Ethereum: How whales failed to reverse ETH’s bearish trend

- Most short-term traders experienced losses and would be eager to exit their positions in case of a price bounce.

- The $2.8k level is likely to be revisited as support, but it is unclear if the bulls can hold on thereafter.

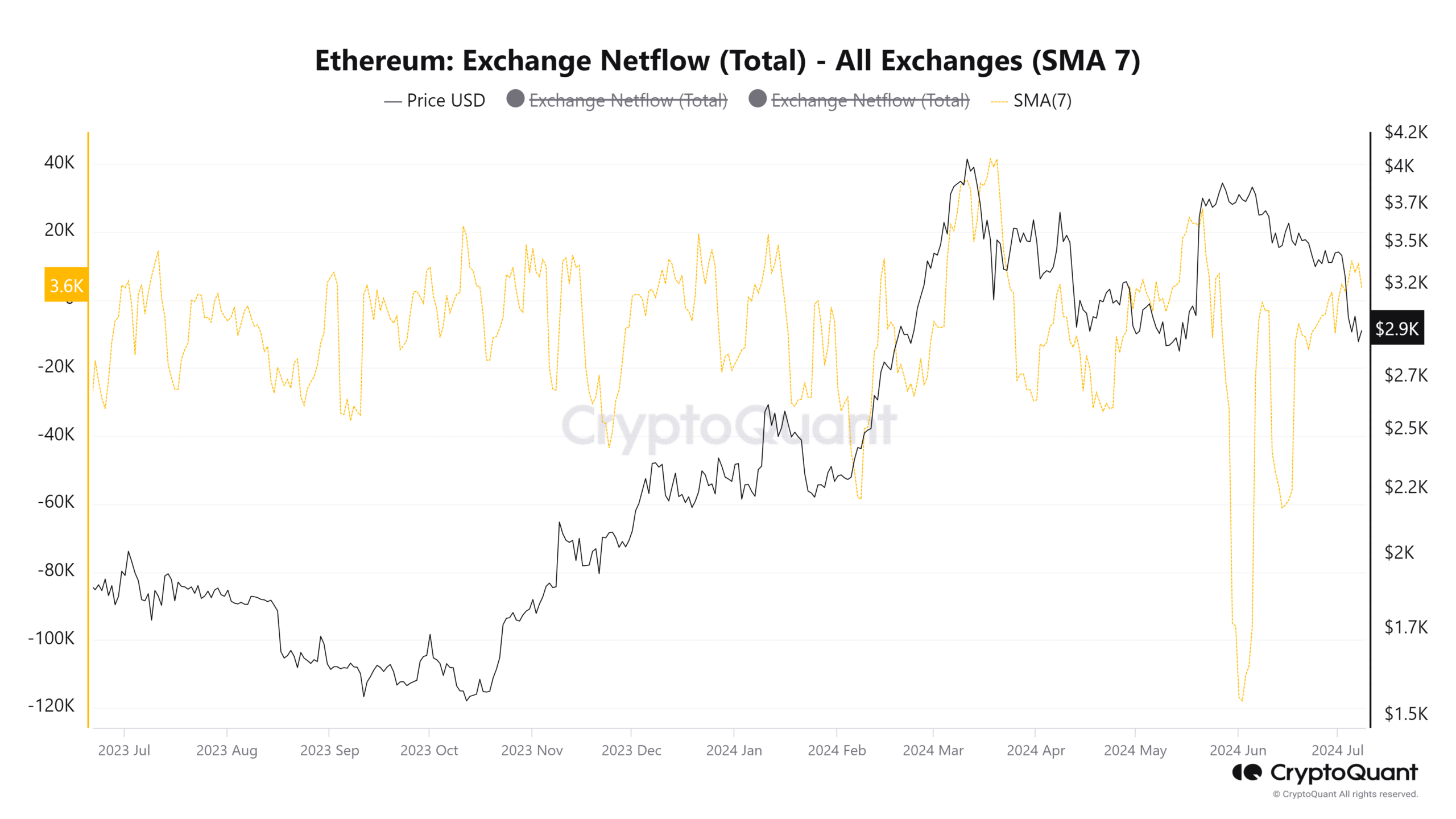

The Ethereum [ETH] flow from exchanges took a turn recently and strayed deep into negative territory in June, but this has not turned out the way investors were hoping it would. Instead of appreciating, the prices continued to drop.

Bearish sentiment was prevalent in the market, as seen by the price drop below $3k. This psychological level is likely to be contested hard, but the selling pressure behind ETH has been unforgiving.

Whale accumulation did little to halt bearish trend

Source: CryptoQuant

In June, the 7-day simple moving average of the exchange netflow dropped deep into the negative territory. It stayed negative till the 28th of June.

In the past ten days, it has crept into the positive territory, accompanying the sharp price drop seen in July.

The negative netflow indicated Ethereum tokens moving outside of exchanges and signaled accumulation. Despite this, the prices continued to slump.

Investors would be hoping that this is the final jolt of pain before the trend turns bullish.

