Ethereum: Shanghai Upgrade’s full impact yet to occur? This data suggests…

– Even after the Shanghai Upgrade, many addresses are yet to withdraw their ETH.

– The effect of this upgrade might only occur after all the ETH has been withdrawn.

Ethereum’s [ETH] Shanghai Upgrade, which enables withdrawals for Ethereum stakers, has generated much excitement and anticipation in recent months. The upgrade had a favorable effect on the prices of ETH and Liquid Staking Derivatives [LSD] tokens after its implementation.

Realistic or not, here’s ETH’s market cap in BTC’s terms

However, despite the upgrade, many users were yet to withdraw their staked ETH at press time.

Going through withdrawal

At press time, 892,000 ETH had not been withdrawn, according to data provided by Token Unlock. There are many reasons for the same, one of them being the changing of withdrawal credentials.

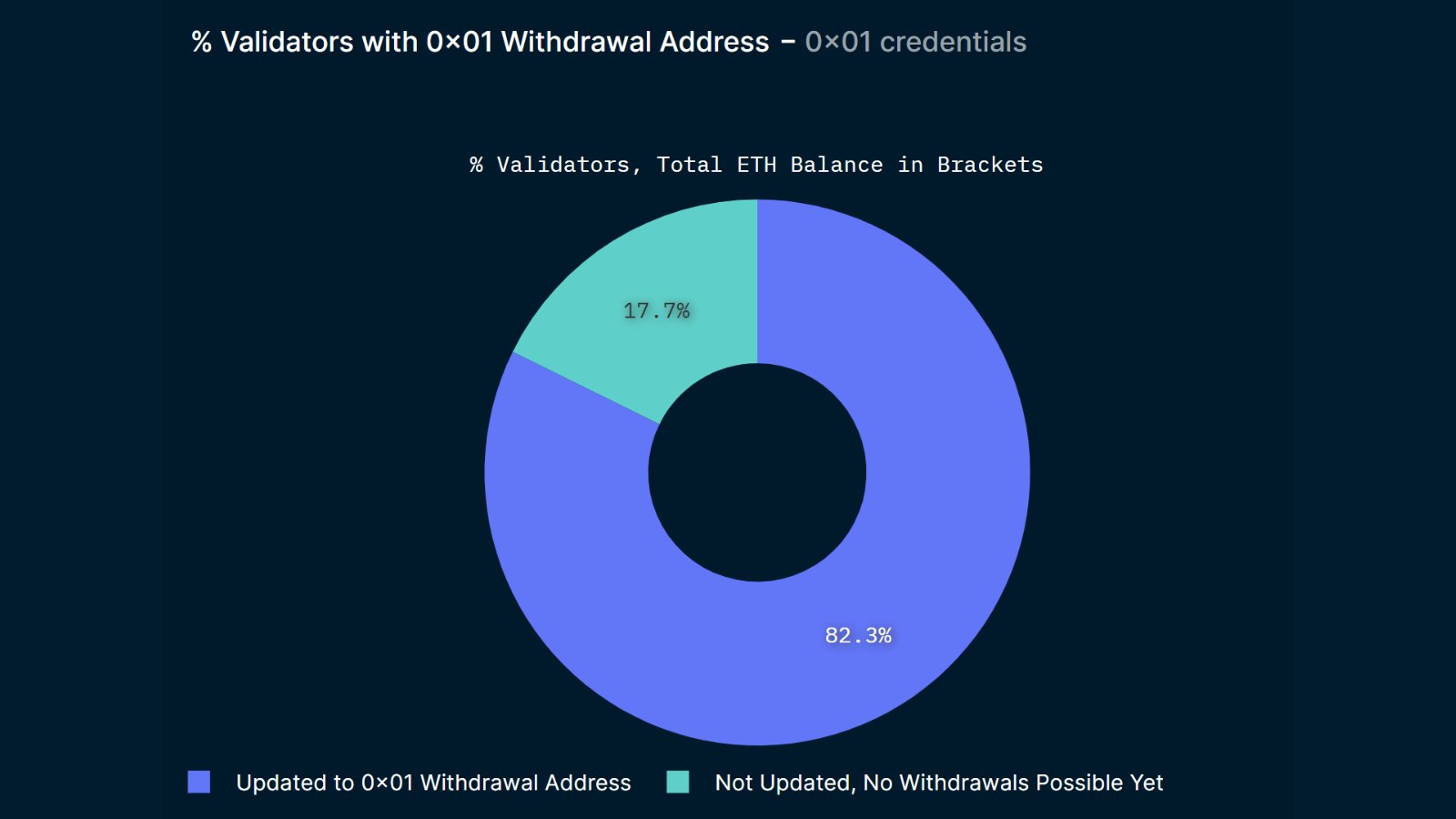

For ETH withdrawals to be possible, validators are required to change their withdrawal credential prefixes from 0x00 to 0x01. During the Shanghai launch, only about 40% of validators had set their credentials to 0x01. However, this figure has since increased to 82.3% and is expected to reach 100% in due course.

Another reason for the delay in addresses getting a hold of their staked ETH is that there is a 27-hour wait to make a full withdrawal on the network. A full withdrawal occurs when all 32 ETH that were being staked are withdrawn all at once, which results in the exit of a validator.

The high time limit is kept in place so that multiple validators don’t exit all at once, as that could pose a threat to Ethereum’s network security.

At press time, there were 561,655 validators on the Ethereum network, according to Staking Rewards.

