Ethereum

Ethereum price prediction: Why a move to $4K may take time

Ethereum’s key indicators confirmed that its price has consolidated within a range since 20th May.

- Ethereum has trended within a range in the past ten days.

- Futures traders continue to take long positions.

An analysis for Ethereum [ETH]

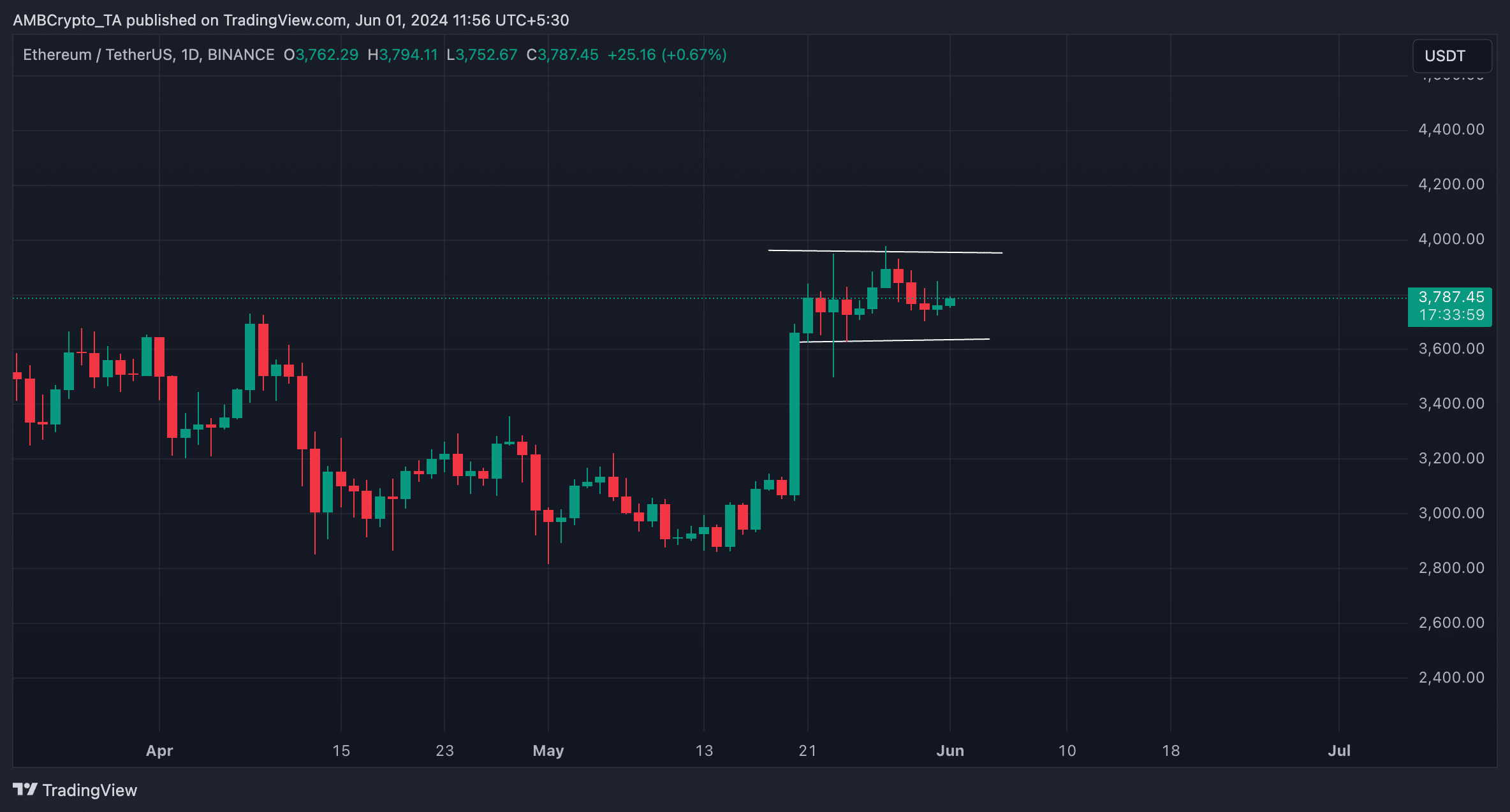

price prediction showed that ETH has trended within a horizontal channel since it closed above $3650 on 20th May.A horizontal channel is formed when the price of an asset consolidates within a range for some time. This happens when there is a relative balance between buying and selling pressures, which prevents the asset’s price from trending strongly in either direction.

The upper line of this channel forms resistance, while the lower line forms support. For ETH, it has formed resistance at $3962, while it finds support at $3638.

Ethereum price prediction shows bulls are here

Readings observed from ETH’s key momentum indicators confirmed that the market has been marked by equal amounts of buying and selling activity in the past few days.

Although still positioned above the 50-neutral spot, ETH’s Relative Strength Index (RSI) and Money Flow Index (MFI) have been “flat” in the past few days.

These momentum indicators are said to be flat when they trend in a seemingly straight line, with no significant swings up or down.

When they trend in this manner, it suggests that neither strong buying nor strong selling pressure exists. Traders interpret it to mean that there is no clear signal for a breakout upward or downward.

As of this writing, ETH’s RSI was 64.92, while its MFI was 63.74.

Further, the coin’s declining Average True Range (ATR) confirmed the price consolidation. This indicator measures market volatility by calculating the average range between high and low prices over a specified number of periods.

When the indicator falls, it suggests lower market volatility and hints that the asset’s price is trending within a range without significant upward or downward movements.

Futures traders are unmoved

Despite ETH’s sideways price movements in the past few days, its futures market activity has continued to grow. Since 20 May, the coin’s futures open interest has increased by 42%.

Is your portfolio green? Check the Ethereum Profit Calculator

When an asset’s futures open interest surges like this, more traders are entering the market to open new trading positions. At press time, ETH’s futures open interest was $16.45, per Coinglass’ data.

Regarding whether these traders are opening short or long positions, ETH’s positive funding rate across cryptocurrency exchanges has remained positive. This shows that there has been more demand for long than short positions.