Ethereum rebounds, whales scoop ETH: Will the ETF approval boost gains?

- Ethereum whales are actively accumulating, with recent large transactions signaling renewed confidence.

- Anticipation of Ethereum ETF approval drives significant institutional inflows, suggesting bullish sentiment.

Ethereum’s [ETH] price increase has triggered heightened activity among large holders, commonly known as whales.

Following a week of downward momentum, ETH’s price has seen a resurgence, leading to substantial transactions by whales.

As of the time of writing, Ethereum was trading at $3,113.58 with a 24-hour trading volume of $14,340,649,075, according to CoinGecko.

This was reflected in a 1.07% price increase over the past 24 hours, although the cryptocurrency has experienced a -7.46% decline over the past seven days.

This uptick in price has catalyzed increased accumulation by whales, signaling a potential shift in market sentiment.

Significant whale movements

Recent on-chain data indicated substantial activity among Ethereum whales.

Notably, Spot On Chain, an on-chain data provider, reported that an Ethereum whale withdrew 16,449 ETH, equivalent to $50.3 million, from the crypto exchange Binance [BNB].

This move came as ETH surged past $3,000, marking the first notable accumulation by a new whale address. The withdrawn ETH has since been transferred to a new wallet and remains there.

Furthermore, Whale Alert noted another substantial transaction involving 9,966 ETH, equivalent to approximately $30.6 million, transferred from the Kraken exchange to an unknown wallet.

This activity aligned with a broader trend of whales resuming their accumulation of ETH following a period of distribution.

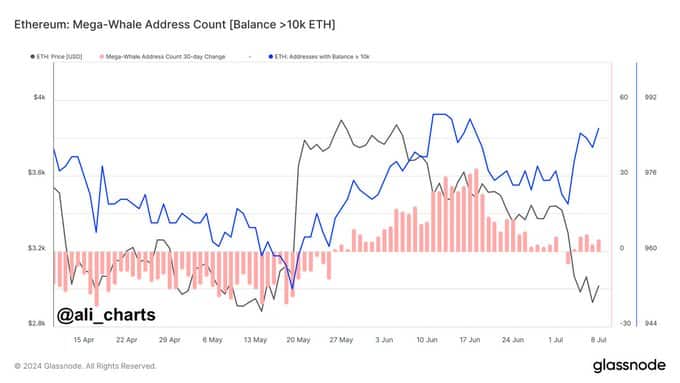

Ali, a known analyst on X, commented,

“After a brief distribution period, #Ethereum whales are back to accumulating $ETH!”

The number of addresses holding over 10,000 ETH has declined since mid-April and began to rise again in early July.

This trend suggested that some mega-whales reduced their holdings during the price decline but are now increasing their positions.

The timing of these large-scale withdrawals and accumulations coincided with the market’s anticipation of the Ethereum ETF, which is expected to go live next week.

This development is a potentially bullish signal for Ethereum, as it could attract further investment and drive up prices.

Potential impact of Ethereum ETF approval

Katherine Dowling, Bitwise’s Chief Compliance Officer, has affirmed that the approval of the spot Ethereum ETF in the U.S. is approaching.

With issuers submitting their S-1 amendments, analysts expect the approval around the 18th of July.

Read Ethereum’s [ETH] Price Prediction 2024-2025

This has led to a surge in inflows into Ethereum investment products, with institutional players accumulating ETH ahead of the ETF approval.

Last week, Ethereum investment products saw inflows of $10.2 million, indicating growing interest from institutional investors.