Ethereum: Major crash coming? Why ETH can drop to $1652, per analyst

- Ethereum faces headwinds after a bearish breakout below the 5-month rectangle pattern.

- ETH has held onto the crucial support at $2,611, but the short-term sentiment remained bearish.

The positive U.S. Consumer Price Index (CPI) data released on the 14th of August turned out to be a sell-the-news event, causing most cryptos to trade in the red.

Inasmuch, the largest altcoin, Ethereum (ETH) is down by 4% in 24 hours to trade at $2,622 at the time of writing.

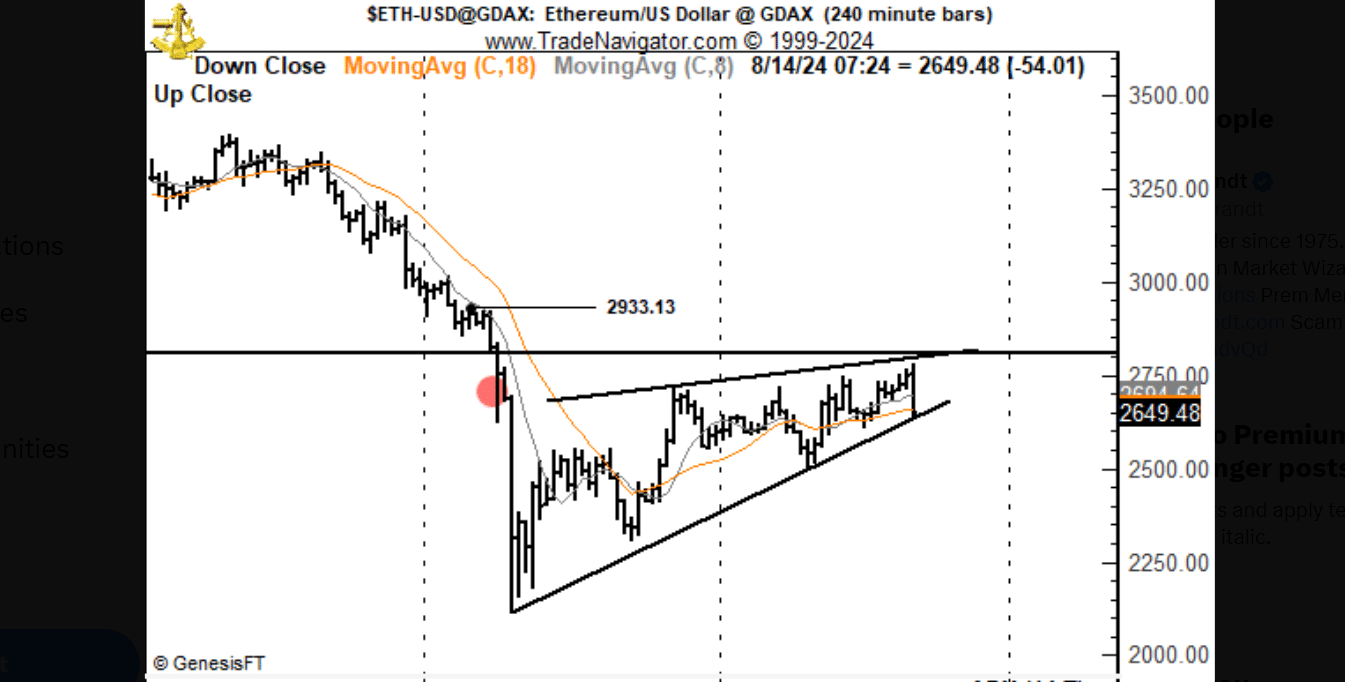

Analyst Peter Brandt believed that ETH was headed for further headwinds after completing a five-month rectangle pattern on the 4th of August.

ETH’s price was range-bound during the five months, before a bearish breakout that saw it form a key resistance at $2,933.

