Ethereum nears YTD high after a 29% surge – Can ATH be far behind?

- Ethereum surged 29% over the past week, reaching a three-month high of $3,184.

- The altcoin could be approaching its YTD high, fueling speculation of a potential Ethereum ATH.

Ethereum [ETH] has experienced a remarkable surge over the past week, climbing 29% to reach a three-month high of $3,184. With this strong upward momentum, the cryptocurrency is on the brink of hitting its year-to-date (YTD) high, drawing the attention of investors and market watchers alike.

With Bitcoin’s [BTC] $89,000 surge, discussions about the possibility of a new ATH for Ethereum are intensifying. Could the leading altcoin be poised for even greater gains, or is this rally a temporary spike?

Ethereum rally driven by traders and holders

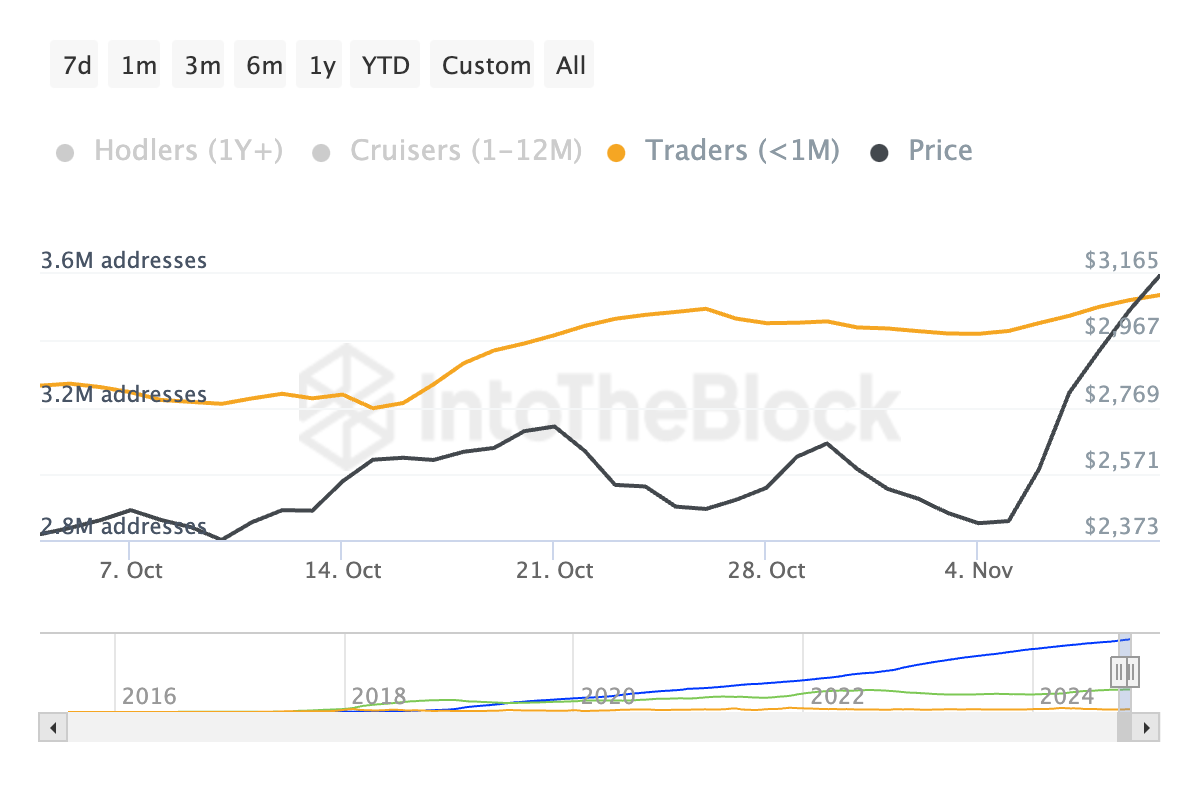

Ethereum’s recent rally was supported by a rising average holding time, indicating increased participation from long-term holders. This trend suggests greater confidence in the ongoing price surge and could signal a stable foundation for further gains.

The concurrent rise in both holding time and price points to a rally with staying power, fueled by stronger market sentiment and reduced selling pressure. Whether this momentum leads to an ATH remains to be seen, but investor optimism is clear.

Moreover, Ethereum’s price surge was also fueled by an increase in short-term traders, with around 3.6 million addresses holding for less than a month.

This spike in speculative activity suggests a potential short-term rally, but long-term holders and mid-term holders remain stable, providing a steady base.

Is an Ethereum ATH possible?