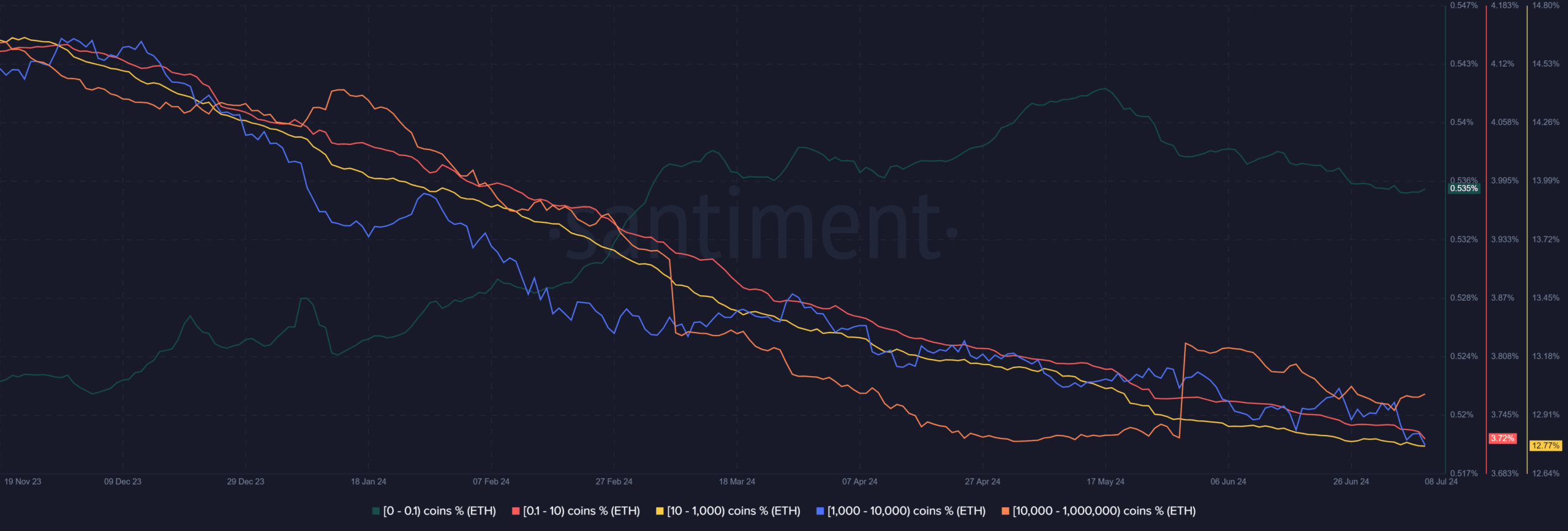

Source: Santiment

The supply distribution analysis showed that the 10k-1M ETH holders have increased since mid-May. The 1k-10k ETH wallets moved higher toward the end of June but have fallen lower again over the past week.

Together it indicated the large whales with 10k+ ETH accumulated, but most other wallets have reduced their holdings.

Where can traders expect prices to find relief?

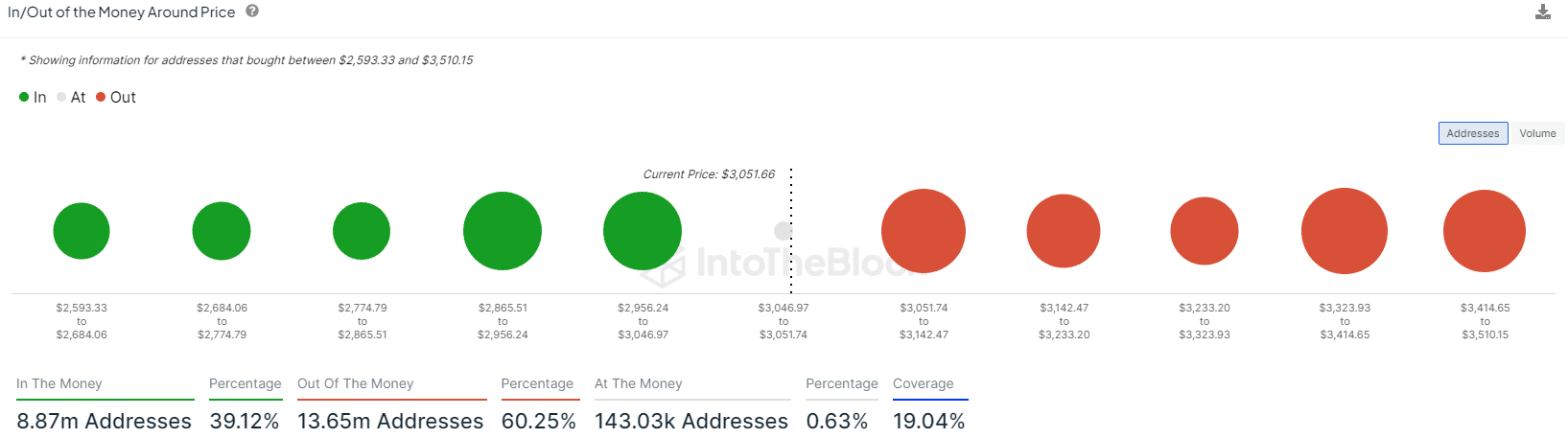

Source: IntoTheBlock

AMBCrypto noted from the in/out of the money data that the $2850-$3000 zone was a strong support zone due to the number of holders.

