Ethereum sees some whale and retail demand, but here’s the issue

- ETH sees demand from whales and retail investors but in low volumes.

- ETH TVL in Ethereum 2.0 soars to new ATH.

The Ethereum network’s next major upgrade dubbed Shanghai is less than a month away. Major network upgrades usually attract some investor interest days before the actual date of the event. Now, the question is- Will the same scenario play out for ETH?

Is your portfolio green? Check out the Ethereum Profit Calculator

Recent data reveals that ETH is experiencing noteworthy demand, especially from retail investors. There are currently over 23.3 million addresses holding at least 0.01 ETH and those addresses are currently at an 8-month high.

This confirms that retail buyers have been accumulating, perhaps in anticipation of some upside as the Shanghai countdown narrows.

? #Ethereum $ETH Number of Addresses Holding 0.01+ Coins just reached a 8-month high of 23,363,445

View metric:https://t.co/XXb0u19Wkf pic.twitter.com/NRmVrvOi13

— glassnode alerts (@glassnodealerts) March 26, 2023

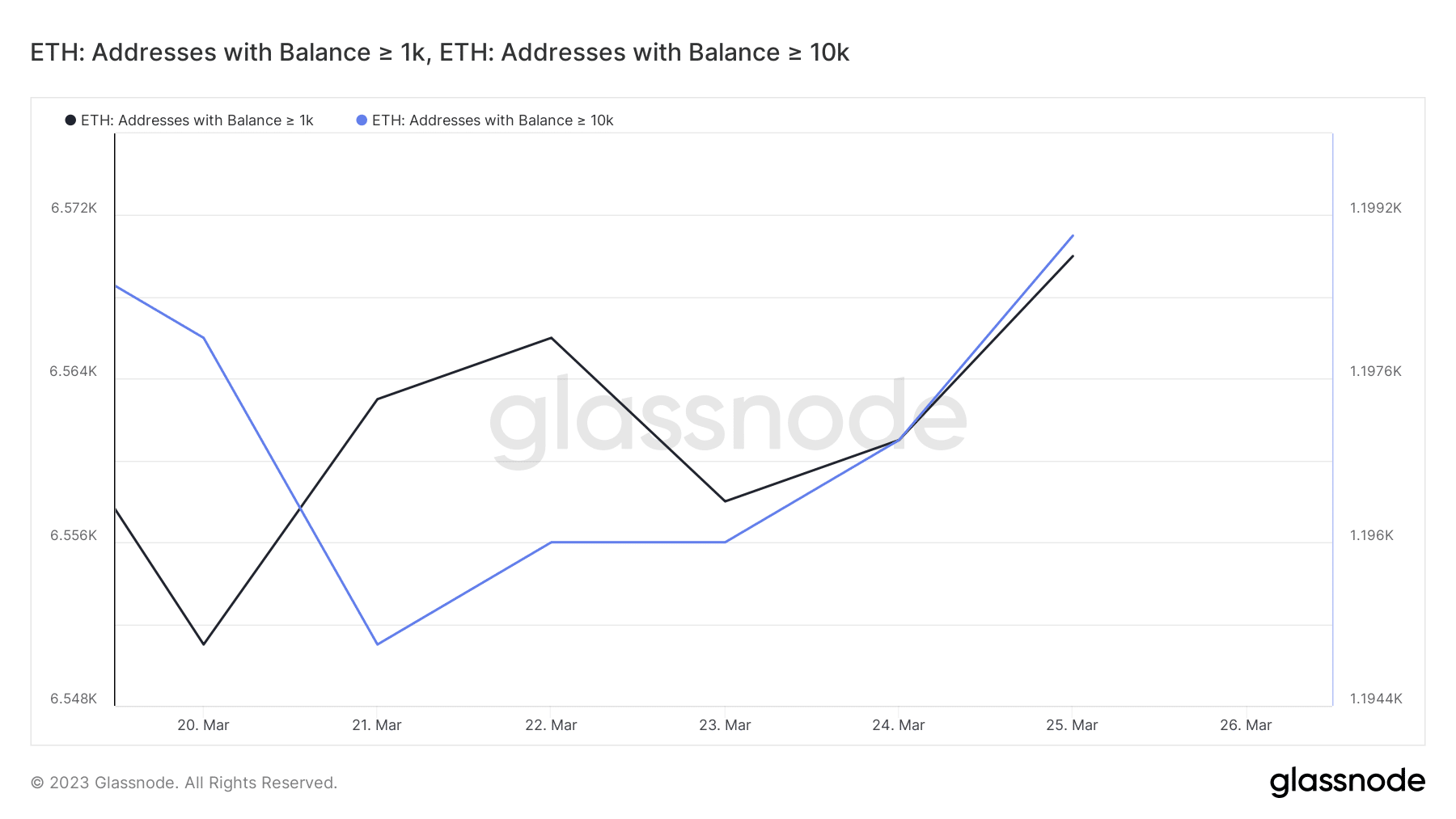

But how does this match up to the level of demand from the whales or institutional buyers? A quick glance at the state of addresses holding over 1,000 and over 10,000 ETH reveals that they have been adding to their balances in the last seven days. This confirms that larger addresses or whales have also been accumulating the king alt.

Things also look favorable for Ethereum on the DeFi front. The network’s TVL data revealed that the total value locked in ETH 2.0 deposit contracts has been growing. It recently reached a new all-time high (ATH) of 17.06 million ETH. It confirms that Ethereum 2.0 is still on a healthy growth trajectory.

? #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 17,061,207 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/eHxVwDn43i

— glassnode alerts (@glassnodealerts) March 25, 2023

So, if the whales and retail segment are buying, why is ETH’s price not experiencing a massive rally?

