Ethereum options spike: ETH to surge to $3K by December?

- ETH showed renewed interest across the options market.

- Despite short-term challenges, it suggested a bullish outlook for ETH in Q4.

Ethereum [ETH] has lagged behind its major peers, such as Bitcoin [BTC] and Solana [SOL], despite US spot ETF approval in Q2. However, on Friday, the 13th of September, there was strong renewed interest in the largest altcoin.

According to the Singapore-based crypto trading firm QCP Capital, ETH options spiked with much interest in contracts targeting $3k by the year-end. Part of the firm’s weekend note read,

“The options market witnessed renewed interest in ETH, with over 20k contracts targeting the $3k level by December 27. The year-end outlook for ETH could be shaping up to be significant.”

ETH’s bullish revival

For context, options data and volume are forward-looking indicators that offer future price expectations and overall market sentiment.

So, the above surge in the options market, including Open Interest (OI) rates, indicated bullish expectations and potential price appreciation in Q4.

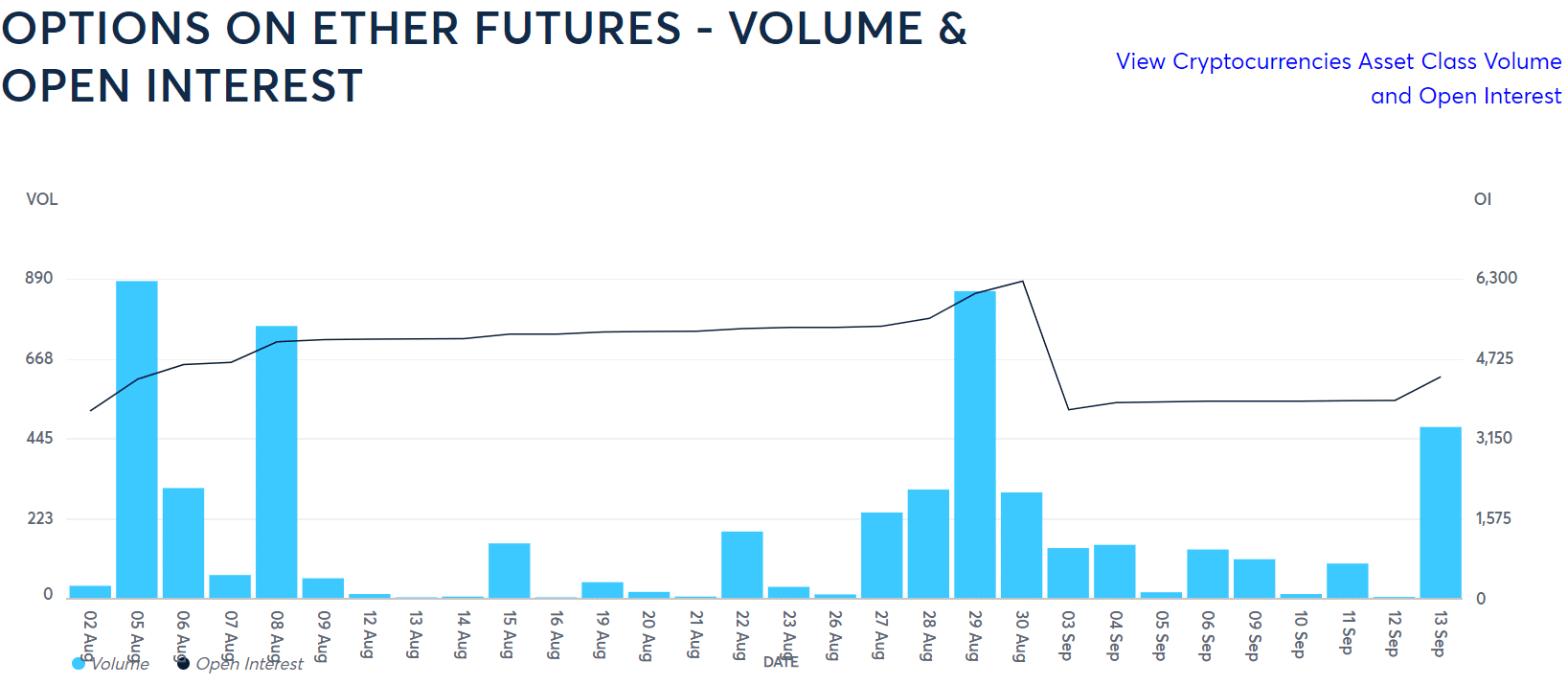

The Chicago Mercantile Exchange (CME) data confirmed QCP Capital’s outlook.

