Ethereum retail sentiment hits rock bottom – Is a breakout rally brewing?

- The U.S. government joins institutional investors in selling ETH in large quantities, adding downward pressure to the price.

- Retailers also join the wave, but this ETH faces the possibility of a steeper market loss.

Ethereum [ETH]investors are beginning to face the bearish wave of the market as massive sell-offs are recorded across the board.

In the last 24 hours alone, the asset has dropped 5.75%, with the possibility of falling even lower.

AMBCrypto’s analysis reveals that a historical trend supporting an ETH bounce back after a sell-off no longer exists. If market participants across the board continue to sell, losses will intensify.

U.S. government sells massively, ETH defies past catalysts

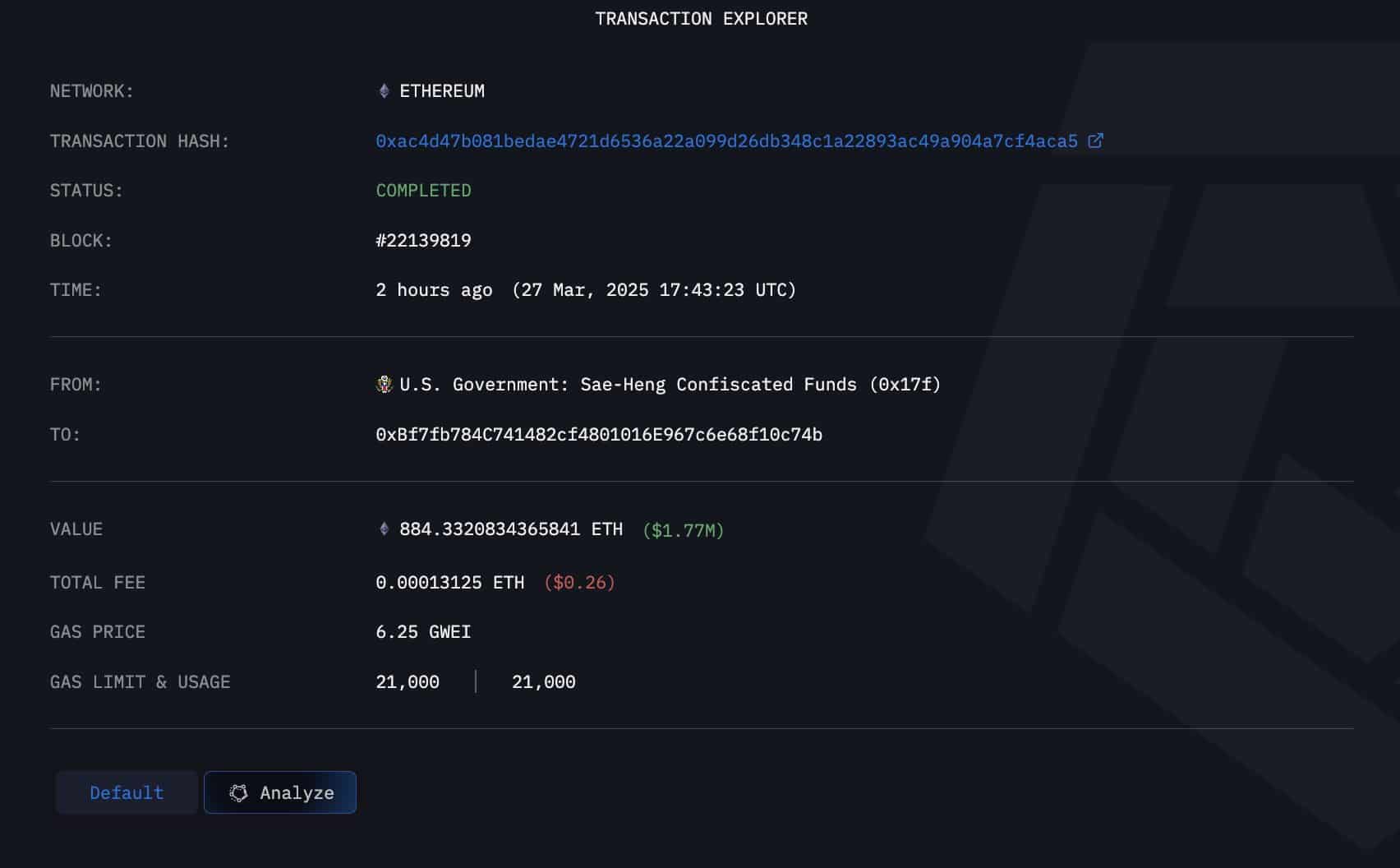

In the past 24 hours, the U.S. government has sold a massive amount of ETH in the market—884.33 ETH worth $1.77 million at the time of the trade.

A notable sell-off from large investors like the U.S. government, which holds 59,965 ETH in its balance, typically indicates a lack of confidence in the asset and tends to negatively influence the broader market.

