Ethereum hits six-month high as sharks, whales play dump and catch

- Whales have been on a dumping spree in the past year, while sharks have been scooping up.

- ETH’s price is over $1,700 for the first time in over six months.

Since the unfortunate events of 20222, Ethereum (ETH) has been fighting against the odds to recover and return to its previous price position.

However, during the past year, there has been a shift in the positions of large addresses toward their ETH holdings.

Read Ethereum (ETH) Price Prediction 2022-23

The Ethereum dump and scoop

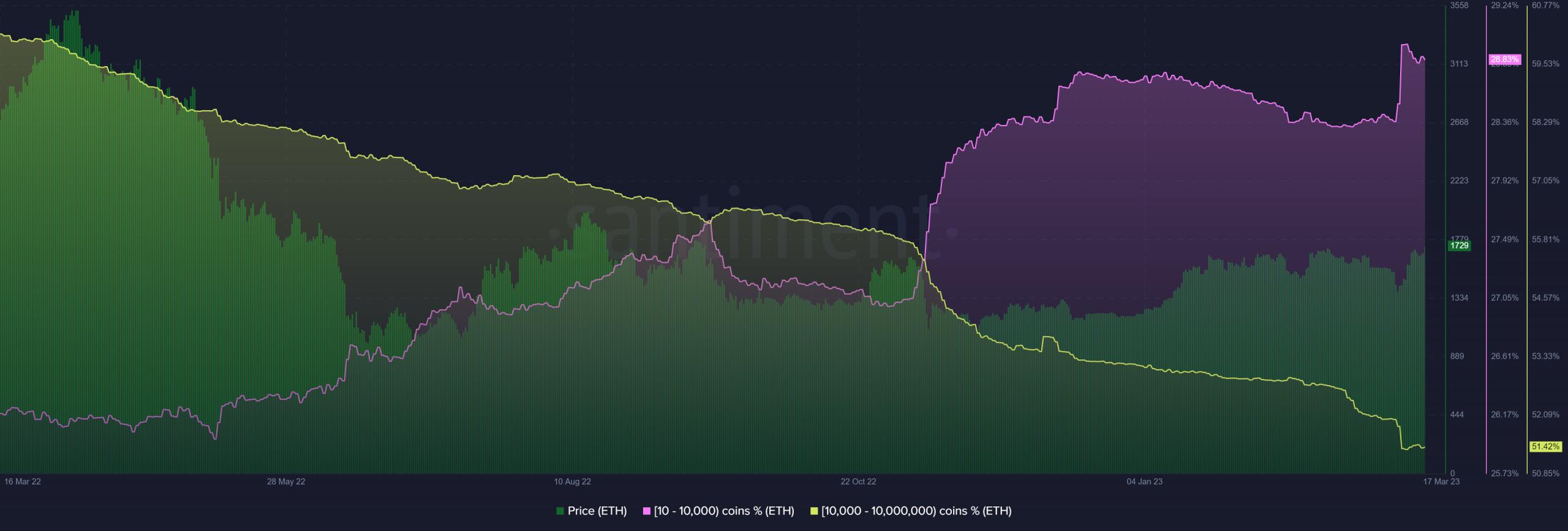

Traders known as “whales” and “sharks” on Ethereum have seen a dramatic change in their portfolios over the past year, as reported by a recent post by Santiment.

By comparing the two groups’ charts, we can see that the proportion of whale holdings has decreased while that of sharks has increased. While whales have sold off 9.43 million ETH, sharks have added 3.61 million to their stash over the past year.

There has been a lot of selling pressure on Ethereum, and the activity of the whales over the past year and the amount dumped thus far are symptomatic of this. Even though the sharks’ stockpile was minor, it mitigated the effects of a sharp price drop.