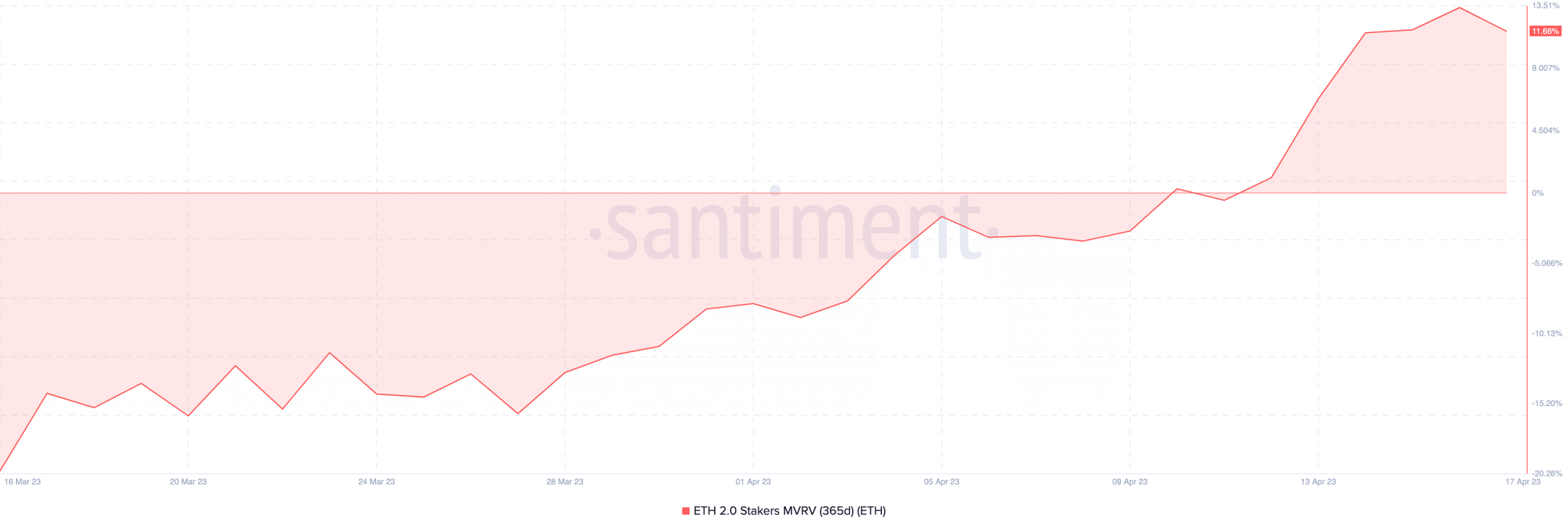

After all the addresses have unstaked their Ethereum, the chances of a sell-off could be high. Santiment’s data suggested that the pres time MVRV ratio of stakers’ ETH has been increasing significantly. This implied that most of the addresses that have unstaked their ETH are profitable.

Read Ethereum’s [ETH] Price Prediction 2023-2024

If the prices of ETH continued to rise, these addresses may have more of an incentive to sell their holdings.

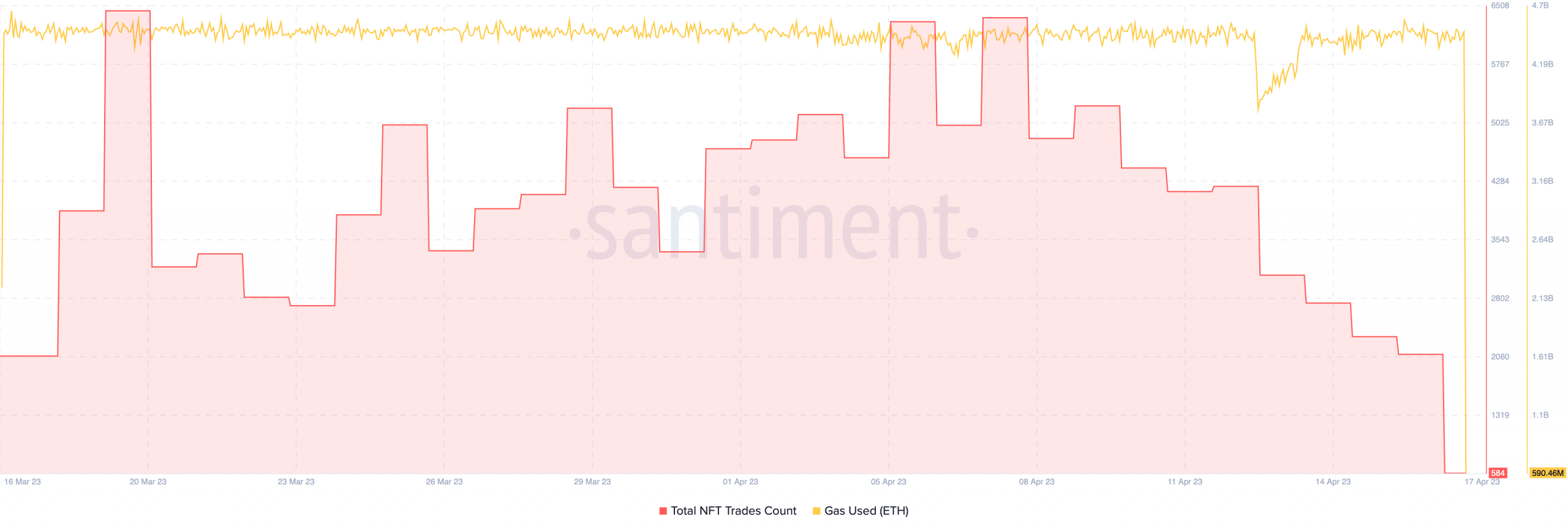

However, in terms of network activity, Ethereum wasn’t doing too well. The interest in Ethereum NFTs dwindled over the past month according to Santiment’s data. Due to this, the overall gas usage on the network also fell.