Ethereum in the spotlight as weekly crypto inflows tap $1.84B

- Investment inflows linked to Ethereum rose to $85 million.

- The price of ETH surpassed $3,600 and could hit $4,000 soon.

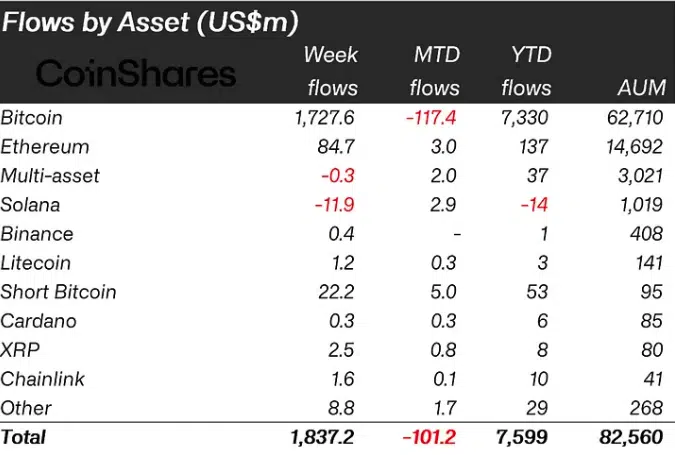

Last week, digital asset investment products registered a total inflow of $1.84 billion. During the timeframe which ended on the 1st of March, Ethereum [ETH] hit its highest inflow since July 2022.

According to the report provided by CoinShares, total trading volume hit $30 billion, indicating high interest in cryptocurrency-related products.

However, most of the inflows went to Bitcoin [BTC] which accounted for 94% of the total. But short Bitcoin inflows also jumped, indicating that some investors were bearish on the coin. The report read,

“94% of the inflows were into Bitcoin, totalling US$1.72bn, although recent price moves saw short investors double down with a further US$22m inflows into short-bitcoin investment products.”

ETFs offer the confidence

For Ethereum, its total inflows were about $85 million. The notable increase suggests that investors were looking to ETH exposure as the deadline to approve spot Ethereum ETFs nears. However, the Assets under Management (AuM) was shy of its all-time peak.

Furthermore, AMBCrypto observed that the AuM hit $14.6 billion. But it was still far off the high of $23.7 billion. This number implies that the value of Ethereum funds controlled by institutions was still lagging.

However, if the U.S. SEC approves the Ethereum ETFs, this position might change and the total AuM value might go higher. But as of this writing, there were rumors that the SEC might delay the applications.

In terms of the price action, ETH’s value has been increasing. At press time, ETH changed hands at $3,696, thanks to a 14.66% increase in the last seven days.

Volume increases as ETH eyes a higher value

When it comes to the volume, on-chain data showed that it has been increasing. As of this writing, ETH’s volume was 31.69 billion.

If the volume continues to increase alongside ETH’s price, then a higher value might appear in the short term. In a highly bullish scenario, ETH might cross the $4,000 mark within a few weeks.

Despite the bullish sentiment, traders might need to be careful. If ETH slides below $3,500, the bullish thesis could be invalidated. Though it seems unlikely, it remains an option to watch out for.

However, it is important to note that the total AuM hit $82.6bn. This was only a little away from the $86bn peak which occurred in early November 2021. If the inflows continue to increase as it had done since the beginning of the year, the AuM might surpass the 2021 high.

Realistic or not, here’s ETH’s market cap in BTC terms

In addition, other altcoins were also involved in the flows. While Polygon [MATIC] had more inflows, Solana [SOL] registered high outflows:

“Polygon saw inflows of US$7.6m, representing 22% of AuM, while Solana saw outflows of US$12m.”