Ethereum Shanghai hardfork: New testnet launches on network as these metrics soar

- Testnet dubbed Zhejiang will launch on February 1 to test staking withdrawal.

- Validators and ETH staking continue to increase as Shanghai hardfork nears.

The Ethereum [ETH] network has come one step closer to the Shanghai hardfork with the launch of a testnet. The testnet, titled Zhejiang, will reportedly serve as a precursor to the eventual launch. It will allow network users to test features that will eventually be implemented in the fork.

Read Ethereum’s [ETH] Price Prediction 2023-24

Zhejiang launch beckons

On 31 January, an Ethereum developer announced that a public testnet would be released on February 1. It would allow Beacon Chain withdrawals. Additionally, users will be able to test staked Ether withdrawals, which are a part of the Ethereum Improvement Proposal-4895 (EIP) that will be implemented in the next Shanghai hard fork.

Six days after the testnet goes live, a practice run of the network’s impending Shanghai and Capella improvements will begin.

The Shanghai+Capella upgrade is going full steam ahead! The first public withdrawals testnet is launching 1st of Feb at 15 UTC.

All info here: https://t.co/S5kp9o6Pzs#TestingTheWithdrurge https://t.co/fw2SZqPbHe

— parithosh | ???? (@parithosh_j) January 31, 2023

Using the Zhejiang public testnet, any Ethereum user can practice withdrawing staked ETH. When the Shanghai upgrade goes live, all of this functionality will be made available. The Ethereum Foundation’s developers have been eyeing March 2023 as a likely time for the Shanghai hard fork.

The developers have EIP-4844 scheduled for release in May or June 2023 as the next upgrade after Shanghai. EIP-4844 has the potential to decrease transaction fees by order of magnitude and boost the scalability of layer-2 rollups on Ethereum by a factor of 100.

