Ethereum Pectra Devnet nears launch: Will ETH climb higher?

- Developers continued to work on Plectra upgrade for the Ethereum network.

- Changes in staking rewards were discussed to mitigate centralization and other risks to the network.

Apart from the market recovery, the increasing attention around Ethereum [ETH] has helped it soar over the past few days. The upcoming Plectra update could further help Ethereum see green.

Developers continue with their work

In the 137th All Core Developers Consensus (ACDC) call, the primary focus was on the progress of two testnets, Pectra Devnet 1 and PeerDAS Devnet 1.

Pectra Devnet 1 is nearing its launch, with both Consensus Layer (CL) and Execution Layer (EL) clients prepared. The Ethereum Foundation DevOps team is rigorously testing various client combinations to ensure compatibility and stability.

PeerDAS Devnet 1 is currently undergoing bug fixes before its planned relaunch. Once these issues are resolved, the devnet is expected to be restarted by the end of the week.

In addition to testnet updates, the call also covered research on fork choice testing by the TxRX team at Consensys. Their newly developed test generator aims to identify potential bugs and deviations in client software from CL specifications.

The successful launch of Pectra Devnet 1 is a significant step towards the Pectra upgrade, which is expected to introduce several improvements to the Ethereum network.

The ongoing development of the fork choice test generator is crucial for enhancing the reliability and security of the Ethereum ecosystem.

New changes for stakers

Additionally, Ethereum is also considering adjusting its staking rewards to maintain a lower staking rate, potentially around 25% or 12.5%.

This change could have a substantial impact on the returns ETH holders receive from staking. The Ethereum Foundation is exploring this option to address several concerns.

A lower staking rate is seen as a way to mitigate the risk of centralization, where a significant portion of ETH becomes concentrated in a few large staking pools.

This centralization could potentially threaten the network’s security and decentralization.

Additionally, a lower staking rate might reduce the likelihood of a mass slashing event leading to a chain split, a scenario where ETH holders might pressure the protocol to restore lost funds.

How is ETH doing?

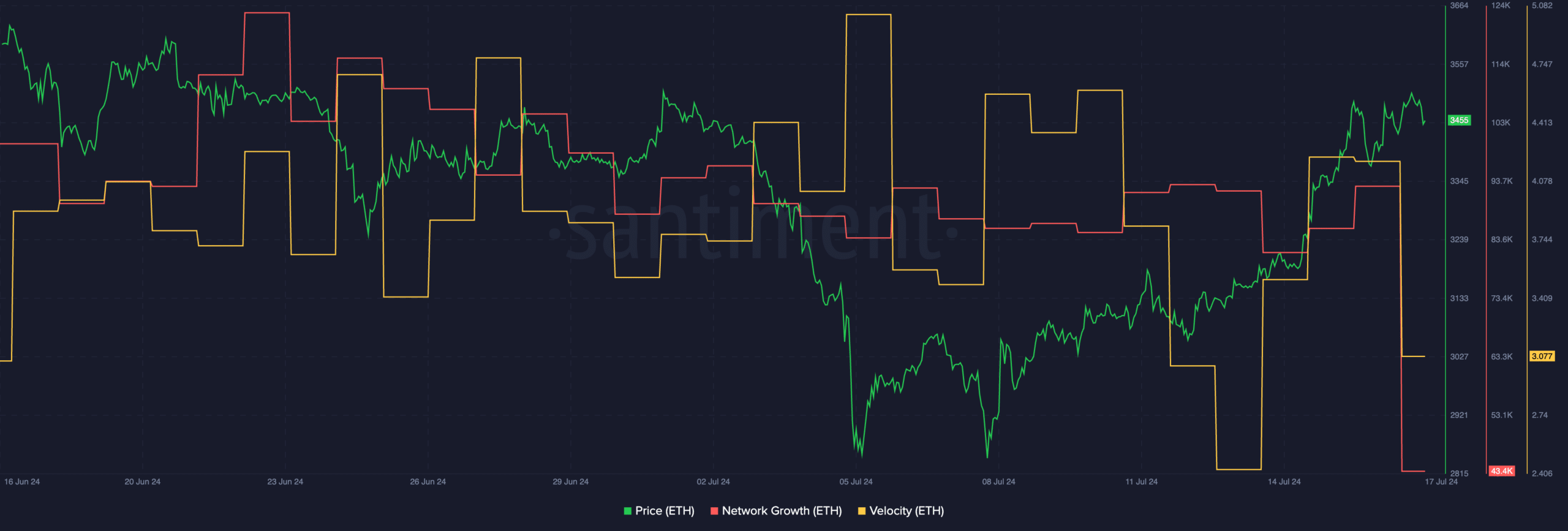

At press time, ETH was trading at $3,455.17 and its price had grown by 1.16% in the last 24 hours. Despite the recent surge in price, the network growth for the Ethereum token had declined, suggesting that new addresses were slowly losing interest in the ETH token.

Read Ethereum’s [ETH] Price Prediction 2024-25

Moreover, the velocity at which ETH was trading at had also fallen significantly, implying that the frequency at which ETH was trading at had also fallen.

If these trends continue, ETH’s chances of rallying further would diminish even further.