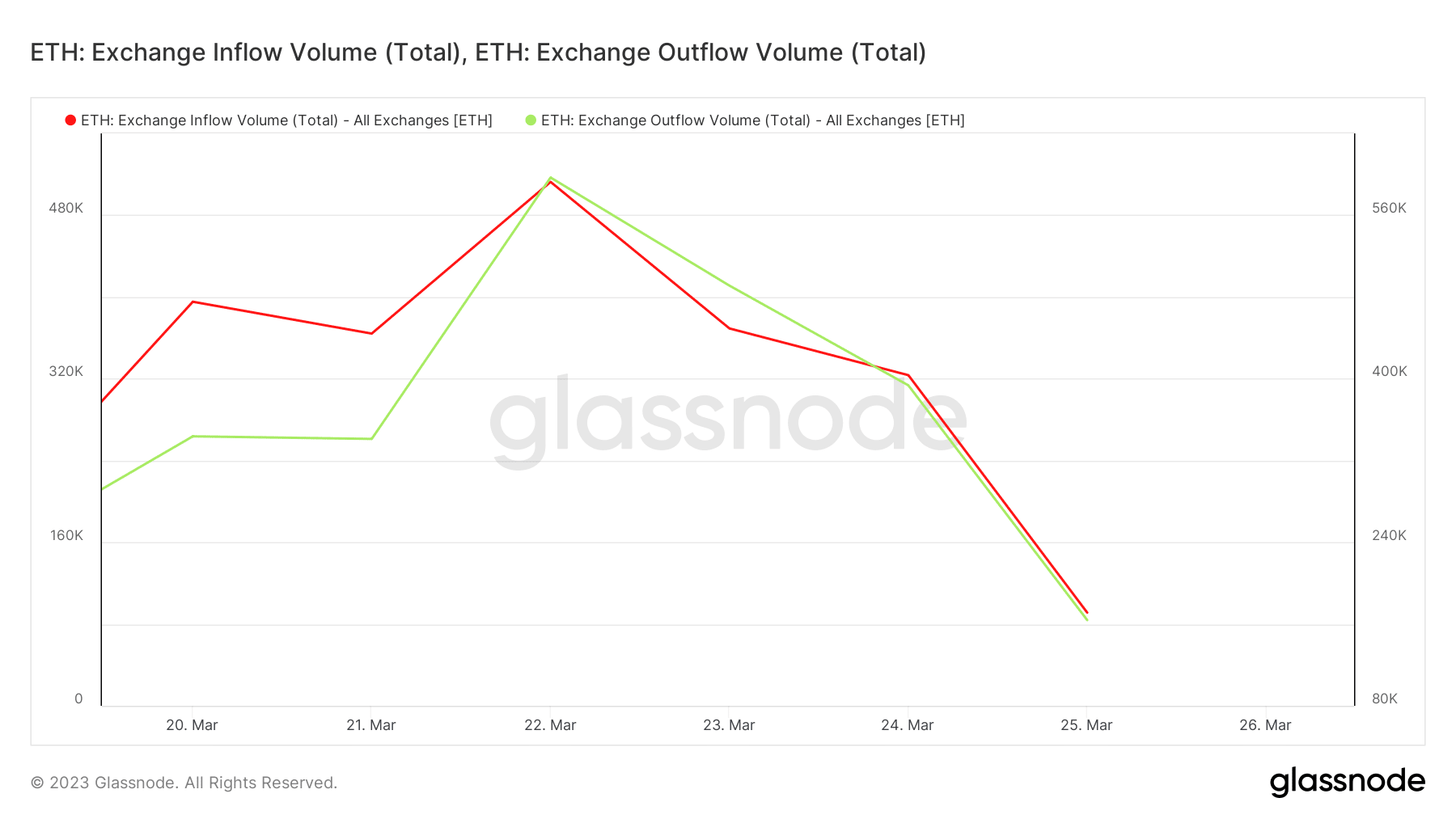

Exchange flows may provide a reasonable answer. The volume of ETH flowing in and out of exchanges is down notably in the last seven days. It implies that the prevailing volumes are weaker, hence a lower impact on price action.

However, the latest Glassnode readings revealed that the ETH exchange outflow volume was almost double the exchange inflow volume.

These flows were responsible for curtailing ETH’s downside on Saturday (25 March) and a 3.6% uptick within the last 24 hours to its $1778 press time price.

