Analysis

Ethereum reclaims $1700 but struggles to hold on

ETH struggles to hold on to $1700 after benefiting from Grayscale’s recent win against SEC.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH’s recent pump waned and eased towards $1700 at press time.

- Open Interest surged to $5 billion, last seen on 18 August, but later dipped.

After an impressive pump on 29 August, Ethereum [ETH] struggled to hold above $1700. The pump followed Grayscale’s win against SEC, but it appeared buyer exhaustion crept in.

Is your portfolio green? Check out the

ETH Profit CalculatorSimilarly, Bitcoin [BTC] faced rejection at $28k and struggled to hold above $27k. So, a BTC breach below $27k could complicate matters for ETH bulls.

In a new development, on-chain data showed that ETH outperformed BTC on long-term holders by a whopping 40 million. The milestone was due to ETH’s many use cases.

Will bulls defend $1700

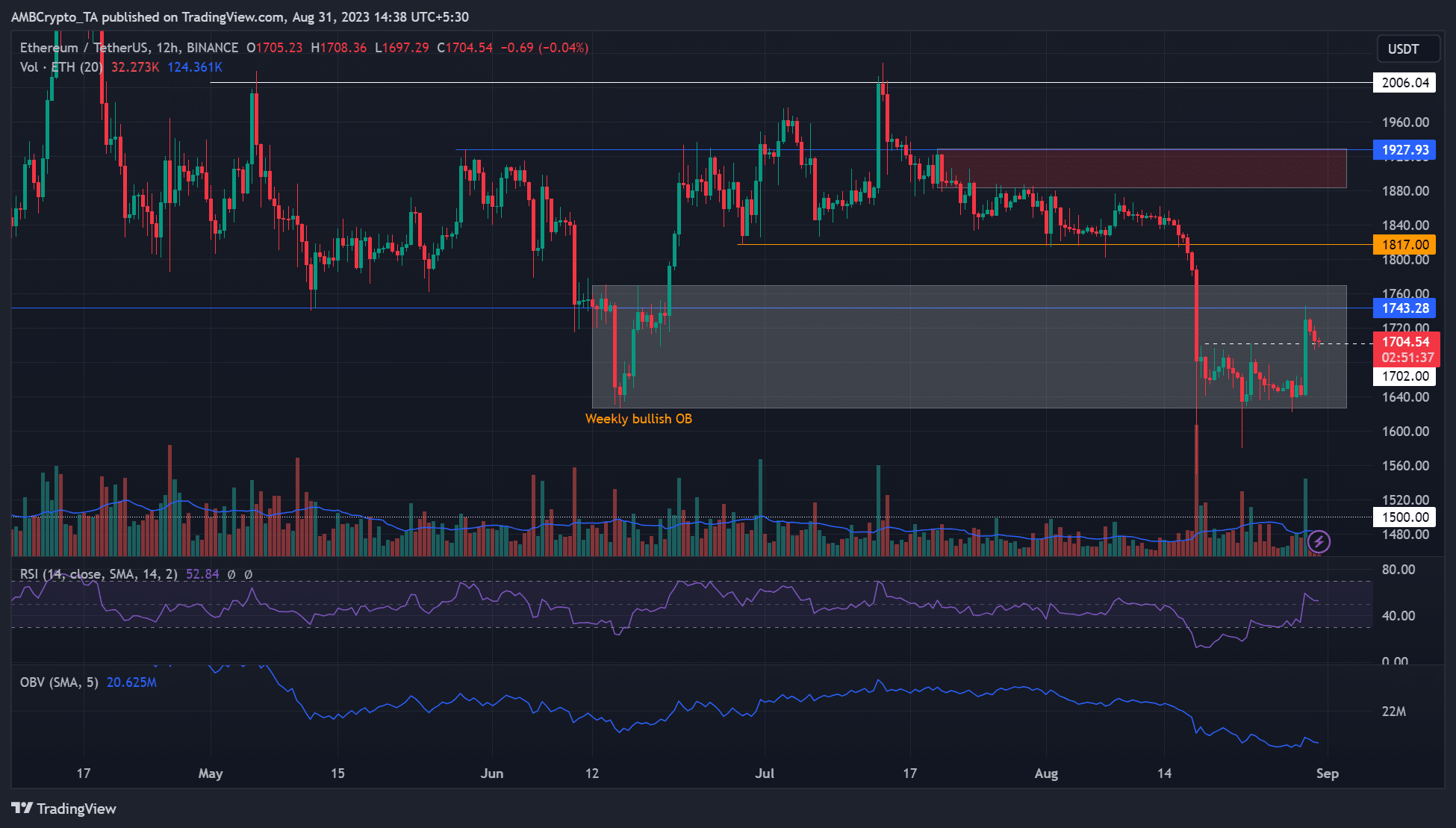

ETH’s price dump around mid-August eased at a weekly bullish order (OB) of $1626 – $1770 (white). The 29 August pump led to a recent new high at $1745, flipping the higher timeframe market structure to a bullish bias.

But the price rejection at the May lows set ETH to a retracement as of press time. If the $1700 cracks, ETH could depreciate towards $1640 or $1627 in the mid-term. But a further drop below the weekly bullish OB could make a retest of $ 1,500 feasible.

On the upside, bulls could gain an edge if ETH pushes above $1745. If so, the next target could be $1800.

Meanwhile, the RSI registered a downtick after climbing above 50, denoting buying pressure eased. Besides, the OBV has been making lower highs since mid-August, demonstrating a decline in demand over the same period.

How much are 1,10,100 ETHs worth today?

Open Interest eased

The price jump on 29 August led to an uptick in Open Interest rates that graced $5 billion, last seen on 18 August. But the metric eased below $5 billion as of press time, denoting a slight decline in demand in the derivatives segment.

On the liquidation side, more longs ($2.1 million) were wrecked compared to shorts ($736k) in the last 24 hours before press time, Coinalyze data showed. The above insight could suggest $1745 being a sticky resistance in the mid-term.