Ethereum

Ethereum: Of staking, Lido’s dominance, and rising concerns

Lido’s soaring dominance in Ethereum staking raises centralization concerns, while a closer look at its market performance suggests its grip may not be as firm as it appears.

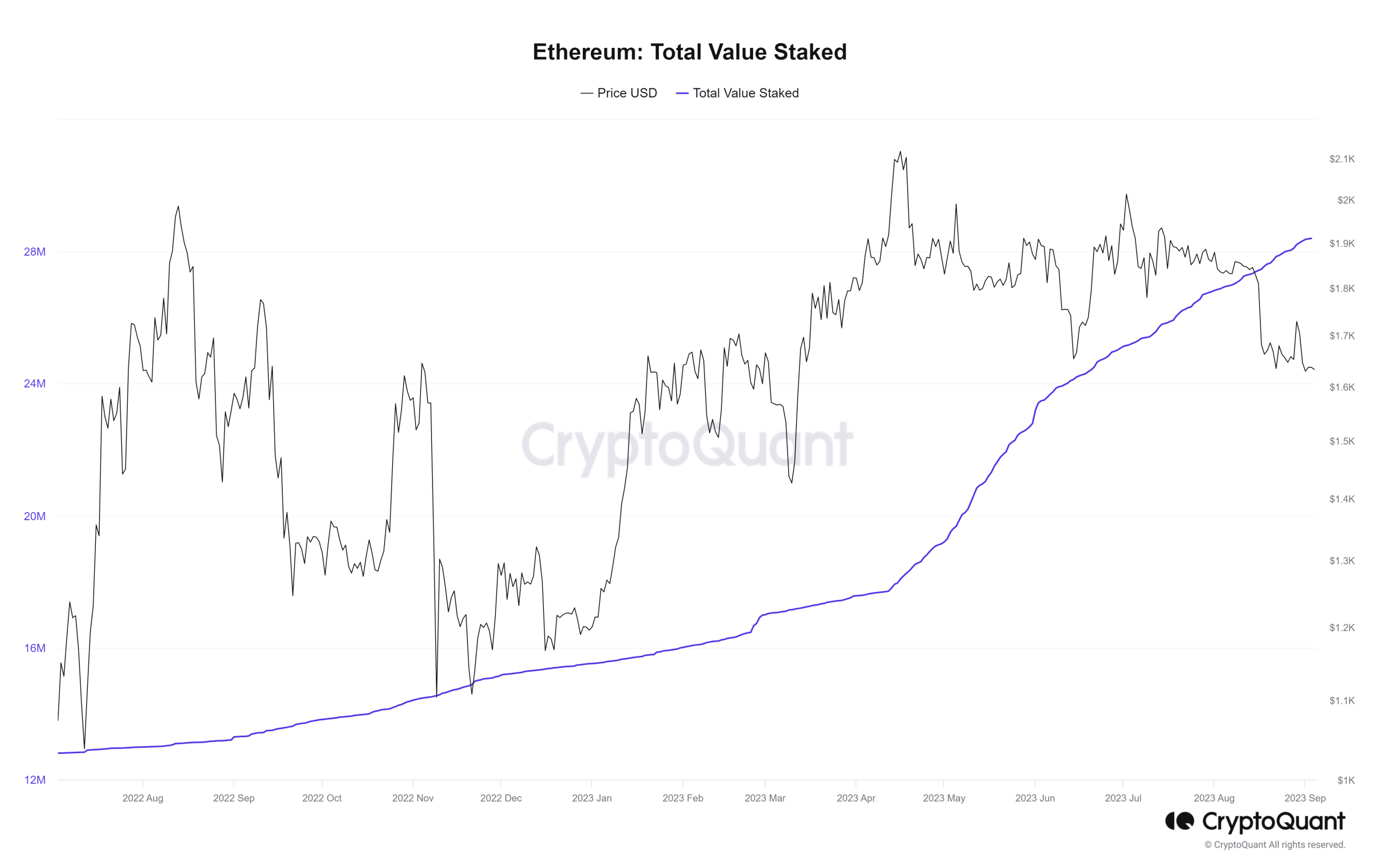

- ETH staked was over 28 million at press time.

- Likewise, ETH staked through Lido stood at over 8 million.

Ethereum [ETH] staking has seen a consistent rise in participation since its inception. With the increasing popularity of ETH staking, Lido’s [LDO] share of the staking market has also expanded, leading to certain concerns.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum staking and Lido’s dominance keeps rising

According to Ethereum’s staking chart on CryptoQuant, the press time amount of ETH staked exceeded 28 million. What’s particularly notable in the chart was the significant surge in Ethereum staking, with this upward trend becoming evident around April.

Additionally, data from Dune Analytics indicated that the total ETH staked accounted for approximately 22% of the total ETH in circulation.

However, the most intriguing aspect emerged when the percentage of ETH staked through Lido was examined. According to Dune Analytics, Lido commanded 32.4% of the total ETH staked, amounting to more than 8 million ETH.

In comparison, the closest competing platform had approximately 2 million ETH staked as of this writing.

Given Lido’s pronounced dominance in the Ethereum staking landscape, concerns regarding the centralization of the Ethereum network have recently arisen.

Lido’s Ethereum staking dominance sparks concerns

Ryan Berckmans has expressed concern that the increasing dominance of Lido may lead to Ethereum being viewed as a centralized platform.

Berckmans cautioned that this growing centralization could potentially damage Ethereum’s reputation, particularly in the eyes of corporations and governments, and undermine its aspirations of becoming a globally recognized settlement layer within the financial system.

imo, the realistic worst-case scenario for Lido's uncapped dominance isn't network disruption.

It's that Ethereum develops a reputation among corporations and governments as having been "captured" or "not actually that decentralized relative to other chains".

If this were to…

— Ryan Berckmans ryanb.eth?? (@ryanberckmans) September 1, 2023

Such a perception could adversely affect Ethereum, which has gained popularity due to its multitude of decentralized applications (dApps) hosted on the network.

LDO not as dominant

An examination of Lido on a daily timeframe chart revealed that it was not as dominant as its staking share. As of this writing, LDO was trading at approximately $1.5, experiencing a modest price increase of over 1%.

How much are 1,10,100 LDOs worth today?

In the days leading up to the observed trading session, LDO had been downward for five consecutive days.

The bearish trend was further corroborated by the positioning of its long and short Moving Averages (yellow and blue lines). The price was trending below the yellow line, acting as a resistance level in the range of $1.8 to $1.9.