, further establishing the fact that buying pressure was high.

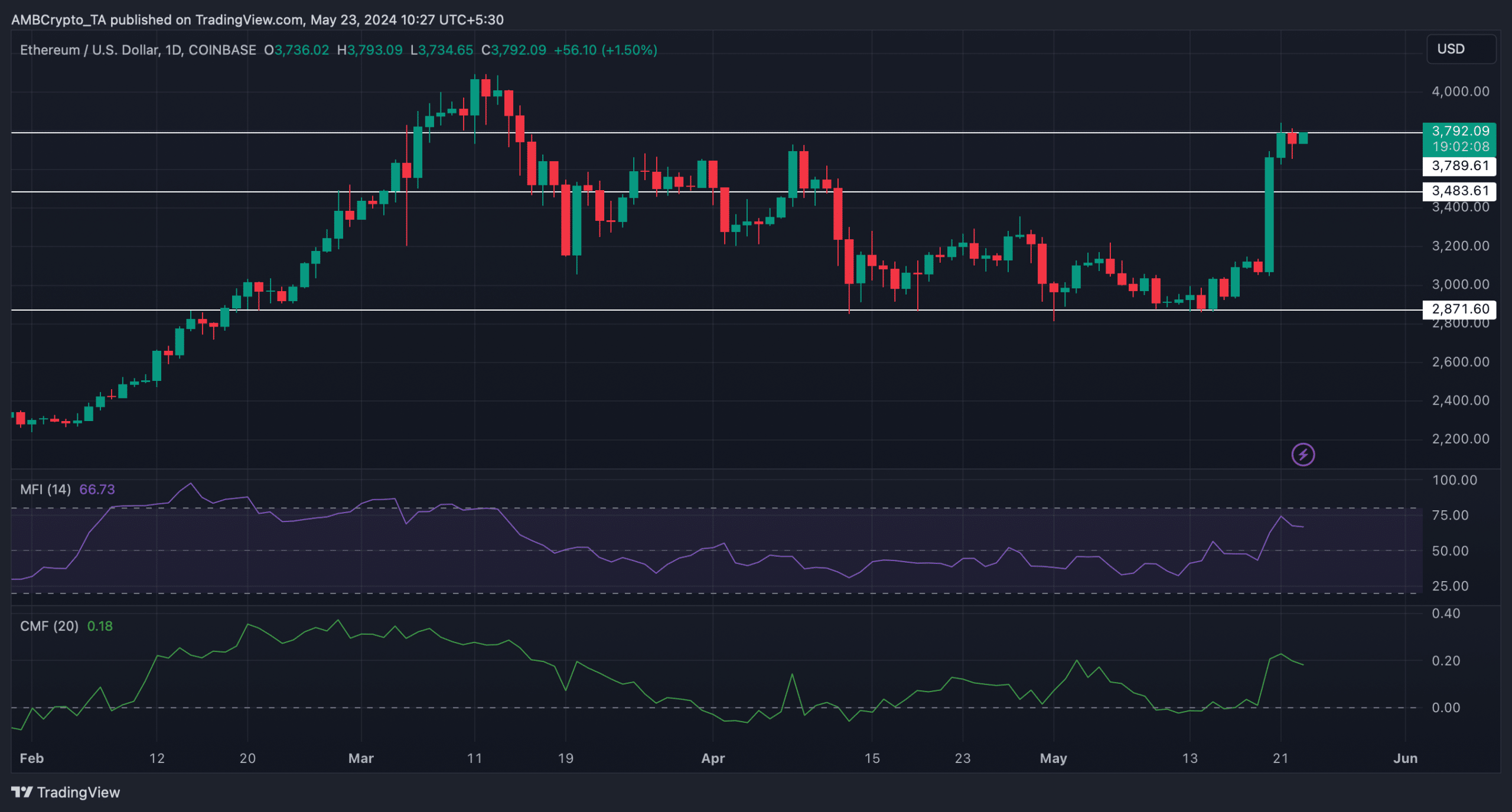

However, the accumulation phase might end soon as ETH’s Relative Strength Index (RSI) entered the overbought zone.

This might motivate investors to sell and, in turn, push the token’s price down in coming days.

Is a price correction inevitable?

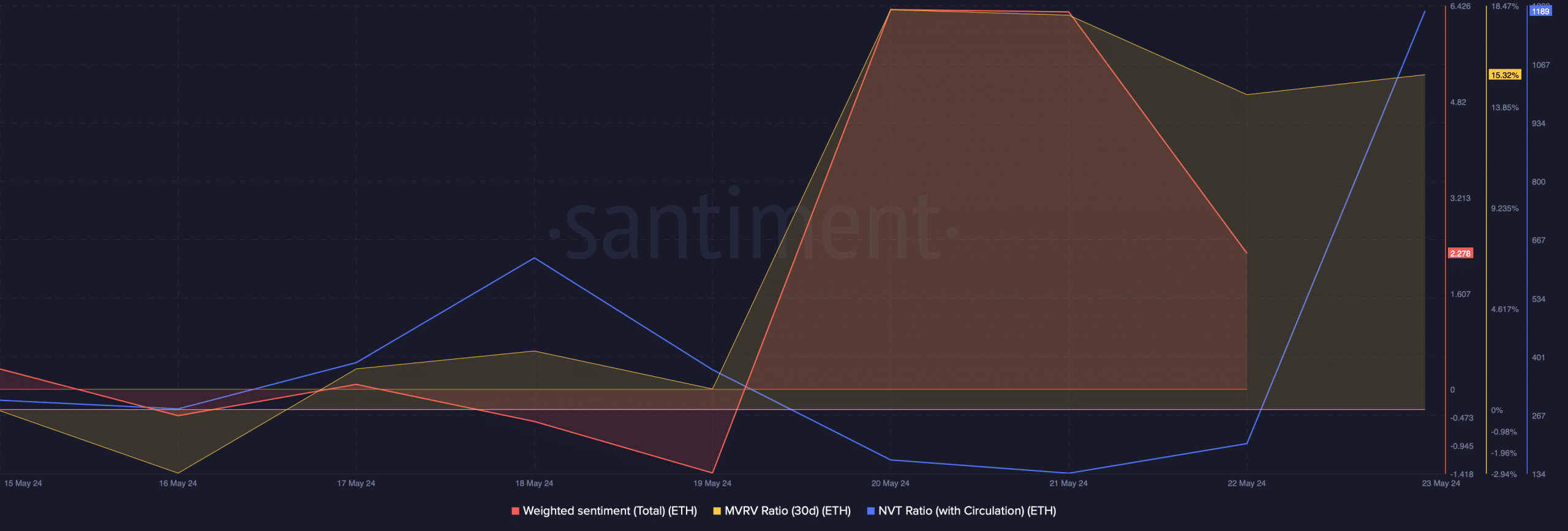

AMBCrypto then analyzed Santiment’s data to understand whether the token was awaiting a price drop.

We found that ETH’s Weighted Sentiment declined in the last few hours, meaning that bullish sentiment around the token dropped. Its NVT ratio also registered a massive spike.

A rise in the metric means that an asset is overvalued, increasing the chances of a price drop.

Nonetheless, the MVRV ratio remained bullish, as it had a value of over 15% at press time.

Is your portfolio green? Check out the ETH Profit Calculator

Like most metrics, a few market indicators also looked bearish. For example, the Money Flow Index (MFI) registered a downtick. The Chaikin Money Flow (CMF) followed a similar trend, hinting at a price correction.

If ETH turns nearish, then investors might witness ETH falling to $3.4k. To the contrary, in order to sustain the full rally, ETH must flip its $3.79k resistance into its support.