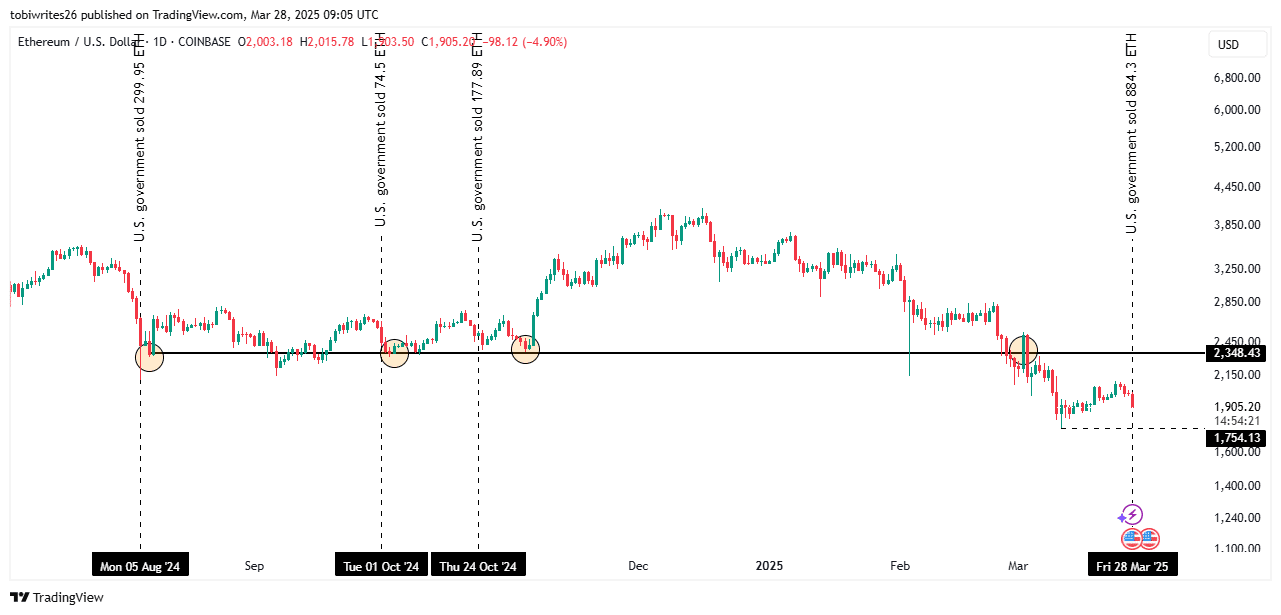

To understand the impact of this, AMBCrypto studied the U.S. government’s past ETH sales and their effects on the market.

Typically, the U.S. government sells when the market is already declining, which is the current case. Unlike before, ETH might not see a bounce back.

On three past occasions—August 5, October 1, and October 24—the U.S. government sold 299.95, 74.5, and 177.89 ETH, respectively. Each time, the asset declined to a key support level at $2,348.43, which acted as a catalyst for a bounce back.

However, this time is different. ETH is currently trading below this support level, forming a series of lower lows. If selling pressure intensifies, ETH risks dropping below $1,754. If it fails to bounce back from this level, further decline is likely.

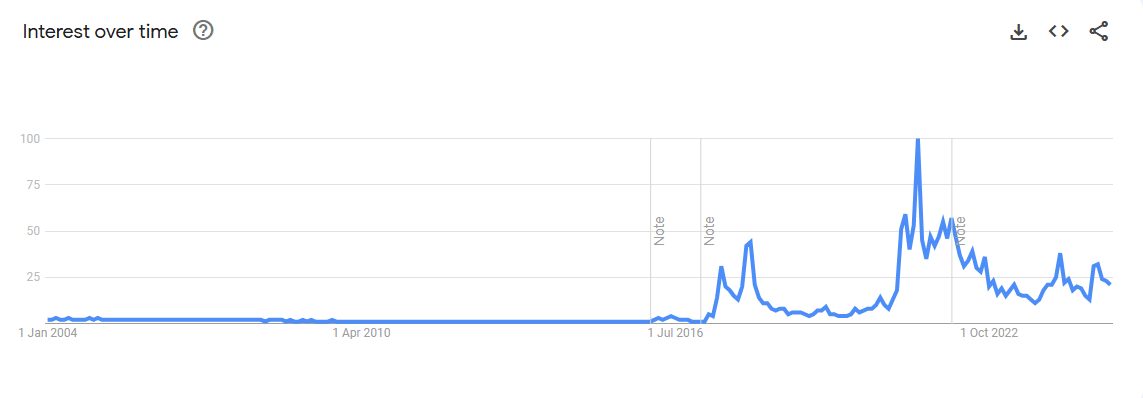

AMBCrypto’s further analysis found that a continued decline could be the current market trend, as retail sentiment toward the asset has hit a new low—a level last seen a year ago.

