Ethereum: Post Teku’s ‘garbage collection,’ here’s how the network is doing

Ethereum’s ETH has finally crawled back over $3,000 and a lot of work is frantically going on behind the scenes to ensure that the merge takes place smoothly. But that does not mean the process is free of hiccups. After what was deemed to be a “minor” incident a few days ago, the Ethereum community came together to decode what exactly went wrong.

Do Teku your time

The incident in question took place on 15 March and involved a drop in participation on the Beacon chain. The incident report found this was due to “garbage collection activity” by the client Teku, which led to the nodes lagging for possibly up to an hour. The report noted,

“This resulted in varying combinations of increased rates of incorrect head votes, increased attestation inclusion delays or entirely missed attestations. Some nodes may have crashed with

OutOfMemoryError.”

The report observed that validator keys were not affected. Teku was in charge of less than 33% of the stake, so this was not a critical emergency. Still, the 4,000 deposits that came through were a hassle.

A fixed version has been shared and Teku is up and running again, but even so, let’s give Ethereum a general check-up just to be sure.

Breathe in, breathe out

Needless to say, development activity is the lifeblood of Ethereum. However, it’s been on a sharp decline since about mid-March. It’s not fair to blame Teku for this since it is a minority client, but the fall in dev activity was still an alarming trend.

Source: Santiment

Next up, from an investment perspective, we can see ETH rapidly moving off the exchanges. This can be attributed to the leading alt’s gradual rally from around $2,500 to above $3,100. Those who came in to buy right at the very end missed the dip opportunity, but are probably hoping that the rally will continue.

Source: Santiment

What about the furnaces of the Ethereum network? Well, the community recently celebrated the burning of two million ETH. At press time, around $6,375,201,963 had been burned in total.

What’s more, average gas prices were falling as well. On 26 March, average Ethereum gas prices stood at 34.69 gwei. Furthermore, prices have been falling since the 200+ gwei rates seen in January 2022.

Only as happy as your unhappiest investor?

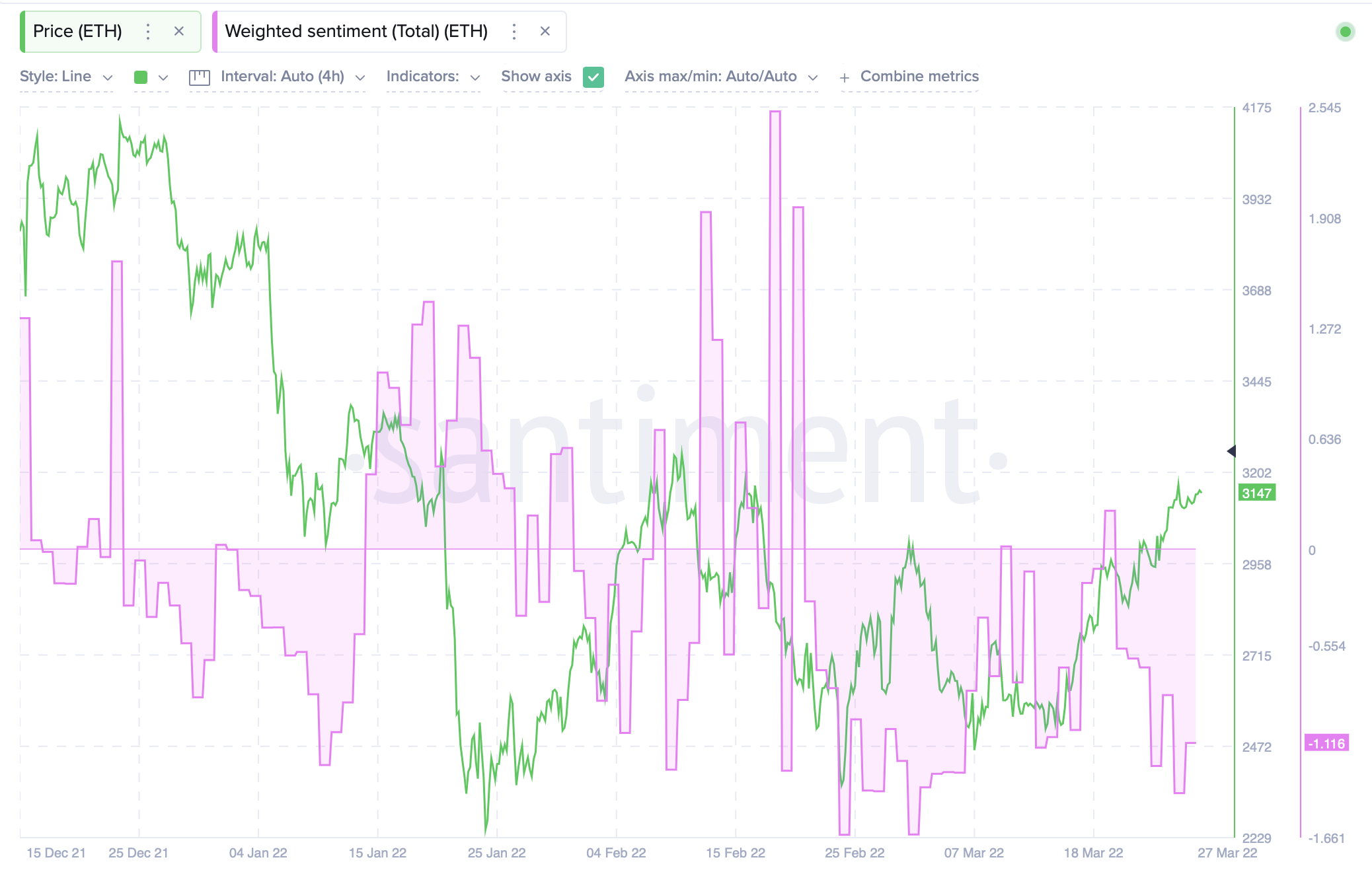

With prices going up and average gas prices coming down, investors should have been happy as pie. However, Santiment revealed that total weighted sentiment for Ethereum was firmly in the negative territory. Around price time, it clocked in at -1.116. While not the most encouraging of signals, low euphoria levels could perhaps help the rally go on.

Source: Santiment