Ethereum, MATIC, and Graph Token – How the three assets’ surges are linked

The fundamental functionality of Ethereum will play a vital role in the future of blockchain. The success of Decentralized Finance, NFTs, and possibly a scalable network in the future, is bringing more development to ETH’s ecosystem.

A series of new crypto-projects have risen from building on Ethereum, while some projects are currently solving some of its inherent issues. Polygon, previously known as MATIC, and Graph token are a couple of projects that may see a significant rise in the future, with the former already ruffling some feathers in the ecosystem.

Scaling Ethereum with sidechains i.e MATIC Mantra

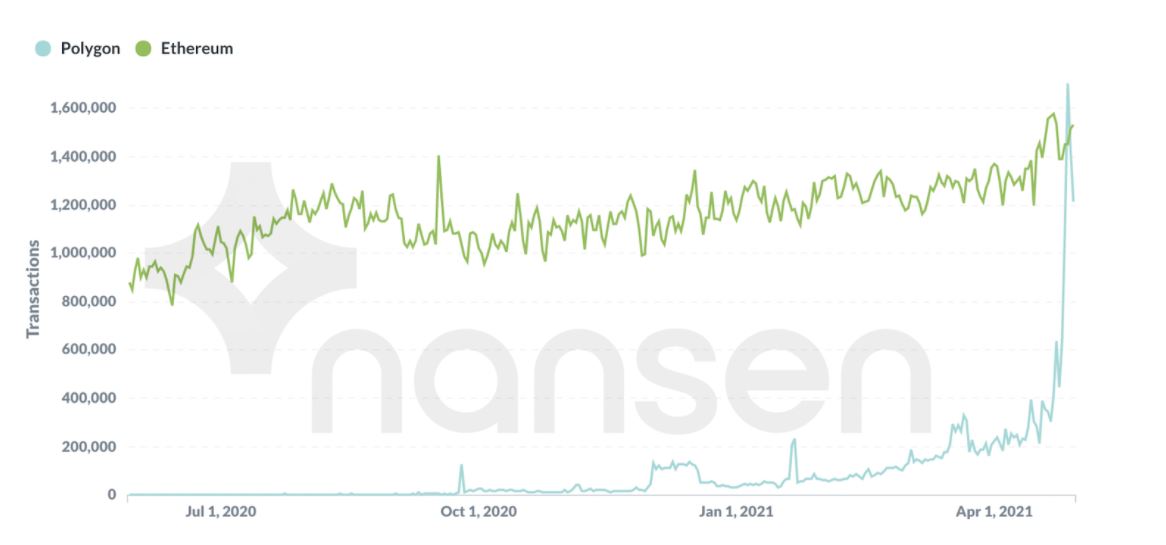

Transactions on Ethereum have been off the charts since the DeFi era began last year. Average gas prices have never been higher, and the value of scaling solutions has only risen in the industry. Enter Polygon aka Matic.

While MATIC is not a new network by any means (launched in Q2 2019), its utility is shining through at the moment, with the project tackling network overload and high transaction costs.

In fact, recent data would suggest that Polygon’s PoS sidechain has registered massive transactional volume, outperforming ETH’s count by 18% earlier this week. Here, it is important to note that 573,000 of the transactions last week were arbitrage trades, i.e conducting buy/sell on multiple platforms to incur some profits due to differences in prices.

Regardless, MATIC’s price has definitely profited from ETH’s current liability of scaling, and until ETH 2.0’s sharding upgrade is implemented, MATIC may continue to grow against Ethereum on the charts.