ETH staking and validators continue upward climb

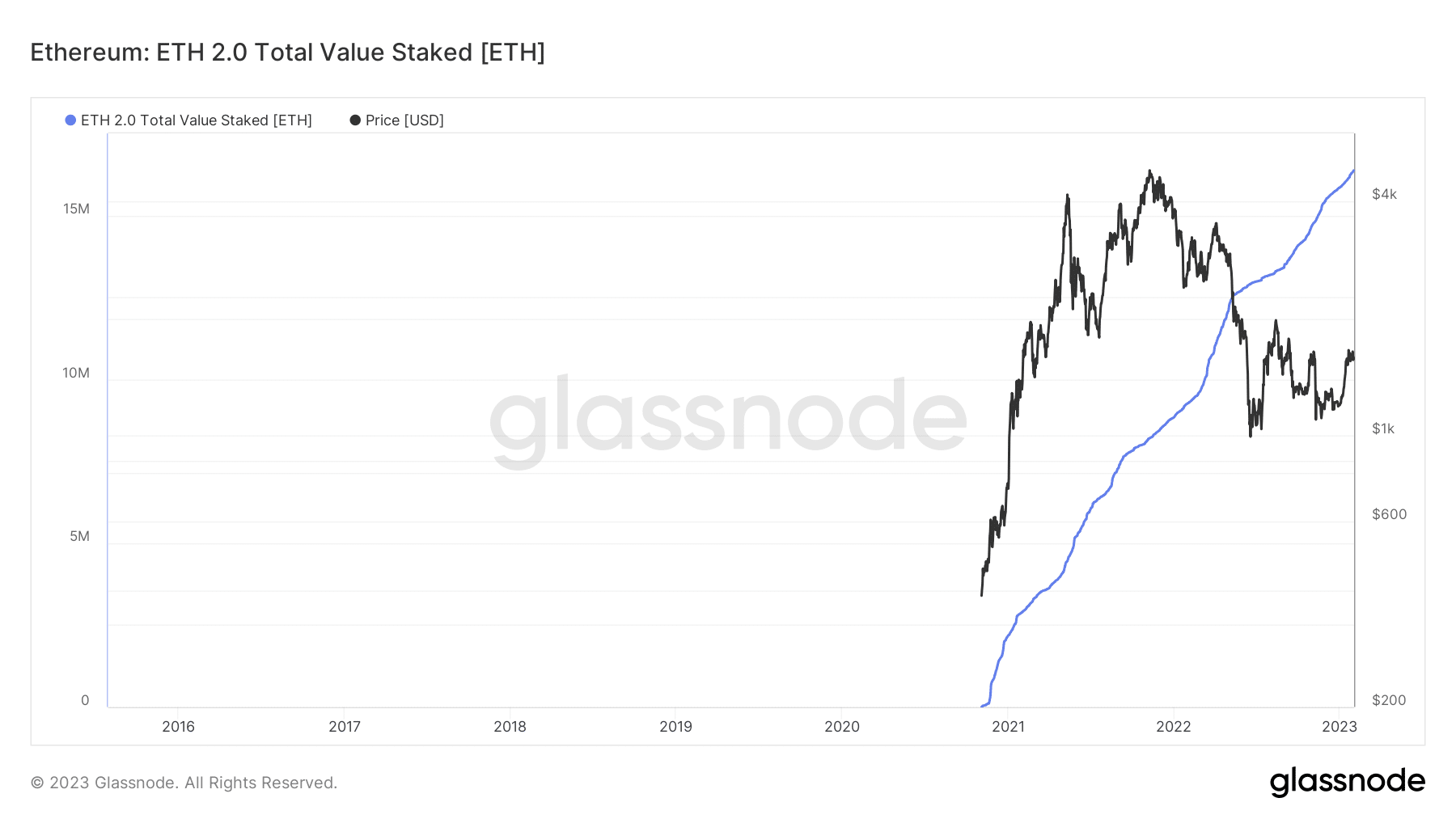

In another spot of good news, staking in Ethereum rose steadily over the past several weeks, according to Glassnode. The amount of overall staked ETH had surpassed 16 million as of the time of writing. Additionally, there were over 500,000 validators present, according to Glassnode.

The overall number of validators on the network grows with the increase in ETH staked.

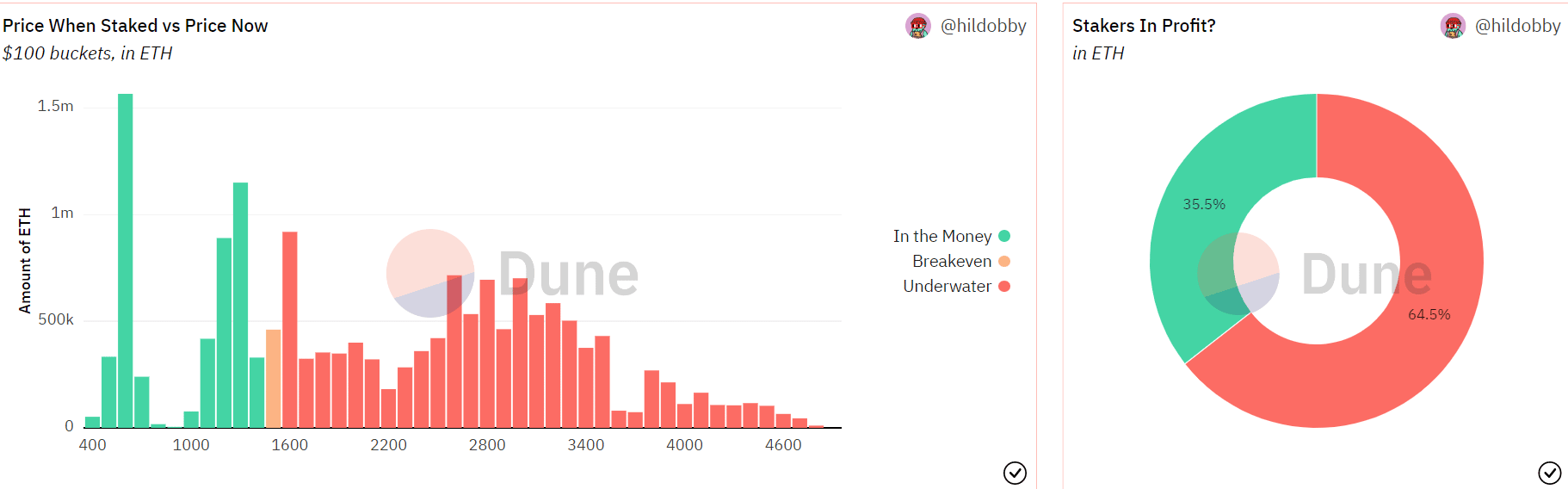

Examining the proportion of genuinely profitable stakes was also necessary, given the increase in Ethereum staking. According to data from Dune Analytics, a few ETH were in profit out of the total amount invested. The earlier ETH that was staked was also included in the profit%.