On the 13th of September, ETH recorded a sharp uptick in volume and OI for the first time this month. The OI surged to $3.1 billion while volume hiked nearly to $700 million, reinforcing institutional interest in the altcoin.

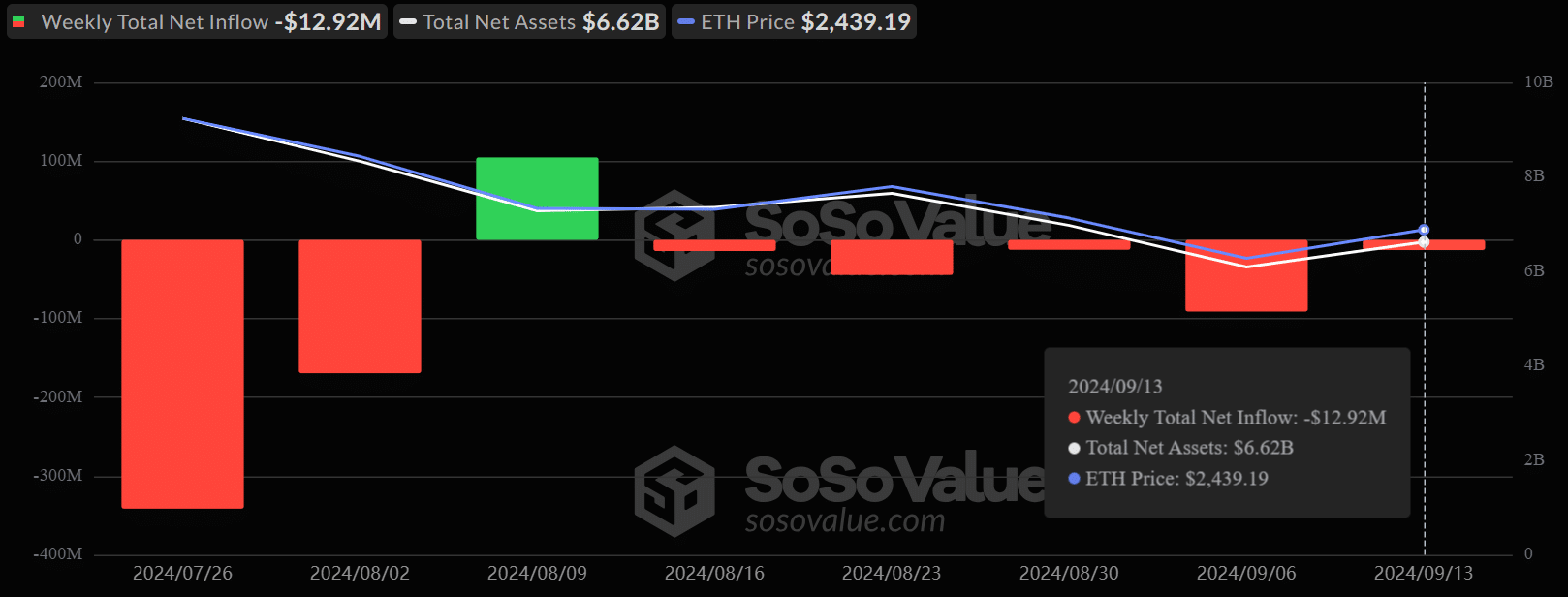

Despite the increased options activity, the spot market saw minimal demand from US ETH ETFs on Friday.

The products saw a cumulative $1.5 million in daily inflow, but it was net negative on the weekly count. They bled $12.92 million last week, a trend that was yet to be reversed to reinforce strong investor confidence.

However, Coinbase analyst David Duong blamed ETH’s muted price performance on the current market structure. Duong noted that crypto investors were tied to other altcoin positions, limiting capital flow to ETH.

Another possible short-term challenge to ETH’s price was a spike in exchange reserves. About 100k tokens moved to exchanges ahead of the Fed rate decision on the 18th of September.

In the meantime, ETH was valued at $2.4k at press time, up 5% in the past seven days of trading.