Ethereum price crash soon? $330 million in bearish bets reveal…

- Intraday traders have placed $330 million in short positions.

- Despite the bearish outlook, a crypto whale has withdrawn $5.27 million worth of ETH.

Ethereum [ETH] and other cryptocurrencies have significantly tumbled following U.S. President Donald Trump’s tariff announcement.

According to recent data, most countries will now face a 10% tariff, while China, the EU, and Japan were hit harder with tariffs of 34%, 20%, and 24%, respectively.

This development has caused a sharp decline in the overall cryptocurrency market.

Meanwhile, Ethereum has dropped over 4.50% and was trading near the $1,800 level at press time, which appeared to be a make-or-break point for the upcoming price levels.

Ethereum price action and upcoming levels

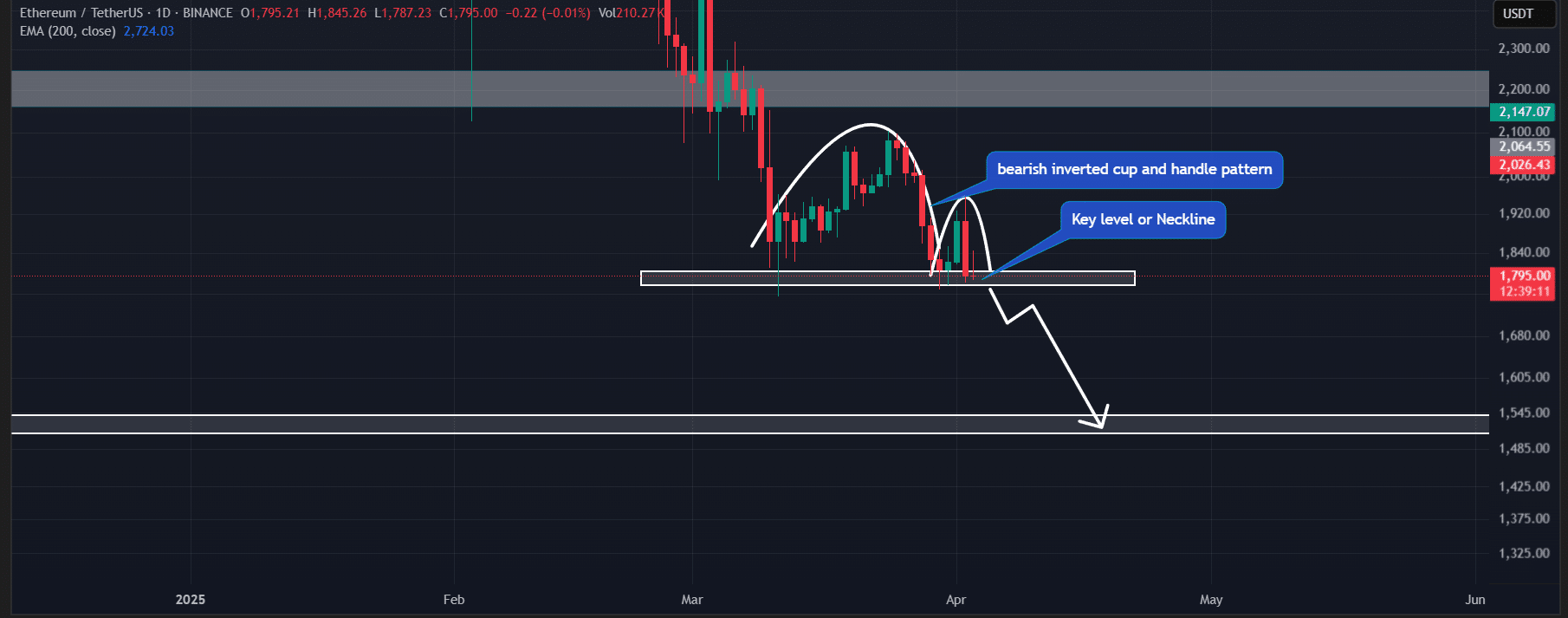

According to AMBCrypto’s technical analysis, ETH appeared bearish and was on the verge of a significant price decline.

