Ethereum price analysis: ETH targets $3,700 resistance after recovery

- Ethereum’s price surged by 6% from its weekly low of $3,381.

- Metrics indicate a potential price reversal.

In an exceptional turnaround, the king of altcoins has witnessed a significant price recovery from its weekly low of $3,381.

According to the data from the top platforms, Ethereum’s [ETH] upswing can be attributed to whale activities.

Ethereum price was up by 14% in the last 30 days. Ethereum was trading at an average price of $3,527, at press time. Its 24 hour trading volume stood at around $19.5 billion, with a market cap of $433 billion.

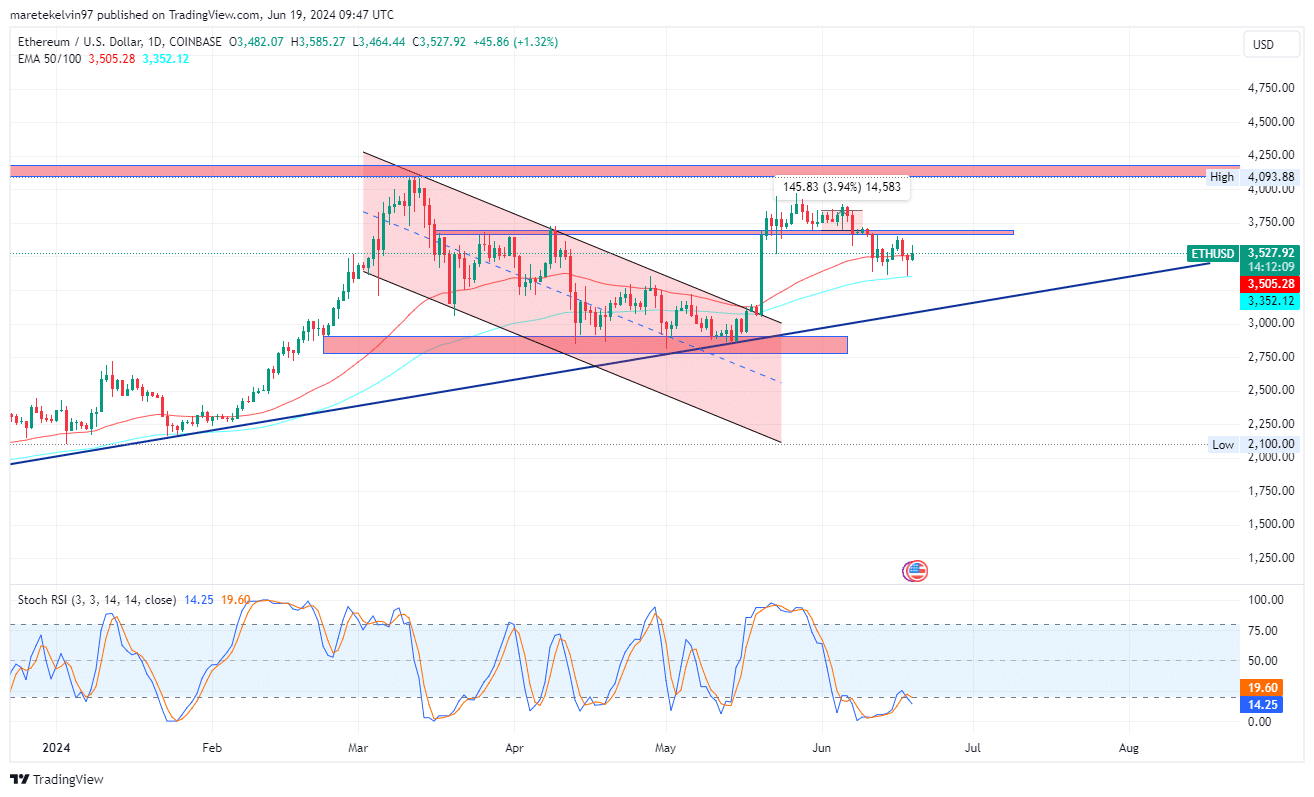

Ethereum has surged by 6% since retesting a 50-day exponential moving average resistance level. The next price target remains at around the $3700 resistance level if the bulls accumulate more momentum.

The stochastic RSI indicates an oversold zone that could signal a potential price reversal to the bullish side.

