Ethereum

Ethereum: Shapella upgrade makes ETH’s future fluctuant, more inside

ETH’s price action after the Shapella upgrade was different from that of the Merge. Although there is a chance that the hike may not last long. and here’s why.

– ETH holders have made good profits but the hike could lead to a correction.

-Massive liquidations hit shorts.

Before the success of Ethereum’s [ETH] Shapella upgrade, there were doubts as to the cryptocurrency’s price action to the development. Expectedly, a number of investors were of the view that the price would drop since validator withdrawals ran into billions of dollars.

How much are 1,10,100 ETHs worth today?

But the market dynamics surrounding ETH’s trajectory changed from the reaction when the blockchain switched to Proof-of-Stake (PoS). This time, the price increased, and the altcoin’s 24-hour performance was a 9.77% uptick, bringing the value to trade above $2,100.

Grand slam win for the red?

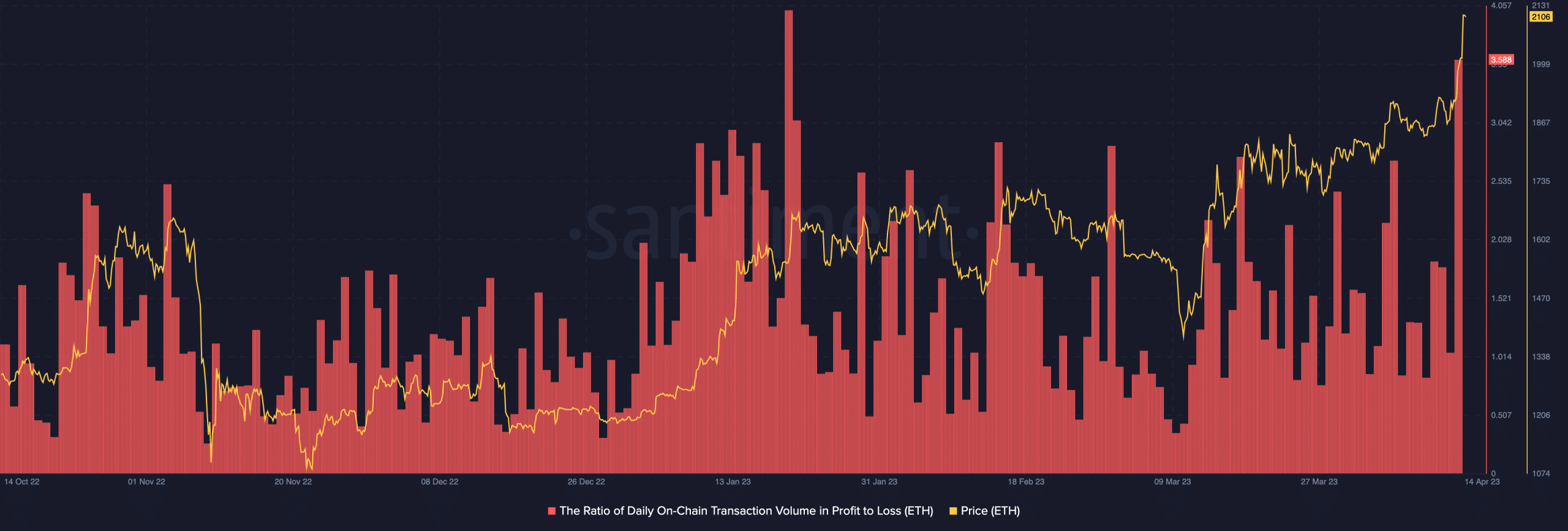

However, the rise in price might not be a guarantee that ETH was ready for an exponential rally. Santiment, based on its 13 April

market insight, noted that there was still heated combat between bears and bulls.Notably, it was important to mention that the outcome of breaking the $2,000 resistance was a jump in the daily on-chain transaction volume in profit to loss ratio. At the time of writing, the metric was 3.58. This was the highest it had reached since 20 January, confirming that holders have made more profits.

But as with the last time it hit such a peak, there could be a significant taking of gains. In consequence, this could cause a temporary price drawdown. Concerning address activity, steps have differed, especially with whales.

On-chain data showed that the supply held 10 to 100 ETH addresses has significantly decreased. It was the same case with those holding 100 to 1,000 ETH. In actual fact, addressing holding 10,000 to 100, 000 ETH has reduced supply to October 2022 levels.

But there was an exception to the trend. While others engaged in profit-taking, addresses who held 1,000 to 10, 000 ETH have continued to increase supply. In a case where the action continues and outpaces those participating in selling, ETH could evade falling from the $2,000 region.

Suspicion bound by liquidation

Nonetheless, this still depicts a dismaying condition for ETH, since only out of the four categories remained optimistic. Furthermore, the Market Value to Realized Value (MVRV) ratio was at a point where the price could experience a correction. At press time, the 30-day MVRV ratio was 15.46%.

The same metric position in the last 365 days was 36.10%. This signified that both short-term holders and long-term investors have been wallowing in gains. Hence, there might be a concern as the ratio was in a danger zone historically required for a price drop.

In terms of its funding rate, Santiment showed that traders were bounded in skepticism. The funding rate shows the number of perpetual futures contracts held by market participants.Is your portfolio green? Check the Ethereum Profit Calculator

Since the funding rate as shown above on the Deribit exchange was negative, it implied that short positions have been paying longs. However, more liquidations for shorts could power the ETH price rise.

From the metric evaluated, ETH seemed to pitch its tent in a bearish state. However, the outlook as the year continues might not bask in the same condition. At press time, validator withdrawals had slowed down, as the total amount to 26291.65 ETH. Although staking deposits heightened at a point, the momentum had also decreased.