Two MVRVs, one Ethereum

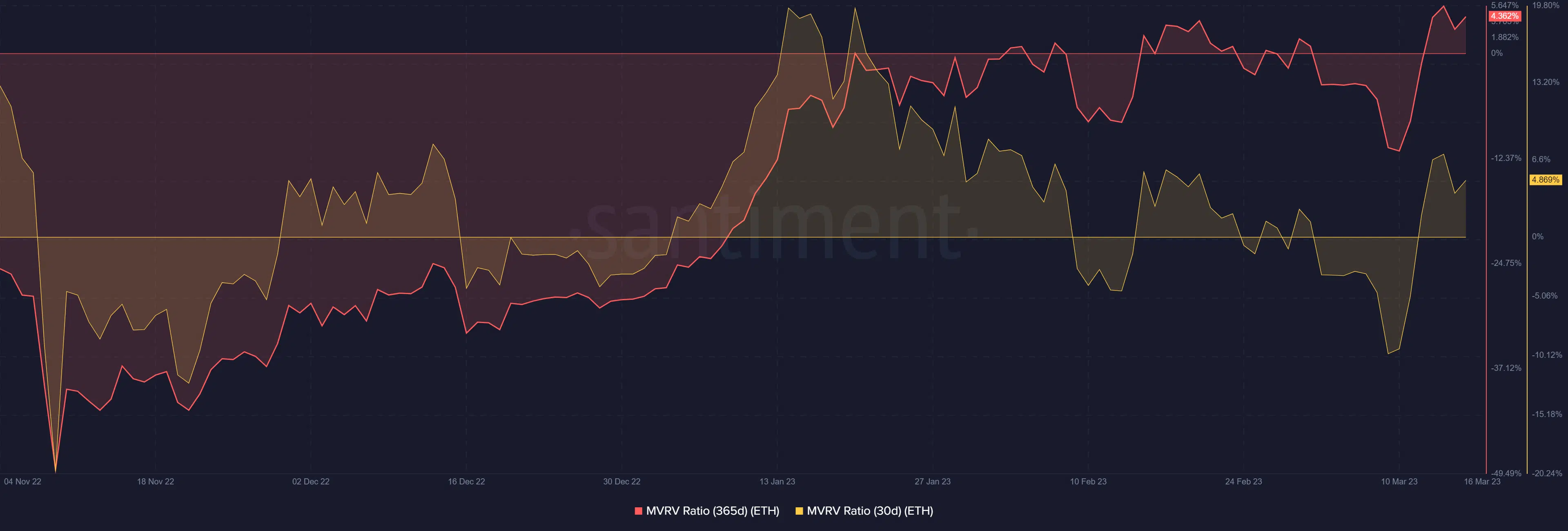

Ethereum has been undervalued for a long period, as shown by its Market Value to Realized Value (MVRV) ratio being below the breakeven point for 365 days.

In November 2022, it reached a low of -49%. With the MVRV in the red, sellers had greater reason to cut their losses, and the price followed suit.

As the price of the asset dropped during the sell-off, sellers suffered a hit, allowing new buyers to enter the market at a lower price.

A review of the 30-day MVRV revealed that buyers who had entered the trade within the previous 30 days had remained profitable for the most part.

As of this writing, the MVRV ratio was close to 5%. Even if the price dropped and there was an apparent sell-off by some whale addresses, the shark addresses that added to their stack are likely to be in profit.

ETH price hits six months high

The value of Ethereum (ETH) has steadily risen over the past week. As of this writing, it gained close to 4% in a day’s trade, trading at roughly $1,740.

A closer examination of the daily timeframe chart revealed that the current price range was the highest in over six months. Also, support was forming around the $1,430 price level, with the support area depicted by the short Moving Average (blue line).

Is your portfolio green? Check out the Ethereum Profit Calculator

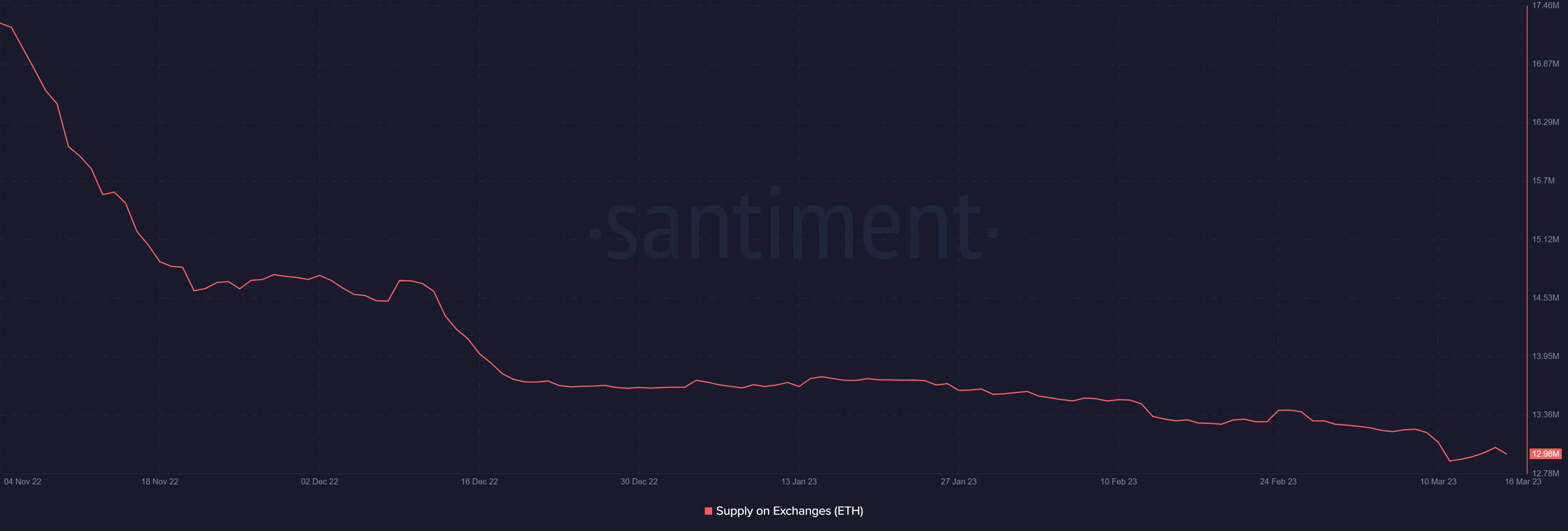

Despite the dump by the whales, the supply of Ethereum on exchanges has not increased, as seen by the supply on exchanges indicator on Santiment.

As of this writing, there was a net drop in the amount of ETH supplied to exchanges—about 12.9 million ETH were available on trading platforms.