Ethereum

Ethereum inflows hit $2.2B: Could $10K be next for ETH?

Ethereum’s YTD inflows hit $2.2B, surpassing 2021 records, as its L2s and DeFi thrive.

- Ethereum sets a new year-to-date inflow record at $2.2 Billion, beating its 2021 highs.

- ETH could hit $10K in the midterm if more chain activities continue to thrive.

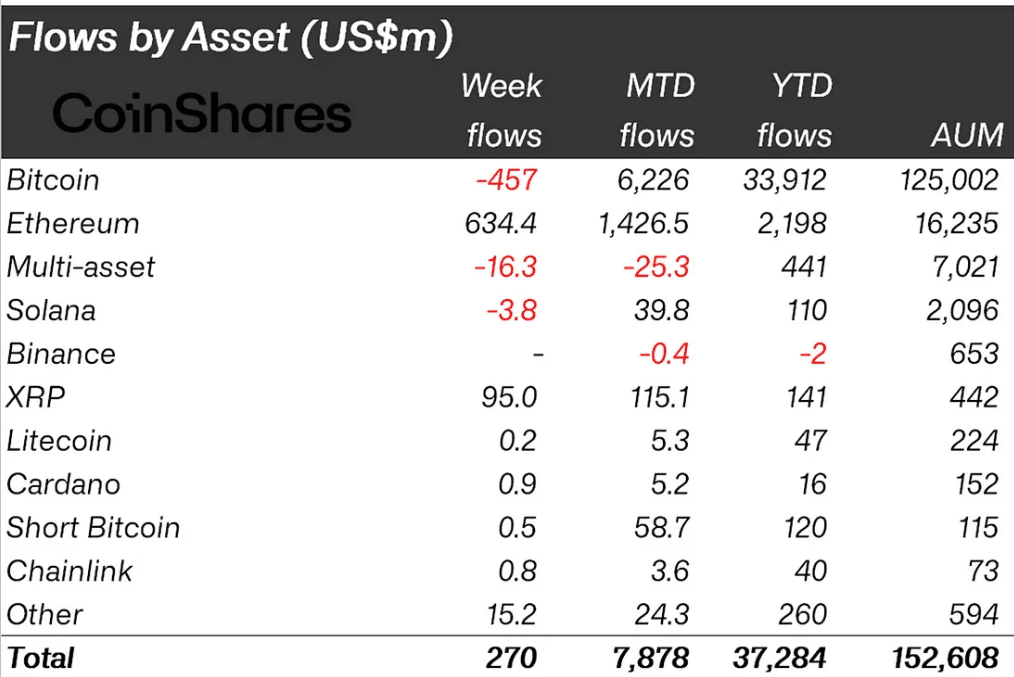

Ethereum [ETH] set a new record for inflows, reaching $2.2B year-to-date, surpassing its previous record of 2021.

The recent inflows accounted for $634 million, indicating a significant boost in investor confidence and market sentiment.

The surge was attributed to Ethereum ETFs’ strong performance. These ETFs have become a preferred vehicle for investors as they offer exposure to ETH without direct investment in the digital currency.

The growing institutional interest was evident as large sums continue to be directed towards Ethereum-based investment products.

Despite some fluctuations and market volatility, the overall trend for Ethereum appeared bullish, with the increased institutional backing providing a solid foundation for future growth.

These developments coincided with overall increasing inflows into crypto ETPs, with Ethereum leading the way alongside Bitcoin.

ETH TVL and Spot ETFs inflows

In the past week, Ethereum experienced a significant influx of $4.81 billion, leading to a notable increase in its total value locked (TVL), as reported by Lookonchain.

These inflows have propelled Ethereum’s Layer-2 networks to a new high, with the combined TVL reaching a record $51.5 billion—a 205% surge over the year.

Additionally, Base’s TVL rose by $302.02 million, reflecting heightened activity and scalability improvements.

This record growth in DeFi TVL has not only revisited the highs of November 2021 but also diversified with increased liquid staking options, Bitcoin DeFi integrations, and enhanced contributions from Solana and other Layer-2 networks.

Also, Ethereum’s spot ETFs reported a substantial net inflow of $24.23 million, marking six consecutive days of positive inflow

Leading the surge, BlackRock’s ETHA ETF saw a remarkable single-day inflow of $55.92 million. Similarly, Fidelity’s FETH ETF showed strong performance, with a net inflow of $19.90 million.

Together, the total net asset value of ETH spot ETFs has reached $11.13 billion, highlighting a sustained and growing interest in Ethereum as a significant asset in the digital currency space.

Price action to hit $10K

These developments could push ETH to new heights, as the chart on a 3-day timeframe shows a breakout from a consolidation triangle and a sharp surge.

Since early 2021, ETH’s price has maintained an overall bullish trend, with some periods of corrections and consolidation.

ETH is on the verge of breaking free from a triangular pattern, aiming for higher levels with an anticipated surge towards $10,000.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The uptrend, reaching slightly past $3600, suggested Ethereum could potentially hit $10,000 in the midterm if the chain activity continues to thrive.

Such movement indicated strong buyer interest and solid market sentiment, possibly setting a new stage for Ethereum’s growth.