How many are 1,10,100 ETHs worth today?

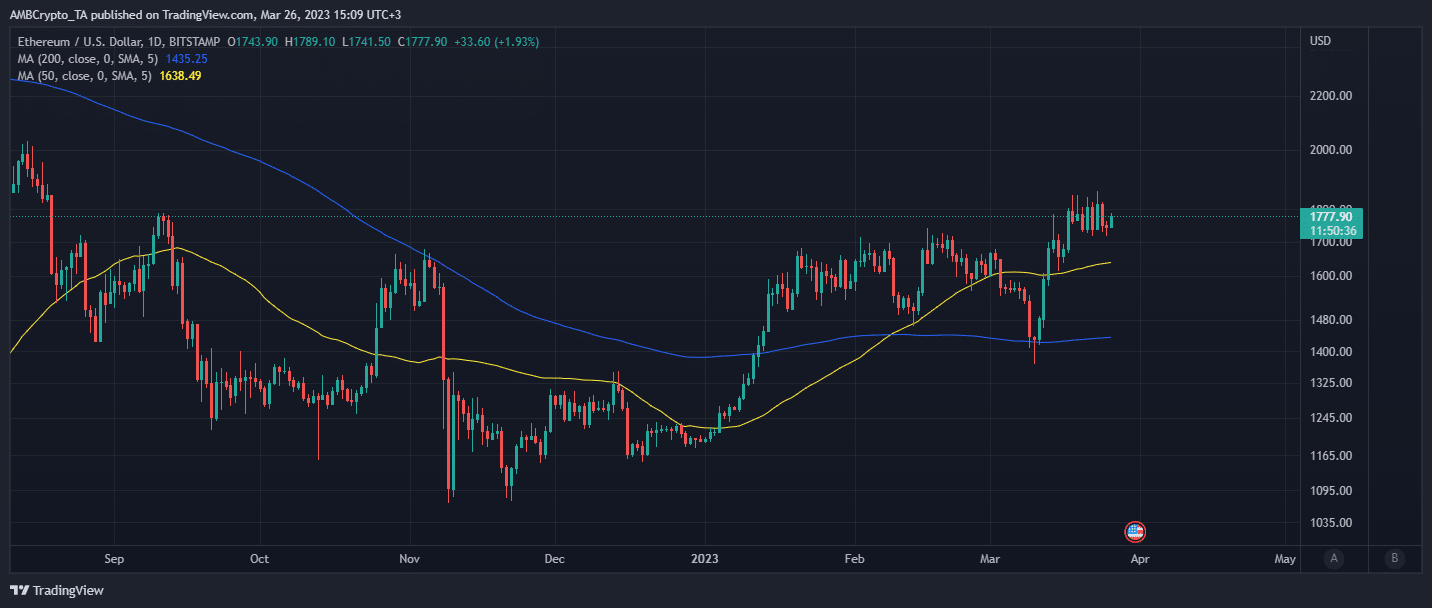

Although ETH is currently demonstrating some bullish signs, investors should note that the volumes are still low. The cryptocurrency has been stuck in a saturated performance for the last few days. Capitulation is still a likely outcome that may lead to a resurgence of sell pressure in the next few days.

Investors should watch for whether ETH demand will continue increasing in the next few days. This would give insights into what to expect.