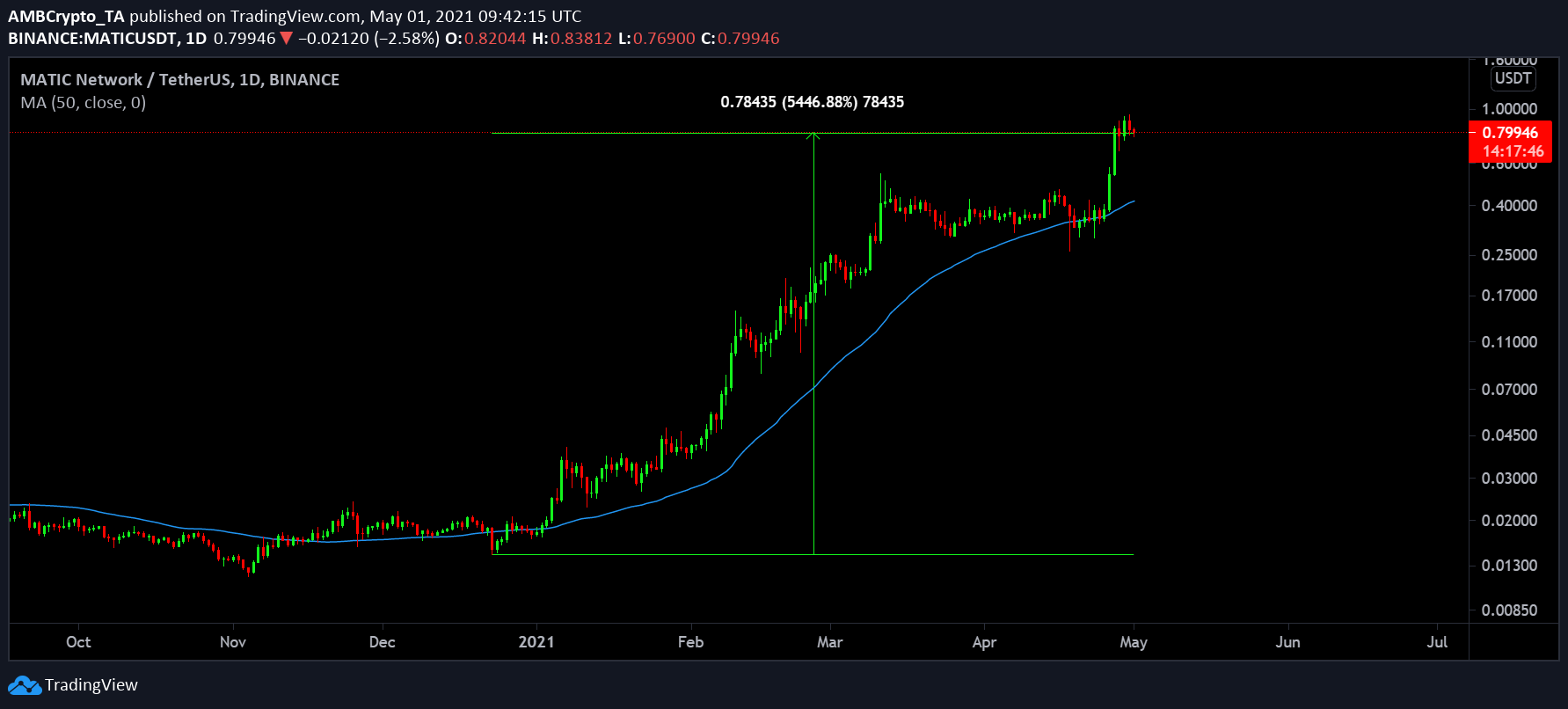

Source: MATIC/USDT on TradingView

MATIC’s value has risen by more than 5000% in 2021. While the market does seem saturated, it may continue to rise in light of the fact that the hype of DeFi continues to remain relevant through the present bull run. Polygon has even taken a step in that direction after announcing a $150 million fund to support DeFi adoption.

Graph Token – The one growing with ETH

With MATIC is profiting due to ETH’s scaling inability, Graph Token or GRT is looking forward to ascending with Ether. Ethereum’s blockchain has possibly the most diverse set of data, amassing various projects and side networks being built on top of its parent chain. With Graph’s indexing protocol, developers are able to search for any Ethereum data through simple queries.