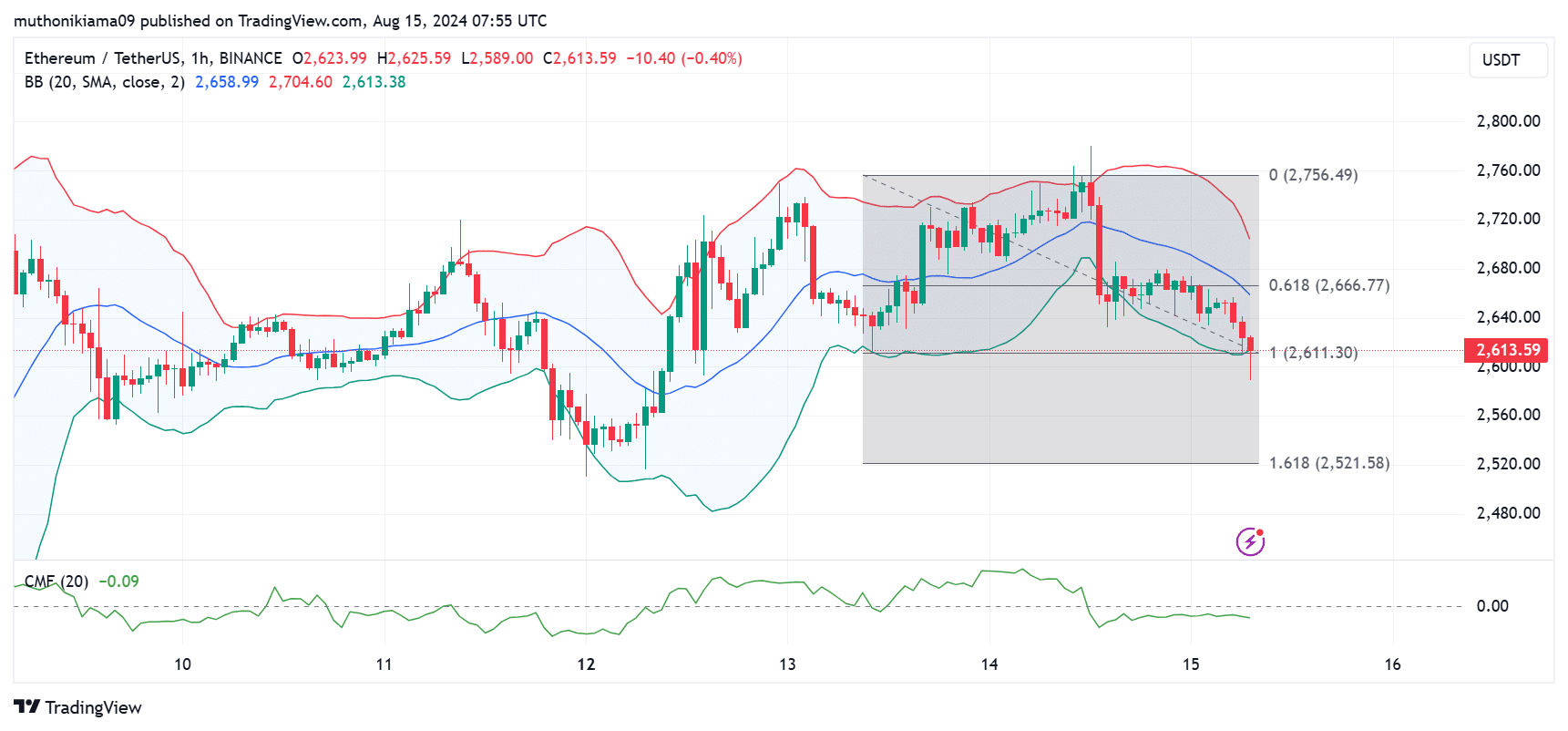

ETH attempted to rally past this resistance on the 14th of August, but failed. The rising wedge pattern on the intraday chart also showed weakening momentum and a potential bearish reversal.

With these bearish indicators in play, Brandt predicted a drop to $1,652. The analyst has since created a short position targeting this drop. He added that the bearish thesis will be invalidated if ETH moves above $2,961.

Big drop ahead for Ethereum?

Technical indicators indicated a short-term bearish thesis around ETH. The Chaikin Money Flow (CMF) was at -0.09 showing selling pressure.

The CMF has also remained flat, suggesting a lack of market confidence in ETH and a reluctance by buyers to open new positions.

The Bollinger bands have widened, showing rising volatility during the downtrend. The price has dropped from the upper band to the lower band over the past day, with this move indicating a sharp bearish reversal.

Ethereum was holding a crucial support level at $2,611. If it fails, it might register a drop to the 1.618 Fibonacci level ($2,521).

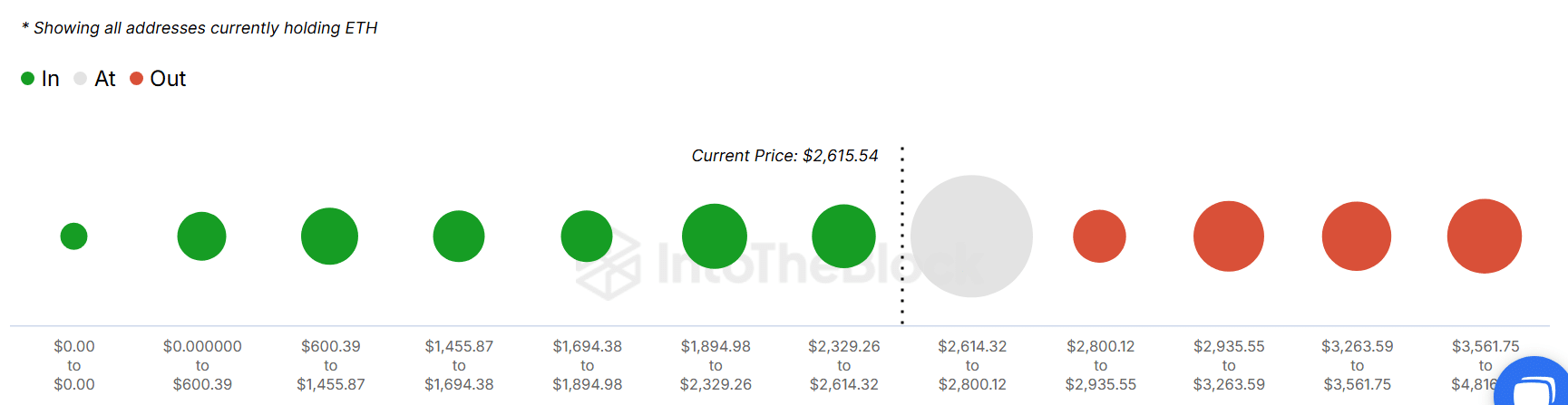

Levels between $2,614 and $2,800 were crucial as a large number of addresses that bought at these prices were “At the Money.” at press time.

Dropping below risks additional selling pressure if traders choose to sell and minimize their losses.

A further look at the Futures market indicated that traders were betting against ETH. The Long/Short Ratio was at 0.90 at press time, suggesting that more traders were taking short positions and abandoning long positions.

Is your portfolio green? Check out the ETH Profit Calculator

The other indication that Futures traders are less convinced about ETH’s price is the 3% drop in Open Interest (OI).

Per Coinglass data, OI has been on a steady drop from over $14 billion at the beginning of the month to the current $10 billion.