Over the past three days, the price decline to $2.8k saw a bounce to $3k but it is unclear if the buyers can withstand the sellers’ onslaught any longer.

Around the current market price, 60.25% of the addresses were out of the money, which meant that price bounces would likely be sold as holders look to exit at break-even. This can add to the downward pressure.

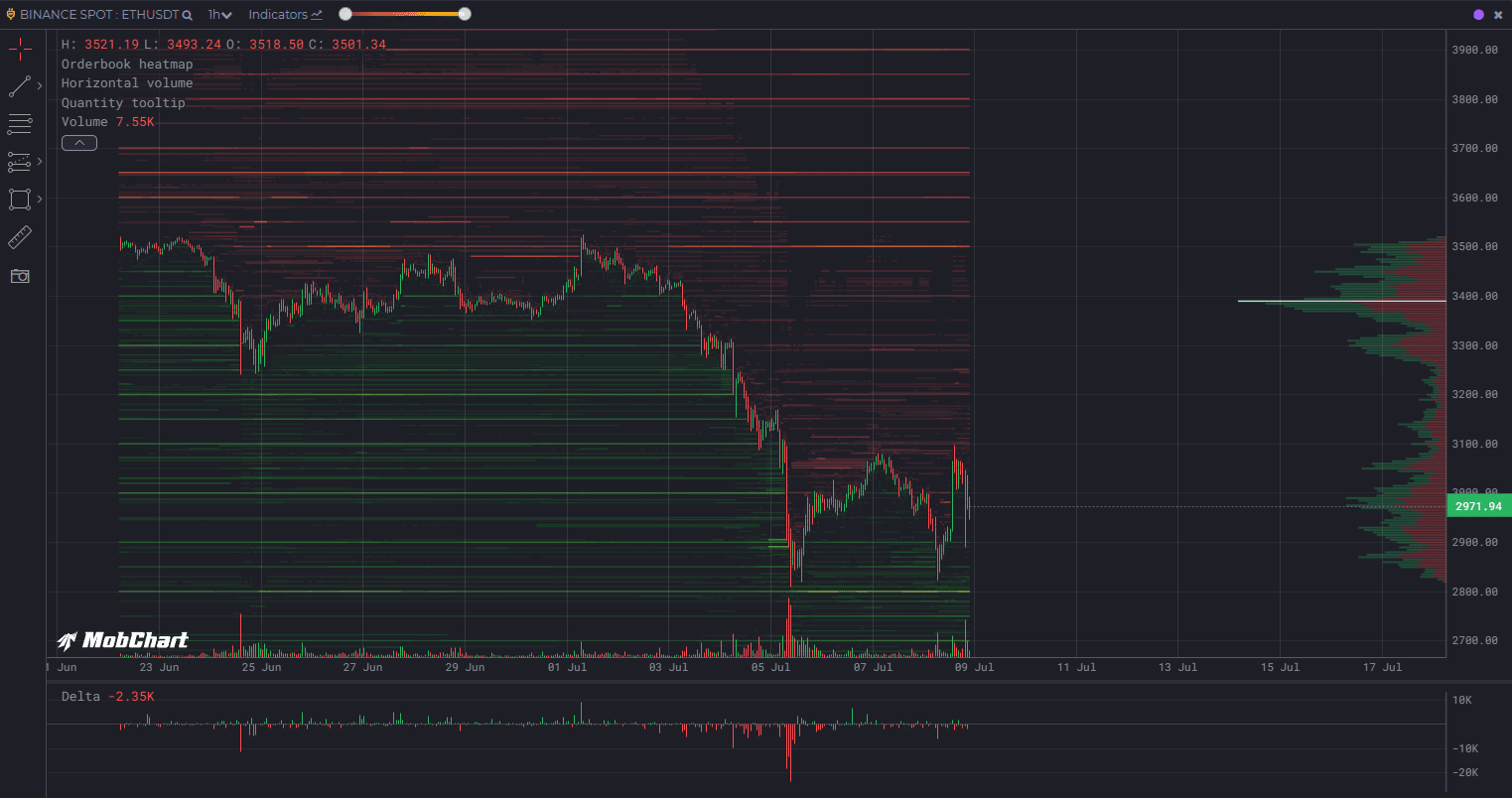

Source: MobChart

The MobChart data outlined large limit orders on the order books for Ethereum. The $3100 and $3170 levels have $3.7 million worth of limit orders. Above them, the $3220-$3250 region and $3500 have just over $5 million, marking these as strong short-term resistances.

Read Ethereum’s [ETH] Price Prediction 2024-25

The $2800 level has just under $10 million worth of buy orders and might be tested once again. Overall, the metrics show that in the short term, bears were in control.

The exchange outflow in June did little to halt the price decline, and the best bulls can hope for now is a period of consolidation around the psychological $3k support.