Altcoin

Ethereum Name Service: Why $20 is critical for ENS’ next rally

ENS’ transaction count and velocity were bullish – a sign of increased market activity.

- ENS has a strongly bullish outlook for the coming weeks.

- On-chain metrics signaled increased market activity and demand.

Ethereum Name Service [ENS] has flipped its long-term bearish trend and beaten a cluster of resistance levels around the $20-$22 region that has challenged the bulls since early August.

The network activity also told an encouraging tale.

With that said, the possibility of a price pullback is present. However, it is anticipated that the Ethereum Name Service token can still trend higher.

It has sizeable unlocks in the coming months that can dent the demand-supply equation.

ENS metrics signal positive market sentiment

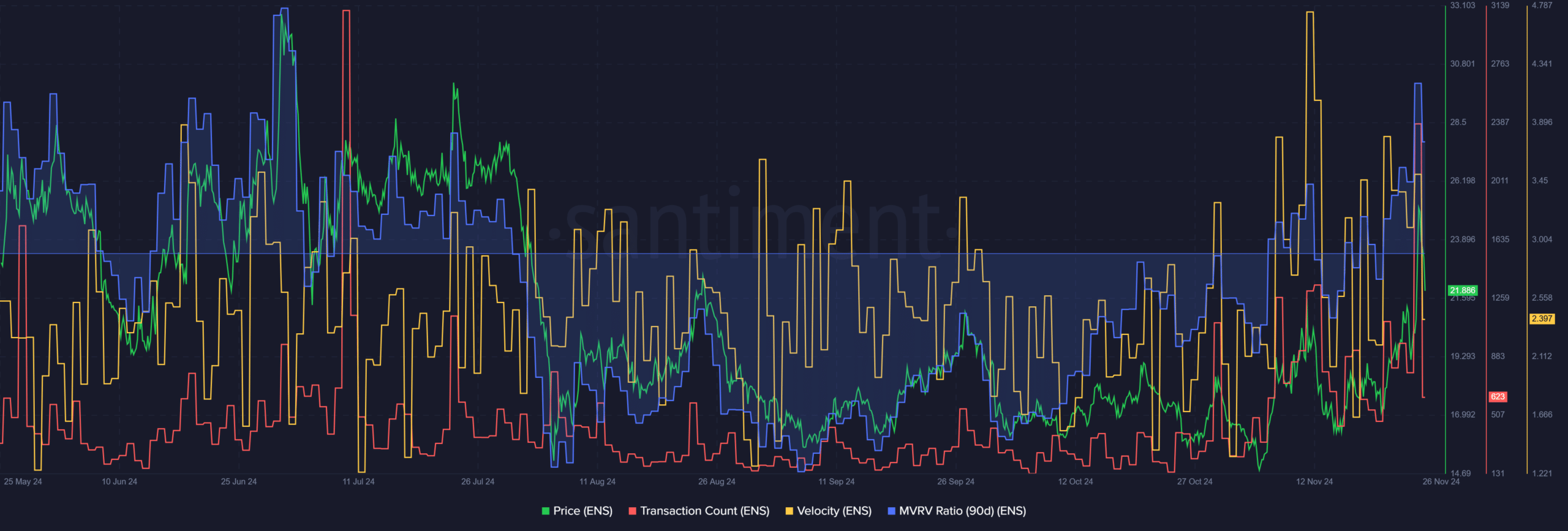

Source: Santiment

The 90-day MVRV was positive after the strong recent gains. This opened the possibility for profit-taking activity and a price dip. However, the transaction count and velocity were more bullish.

Their upward trajectory since late October was a sign of increased market activity. The transaction count measures the unique transactions occurring on the network in a day.

An increase in this metric is a sign of increased market participation.

Velocity measures how often a token changes hands. Increased prices, velocity, and transaction count mean that the token is traded more frequently and supports the idea of a healthy, active market.

Source: Santiment

The supply distribution by balance of addresses showed that the 1,000-1,000,000 ENS balance addresses had shed some of their holdings from October.

The former cohort has begun to climb higher, showing some accumulation.

Shrimp addresses with less than 10 ENS were also accumulating. More importantly, large whales with 1 million or more ENS saw their share of the pie increase, a sign that whales were buying these tokens too.

Will this whale activity increase the odds of a rally?

Read Ethereum Name Service’s [ENS] Price Prediction 2024-25

The move beyond $22 meant that ENS bulls had clear air above them. Volatility due to Bitcoin [BTC]

could pull ENS below the $20 mark, but it is likely to recover soon even in that scenario.The 78.6% level at $15.7 has been diligently defended since early August. A recovery from this level meant that the $34.5 and the extension levels further north were the next targets in the coming weeks.