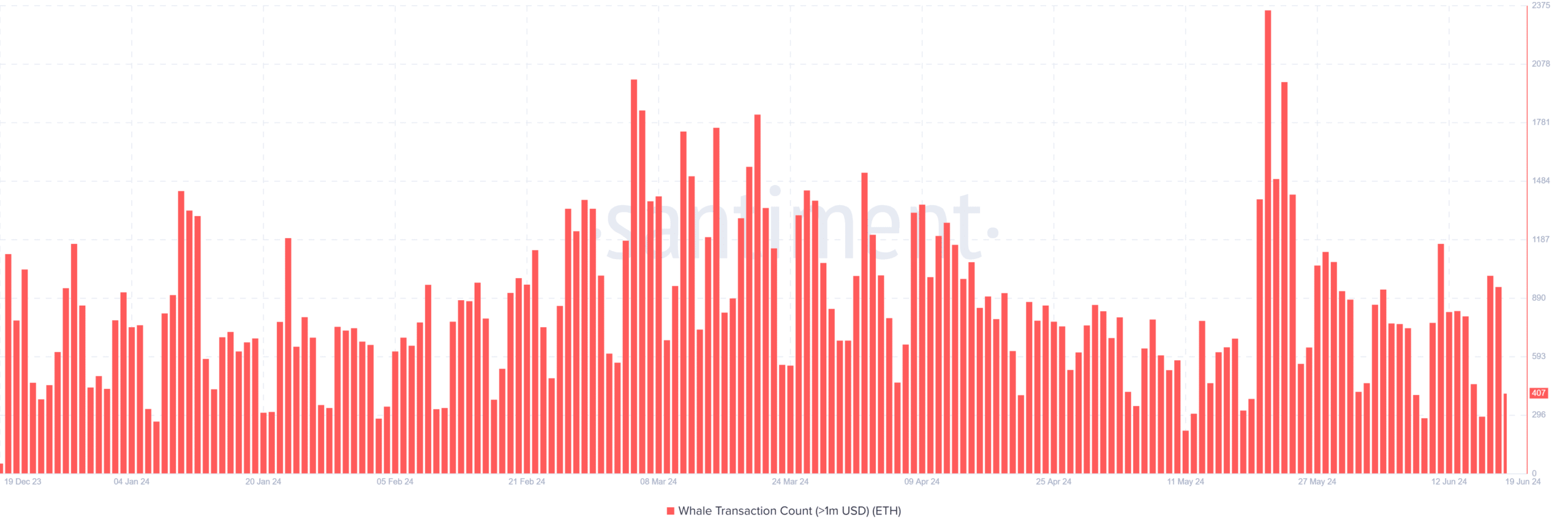

Whale transactions fuel price momentum

According to santiment’s data, the number of whale activities involving ethereum has spiked in recent days. The number of whale transactions soared to over 1400 on 18th June.

This heightened rise in the whale transaction coincides with Ethereum’s recent price surges. This suggests that investors were actively accumulating ETH during the recent dip.

The whales’ long positions may cause ETH to surge if the bullish pressure continues.

Liquidation heats up but Ethereum remains strong

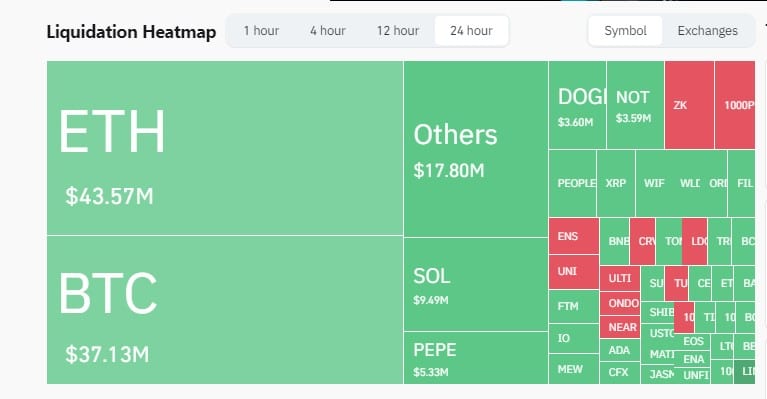

Coinglass’s liquidation heatmap data further indicates Ethereum’s resilience.

Despite the liquidations across the cryptocurrency market, ETH whales managed to hold a significant $43.57 million worth of long positions in the last 24 hours.

This whale’s commitments further indicate confidence among Ethereum’s long term prospects.

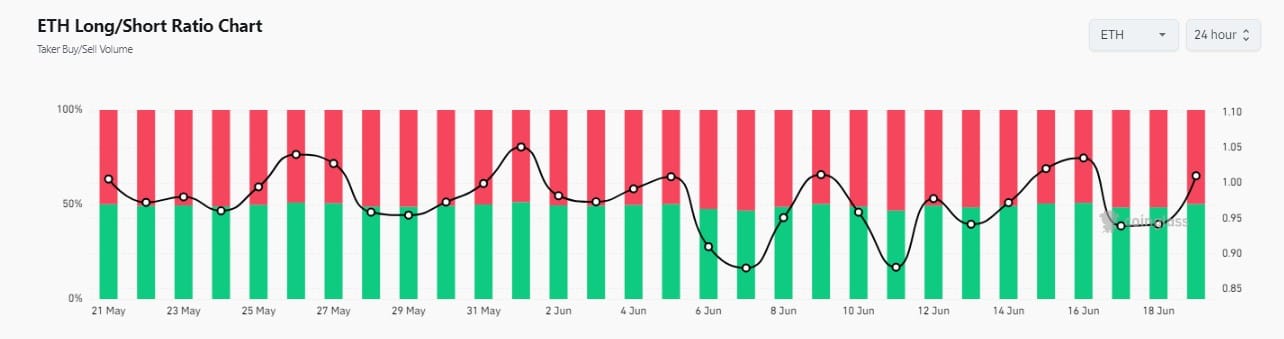

The long-short ratio data reveal that there was a stagnation in the long positions-indicated by a flattened curve. However, there has been a spike in the data, indicating that the long positions are currently in control of the market.

Read Ethereum’s [ETH] Price Prediction 2024-2025

What next for ETH?

With increased whale activity and investor resilience, Ethereum’s recent bullish momentum is likely to be maintained.

The market sentiments indicate that long investors outweigh short position traders, which could signal a price surge in the near future. However, the bearish rally could continue.