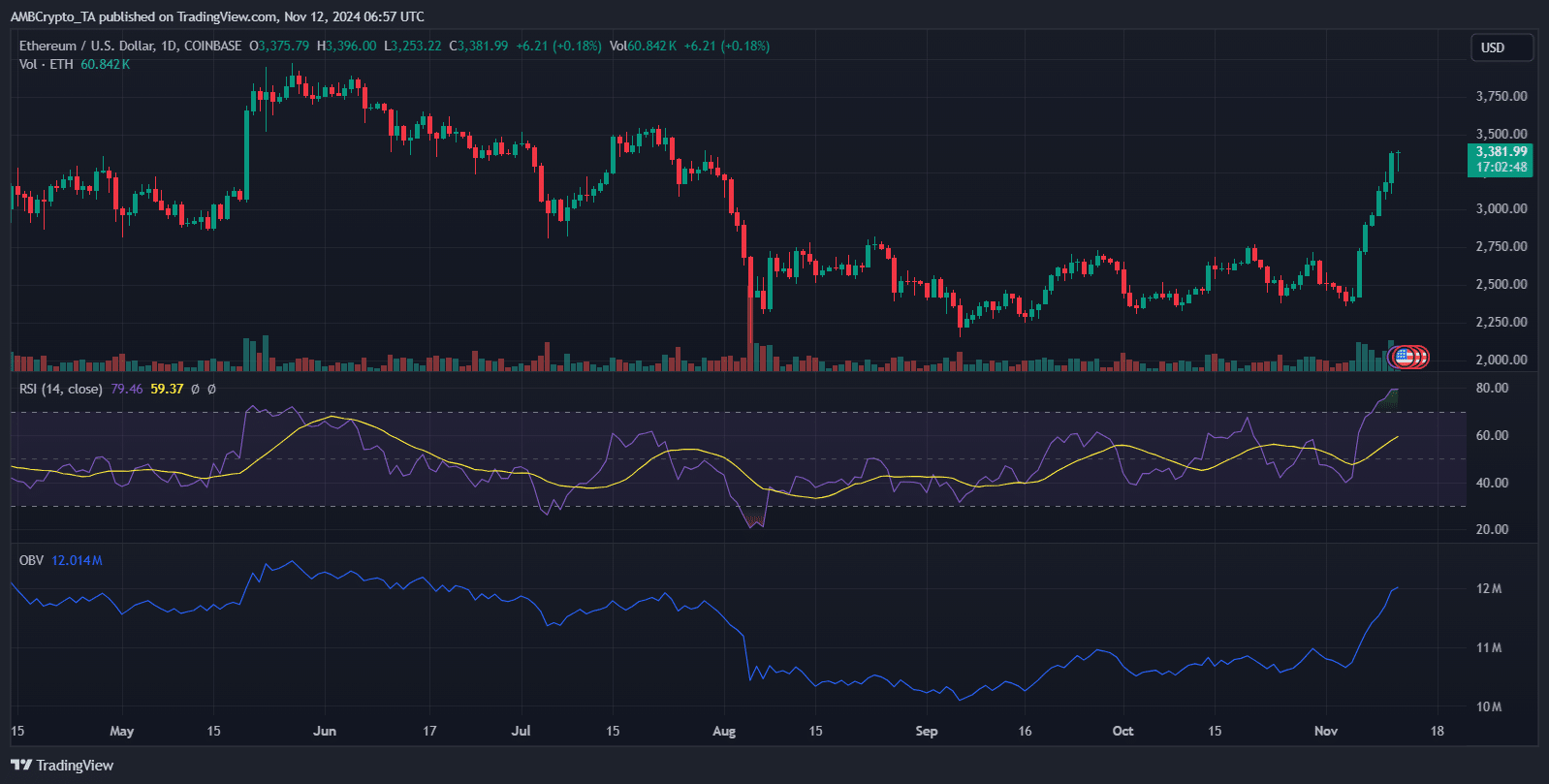

Ethereum’s price surge pushed the RSI to 77.45, indicating overbought conditions, which may prompt a short-term correction. The price momentum is supported by a rising OBV, reflecting strong buying interest.

If Ethereum breaks above its current level of $3,348, it could most certainly move toward the YTD high.

However, given the overbought RSI, a pullback to $3,000 may occur before further upside. Traders should be cautious and watch for consolidation around current levels or potential retests before any attempt to reach a new ATH.

Market sentiment and institutional involvement

Ethereum’s rally is driven by strong market sentiment and rising institutional interest, with big players drawn to its expanding role in DeFi and Web3.

Institutions add liquidity and stability, bolstering Ethereum’s long-term outlook and reducing volatility.

Read Ethereum Price Prediction 2024-25

However, with RSI at overbought levels, any shift in sentiment – perhaps due to macroeconomic or regulatory changes – could trigger a pullback.

If institutional confidence remains high, Ethereum may hold its gains and approach a new ATH. This ongoing institutional support could be pivotal in sustaining the current rally, providing a foundation for potential future highs.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)