Ethereum: Hong Kong spot ETFs fail to impress, what next for ETH?

- ETH was down 3.2% in the 24-hour period at press time.

- Derivatives market has been bearish on the coin for the last 2-3 days.

World’s second-largest cryptocurrency Ethereum [ETH] trended lower since the listing of first-ever crypto spot exchange-traded funds (ETFs) in Hong Kong.

According to CoinMarketCap, ETH rose to $3,250 shortly before the funds started trading on the Hong Kong Stock Exchange (HKEX) – the city’s bourse.

However, the stiff resistance pushed the digital currency back, causing it to fall to $3,020 as of this writing, a 3.2% drop in the 24-hour period.

Well-known technical analyst and trader Ali Martinez had talked about the significance of $3,200 as an important resistance level for ETH recently.

As many as 2.43 million addresses had acquired 5.14 million ETH at this level. Hence, overcoming this “brick wall” was critical for a sustained rally.

Spot ETFs start on a dull note

Three spot Ether ETFs, along with three Bitcoin [BTC] spot ETFs, debuted in Hong Kong, a city which has been vying to project itself as the next crypto hub.

However, the shares of all the three ETFs tied to ETH closed lower, according to AMBCrypto’s analysis of HKEX data, as trading volumes failed to pick up. This, in turn, might have influenced sentiment towards the cryptocurrency, causing it to drop.

Speculative market bets against ETH’s rise

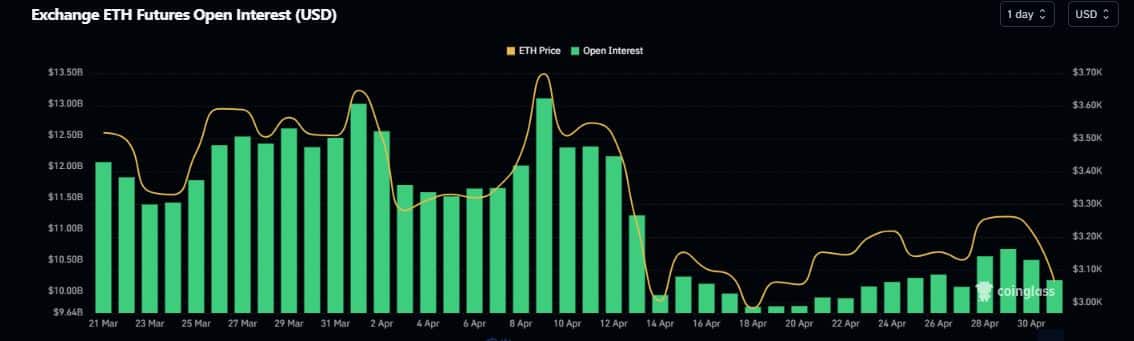

As ETH dipped in the spot market, ripples were felt in the derivatives sector as well. The Open Interest (OI) in ETH futures plunged 4.5% in the last 24 hours, as per AMBCrypto’s analysis of Coinglass’ data.

Is your portfolio green? Check out the ETH Profit Calculator

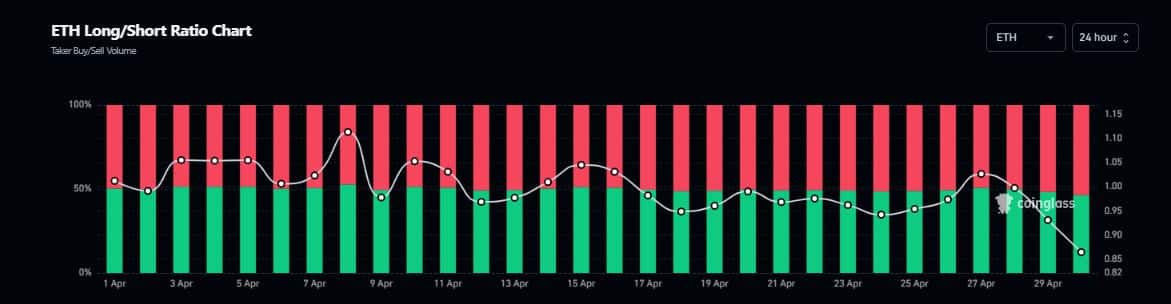

It looked as if the derivatives market had sensed a poor opening day for Hong Kong Ether ETFs. The number of traders shorting the crypto against those who were taking long positions has been rising in the last 2-3 days, as per Longs/Shorts Ratio.

As of this writing, nearly 53% of participants were bearish on the coin.