In the future, such open-source indexing protocols on the blockchain would bring out chain reorganization, query fulfillment, and improve the application experience of evolving and upcoming DeFi apps.

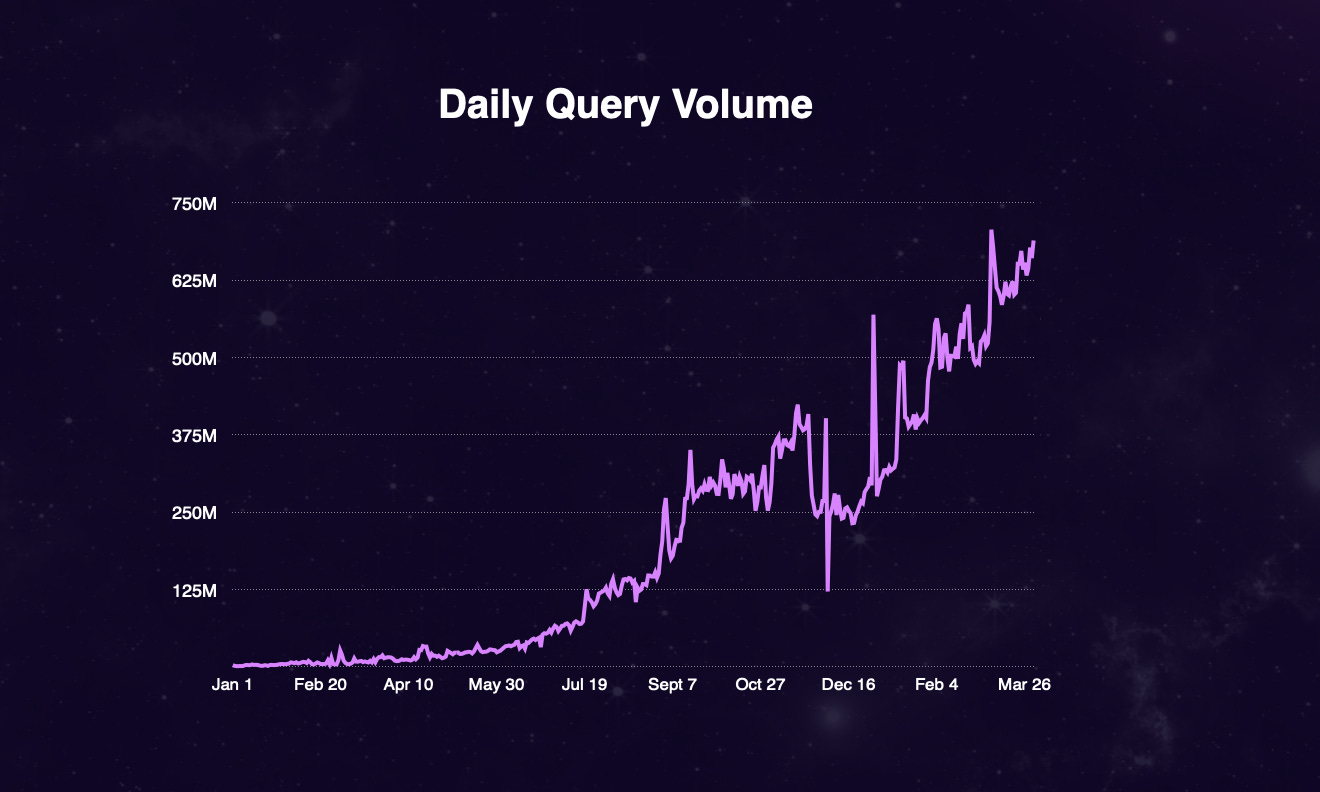

Source: Spencer Noon

The potential is capacious and query volume on The Graph seemed to be suggesting something similar too. According to statistics, for instance, 600 million queries are currently being processed per day, with over 19 billion processes in March alone. The hike in the adoption of Ethereum DApps and EVM-based chains has assisted too. With DeFi continuously evolving, query volumes can be expected to rise in a parabolic fashion.

