Ethereum retail traders accumulate: Will their efforts drive a bullish reversal?

- ETH flagged multiple signs indicating that it was ripe for a bullish takeover.

- ETH whales could be keeping the sell pressure alive.

Ethereum [ETH] has been on a bearish streak since the second week of July. Its mid-August dip extended that downside, but now the bulls have been showing signs of exhaustion. Recent findings suggest that accumulation is gaining traction.

Is your portfolio green? Check out the Ethereum Profit Calculator

ETH delivered sideways price action for the last few days, indicating that the bears are taking a break. According to one of the latest Glassnode alerts, retail addresses have been accumulating at the current levels. The alert reveals that Ethereum addresses holding at least 10 ETH just reached a 4-week high.

? #Ethereum $ETH Number of Addresses Holding 10+ Coins just reached a 1-month high of 348,950

Previous 1-month high of 348,949 was observed on 25 August 2023

View metric:https://t.co/6ggy1nLbSD pic.twitter.com/stSzgk9qDJ

— glassnode alerts (@glassnodealerts) August 26, 2023

The observation was an indicator that ETH traders were regaining some confidence in the market. This was further backed by the observation that ETH has been flowing out of exchanges. In addition, ETH exchange balances just fell to a multi-year low.

The last time that ETH exchanges were at the current level was in 2016. This observation was also favorable for a long-term bullish outlook because it confirms a long-term bias.

Despite these findings, ETH bulls remain subdued. This means that the prevailing levels of accumulation are not strong enough for a sizable rally. This is likely because investors are concerned that the downside might continue, especially considering the prevailing threat of higher interest rates.

Analyzing the key reasons why the bulls remain dormant

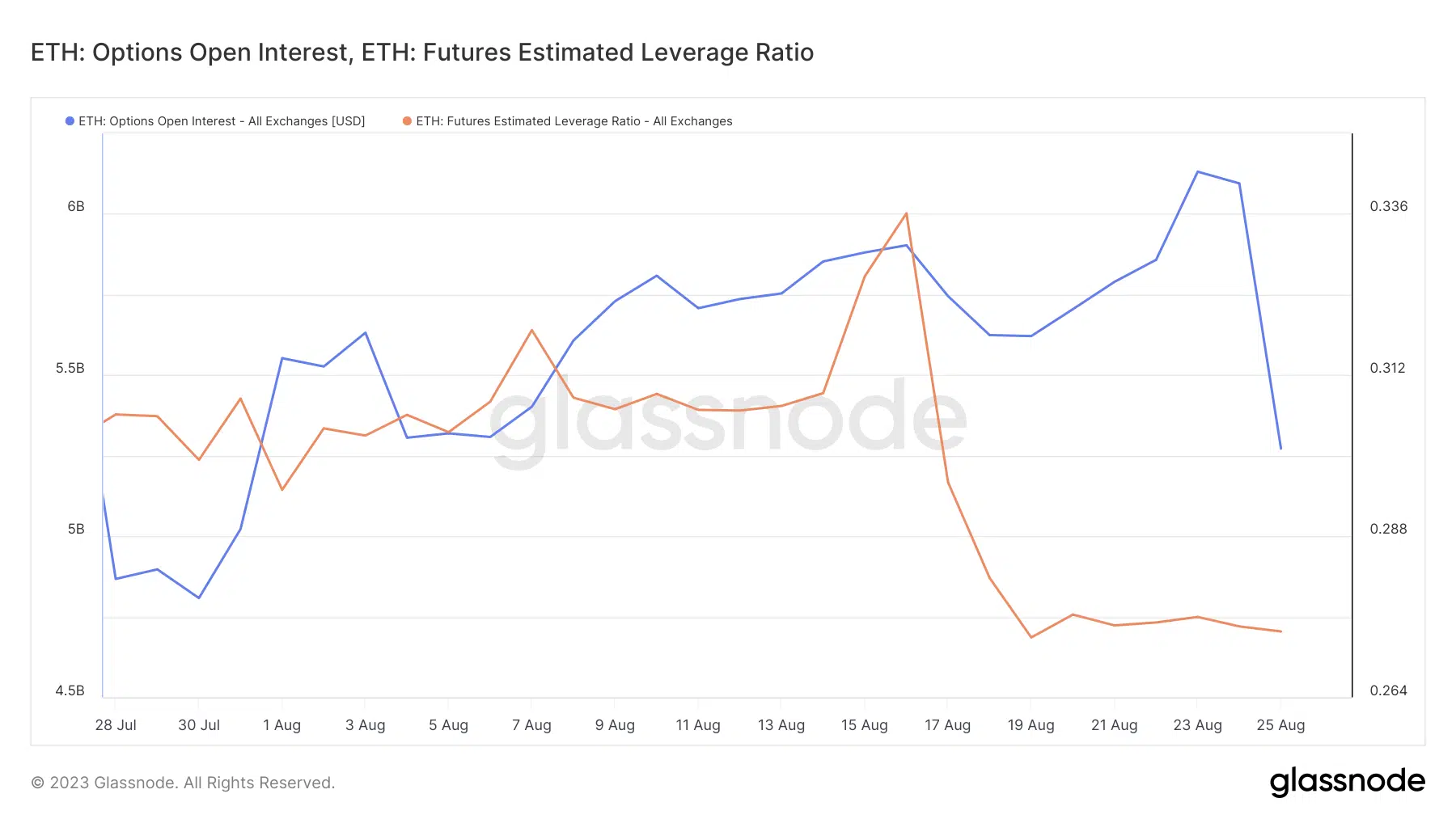

The current state of demand in the derivatives market underscores the aforementioned concern. Usually, a substantial price drop such as the one we observed recently attracts significant demand.