This was confirmed by Google search interest over time, which shows that retail search interest in ETH has dropped significantly, a sign often attributed to selling.

Bearish trends among retail and institutional investors

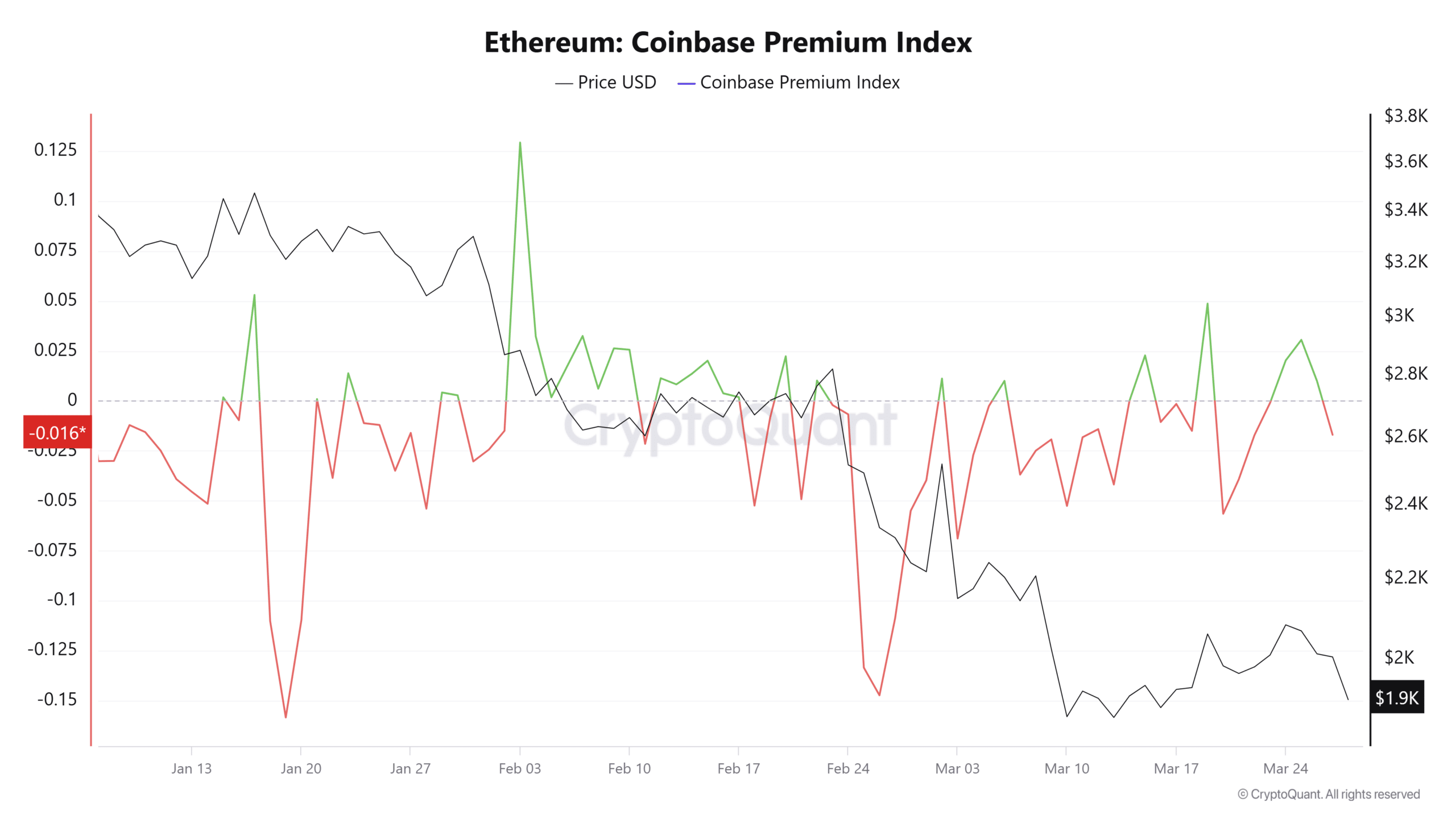

The U.S. government’s sell-off has forced retailers in the country to start selling aggressively. According to the Coinbase Premium Index, which tracks this behavior, this is the first time since the 23rd of March that this cohort of traders is selling.

This is evident whenever the index is in negative territory. At press time, it had a reading of -0.0016, indicating that selling pressure is gradually mounting.

Institutional investors holding approximately $8.83 billion worth of Ethereum as assets under management have also continued selling since the start of March, adding downward pressure to the asset.

Between the 3rd of March and now, a total of $402.6 million worth of Ethereum has been sold.

If institutional investors continue to sell, ETH could reach the target level of $1,754, as indicated on the chart.