On the daily time frame, the asset seemed to have formed a bearish cup and handle pattern and was at the neckline.

Based on historical price momentum, if ETH breaches the neckline and closes a daily candle below the $1,770 mark, a massive sell-off could follow.

The price could drop by 15% until ETH reaches the next support level at $1,500.

ETH was trading below the 200-day Exponential Moving Average (EMA) at press time, which signaled a bearish trend that further strengthened the bearish outlook of the asset.

Whales’ recent activity

Amid this price decline and bearish market sentiment, investors and whales seemed to be taking advantage of the dip and continuing to accumulate tokens.

Recently, blockchain-based transaction tracker Lookonchain revealed on X (formerly Twitter) that a crypto whale withdrew a significant 2,774 ETH, worth $5.27 million, from the Binance cryptocurrency exchange.

Additionally, the same whale has withdrawn over 16,415 ETH, worth nearly $43.90 million, from Binance at an average price of $2,676.

This indicates a “buy-the-dip” strategy, as despite the continued price decline, the whale appeared to be averaging their ETH holdings at lower levels.

Traders’ $330 million bearish bet

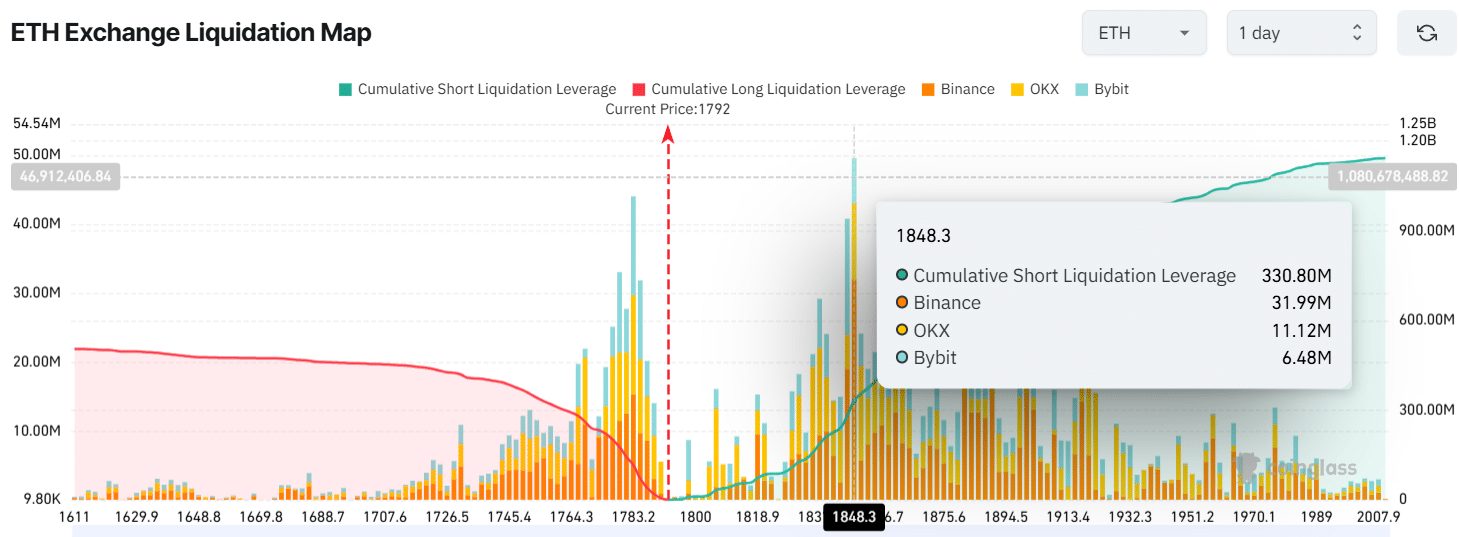

Looking at on-chain metrics, ETH appeared weak and poised for a price crash. Data from the on-chain analytics firm Coinglass showed that intraday traders were notably betting on the short side.

At press time, traders were over-leveraged at $1,783 on the lower side, where they have built $115 million worth of long positions, while $1,848 is another over-leveraged level with $330 million worth of short positions.

These massive over-leveraged positions reflect the true market sentiment, which appears bearish.