Ethereum: Which level will fall after $1760?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure was bearish, but the lack of volatility persisted.

- Ethereum’s recent price action was bounded by resistance at $1880 and support at $1750.

In the past month, Ethereum [ETH] has shed close to 15.2% in value, measured from the swing high at $2141 to the press time market price of $1816. This was extremely disappointing to some ETH bulls, who expected a strong rally following the breach of the $2000 mark in April.

Read Ethereum’s [ETH] Price Prediction 2023-24

The declining volume and compression on the price charts pointed to an uneventful weekend. Will this be followed by a breakout north or south next week? Or, trading gods forbid, will Ethereum prices continue to stutter just above the $1800 mark?

Tight Bollinger Bands meant traders can wait for a sharp move to decide the direction

The Bollinger Bands were closely bound to the price and the BB width indicator was at two-month lows once more. Trading volume was declining over the past few days as well. This came after ETH tested the 4-hour bullish order block at the $1720 area (cyan). The RSI was also unable to break out past the 45 or 55 values showing an indecisive market.

Such compressive price action meant a sharp move was around the corner, but its direction was uncertain. On higher timeframes such as daily, the market structure of ETH was bearish. The H4 bearish order block at $1880 could be tested before a move downward. Traders must also beware of liquidity hunts in either direction before a reversal.

Therefore, the high and low of Monday could be vitally important on the lower timeframes. A strongly bearish performance on Monday could set the tone for the rest of the next week, with bearish targets at $1700 and $1620. On the other hand, a breakout past $1880 and a successful retest as support could see ETH bulls push toward $2000 once more.

The rising mean coin age was at odds with the recent exchange inflows

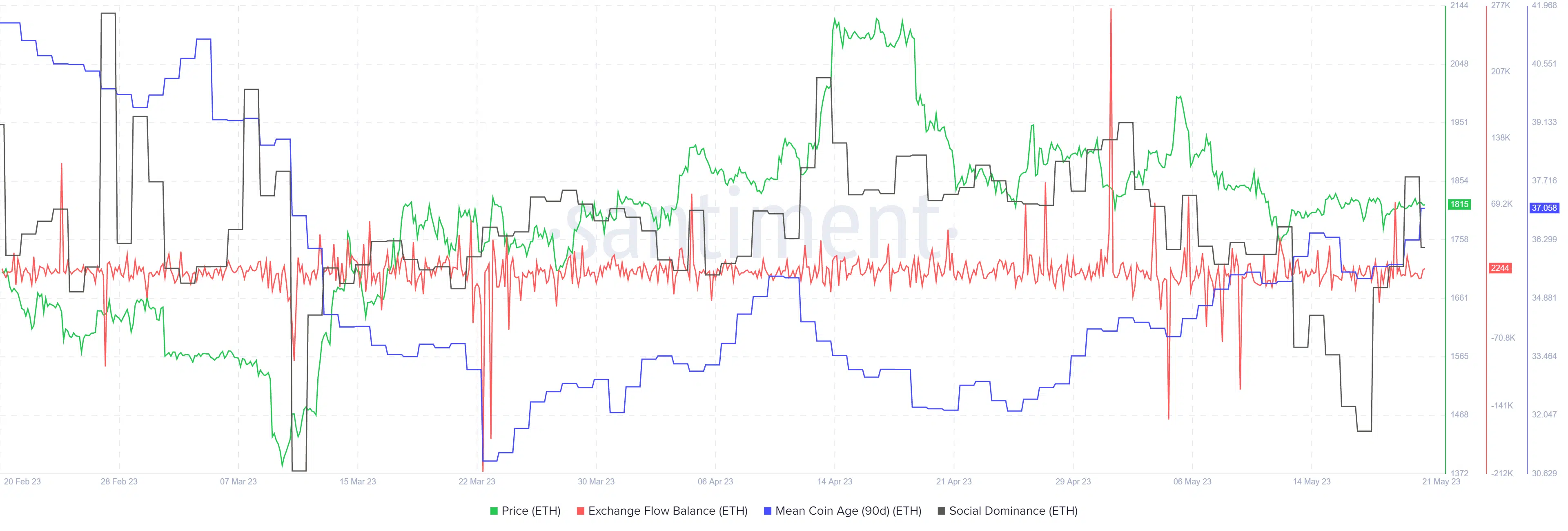

Source: Santiment

The social dominance metric was near the three-month average toward the end of April. Over the past three weeks, it declined toward March lows before a recovery. Yet the price action hovered around the $1820 area last week.

How much are 1,10,100 ETHs worth today?

The exchange flow balance showed that there was a spike in exchange inflows on 19 May with a positive balance of 71.8k ETH. A surge of a similar magnitude last occurred on 6 May, right after prices began to decline from the $2000 mark.

Meanwhile, the mean coin age has trended upward over the past month. The exchange flow balance indicated a rise in selling pressure was imminent but the mean coin age metric underlined an accumulation phase. Whether the bulls or the bears will win remains to be seen, with Monday likely to be important.