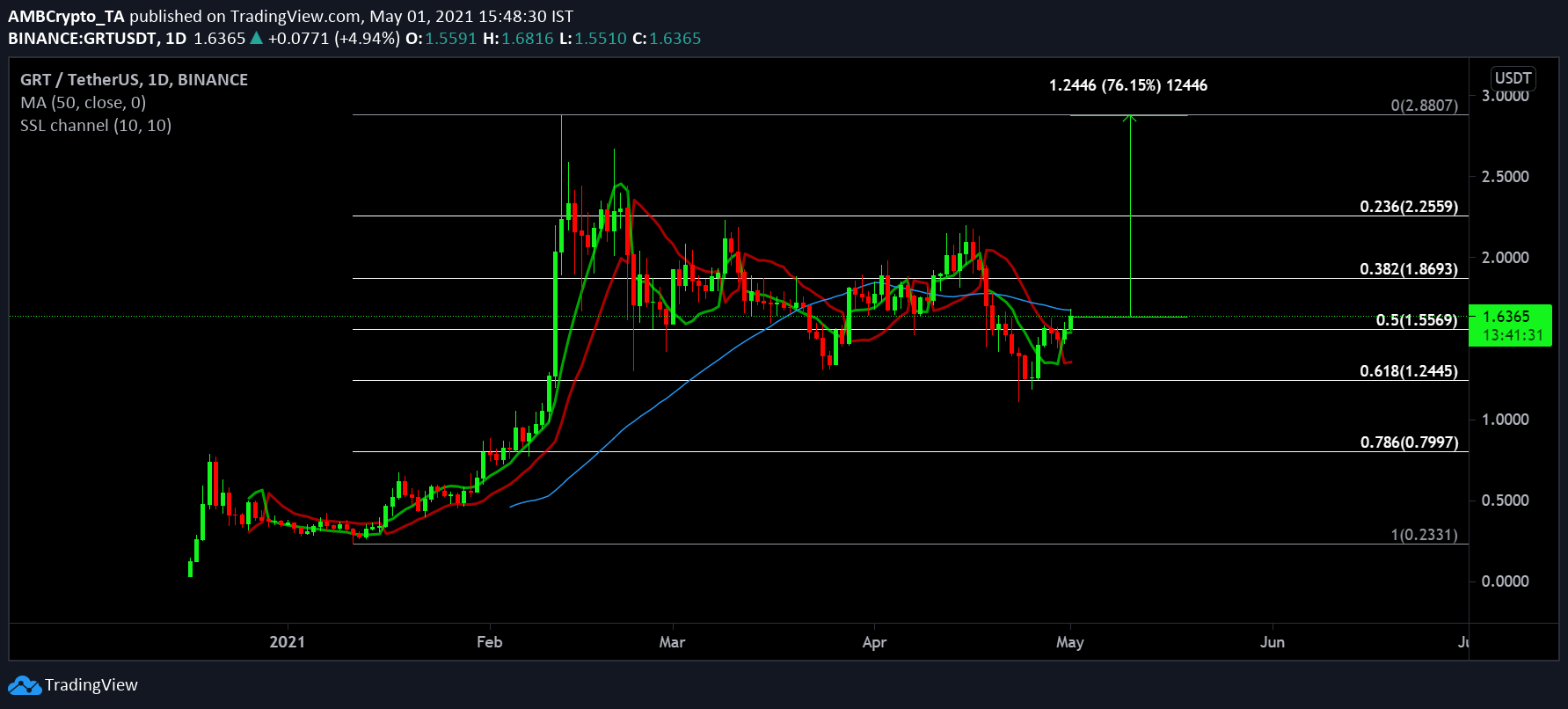

Source: GRT/USDT on Trading View

Right now, the price of GRT doesn’t represent the growth the network has seen of late. However, the possibility of hitting its previous high of $2.88 is very much likely. Therefore, GRT can be projected to grow by at least 75%, if not more, in the next few weeks or months, if the bull market remains intact.