The graphic showed that 35.5% of the staked ETH was profitable while 64.5% was underwater. Moreover, there was a strong possibility of a correlation between the price and profitability of staked ETH.

ETH trade under sell pressure

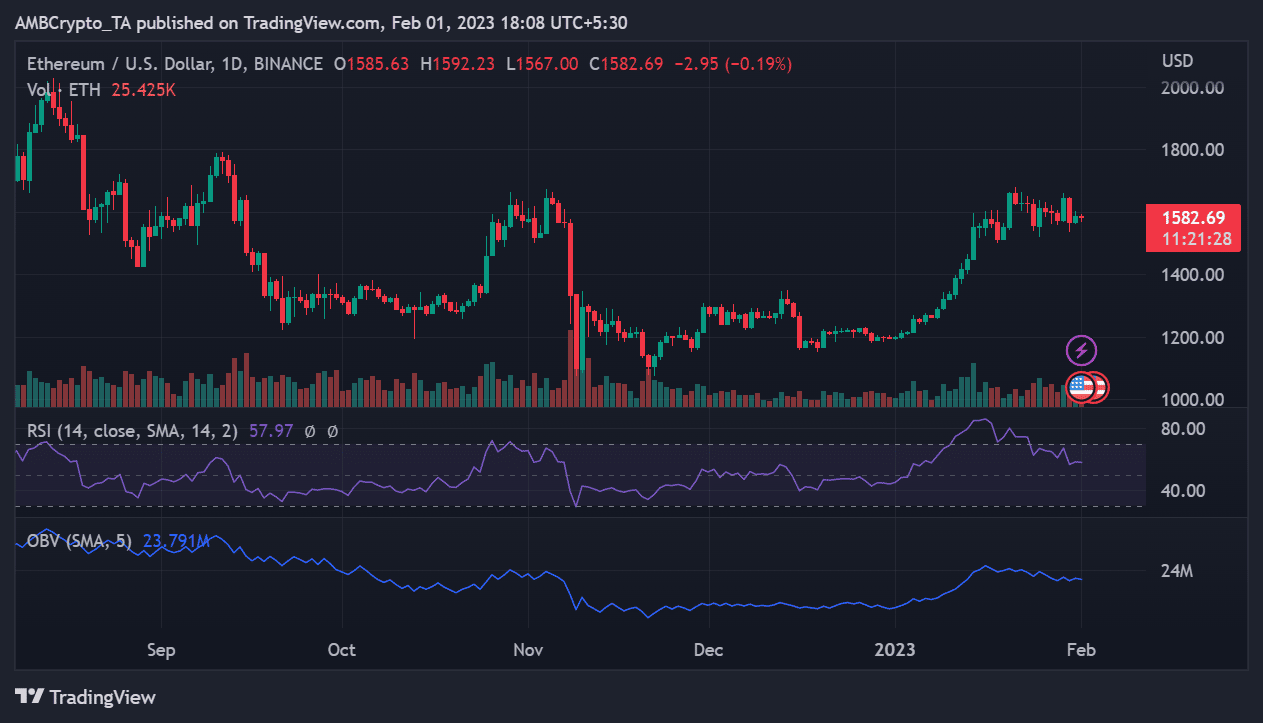

However, the observed daily timeframe chart shows that there has been significant sale pressure on ETH. It was trading at about $1,580 as of this writing, with sell pressure dominating the trading period and a loss of less than 1% noted.

Is your portfolio green? Check out the Ethereum Profit Calculator

Despite the strain, the asset has maintained its price at around $1,500. The $1,500 area might be the new support level, but a breach might cause it to fall even further.

The success or failure of the testnet’s debut will determine how it will affect Ethereum and ETH staking.