However, that price crash was characterized by heavy liquidations. The threat of more downside and subsequent uncertainty resulted in a dip in ETH options open interest.

ETH’s estimated leverage ratio is currently hovering at its lowest level in the last 4 weeks. It further emphasizes the point that there is currently a low appetite for the cryptocurrency.

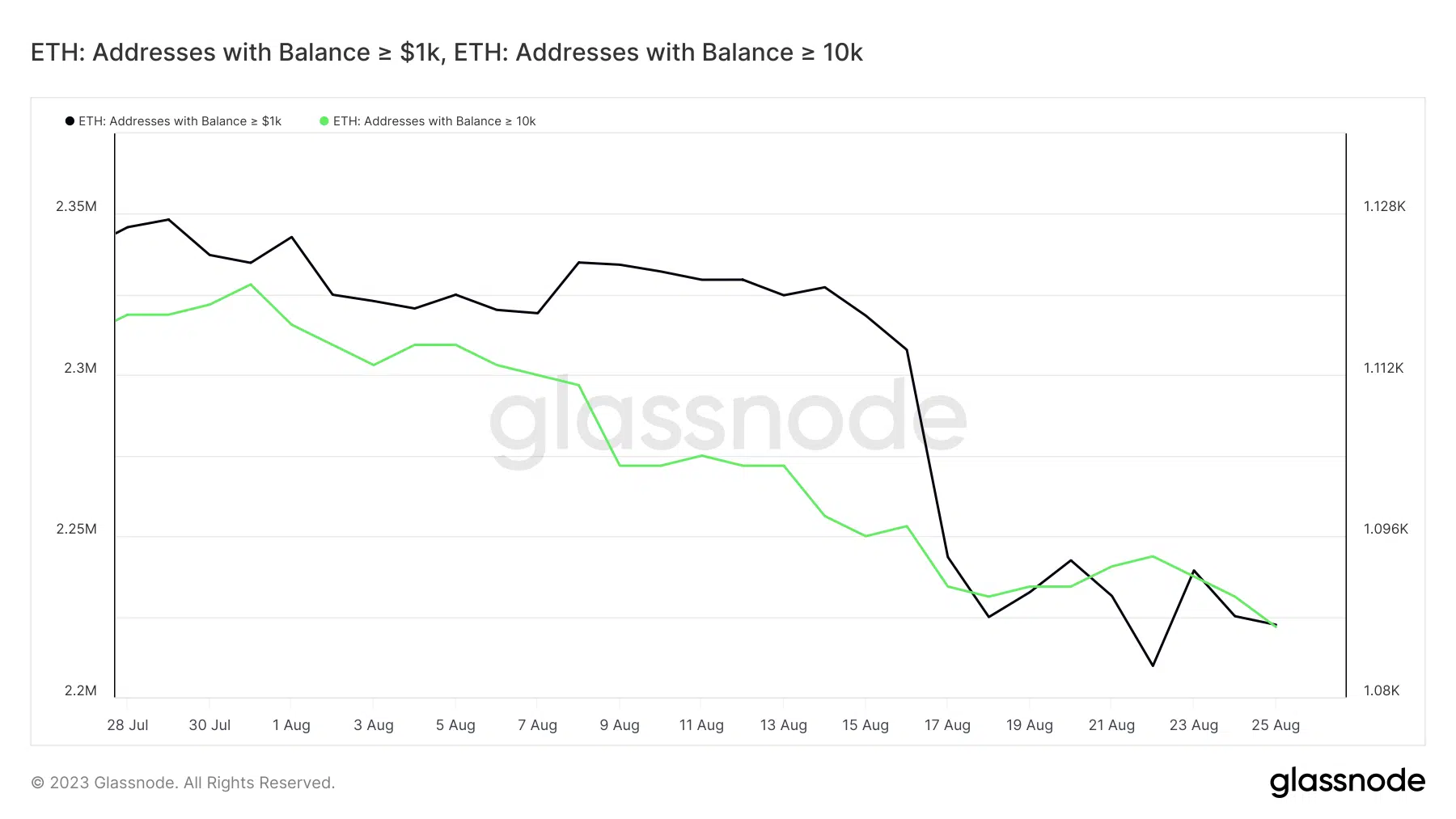

However, the usual suspects seem to be the ones holding back the possibility of a rally. Addresses in the 1,000 and 10,000 ETH categories have been shedding off some of their coins, thus contributing to sell pressure.

Read about ETH price prediction for 2023/2024

Evaluating the possibilities

While the threat of more downside is real, traders should note that the next FOMC meeting is scheduled to take place in the second half of September. This means there might be an opportunity for the bulls to gain an edge over the market.

But with the current whale activity, traders should keep an eye out for when whales start to pivot because it would signal the start of a bullish relief.