Analysis

Ethereum short traders could witness gains only if ETH drops to “this” level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ETH investors enjoyed at least 30% gains in the last two weeks

- ETH short-term traders could have some leverage given ETH’s latest upside

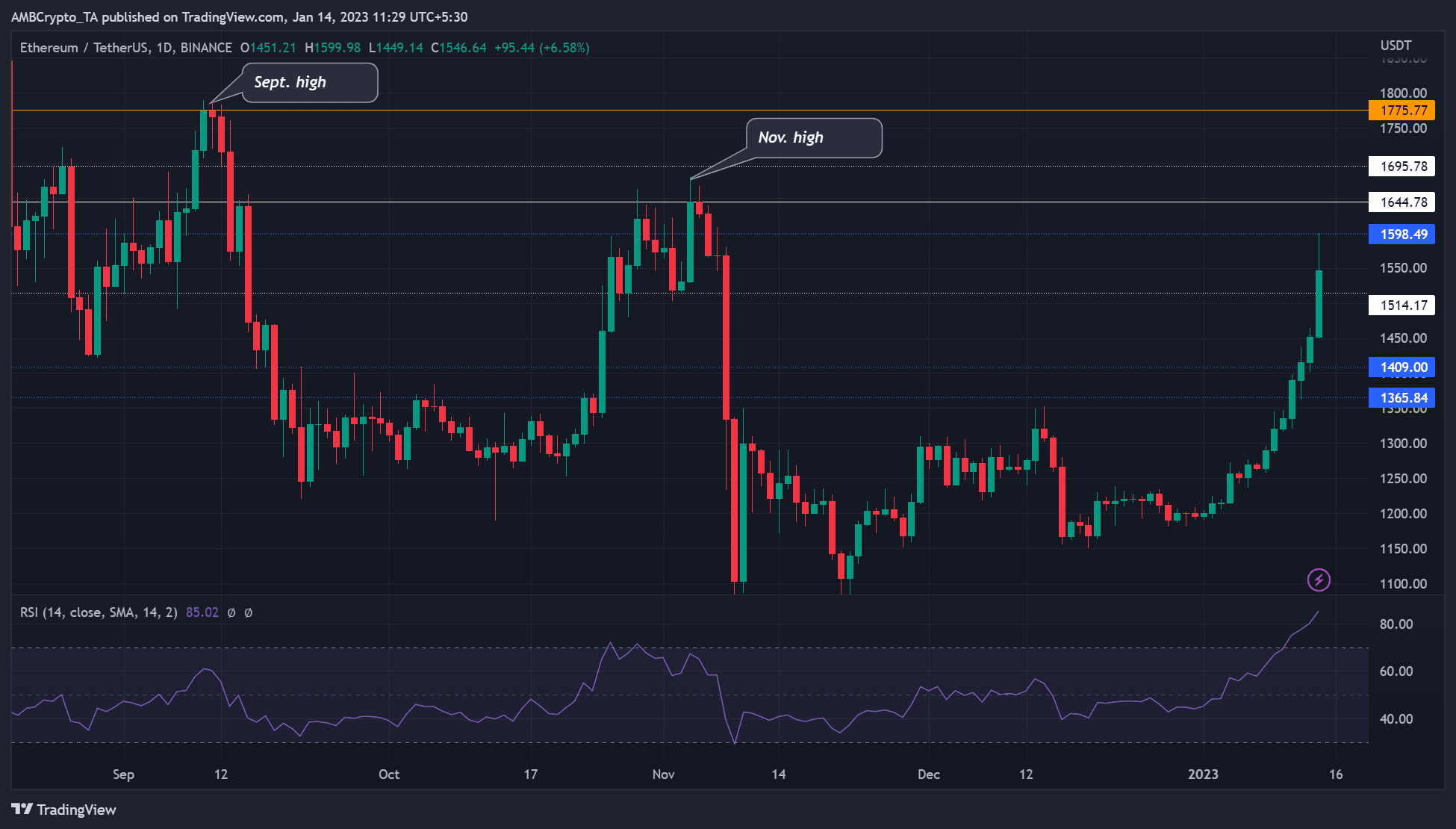

Ethereum [ETH] offered investors over 30% gains in the past two weeks. It rallied from $1,190 to a high of $1,598. The rally put ETH an inch away from its November high of $1,680.

With a bullish BTC following eased US inflation rates, ETH could aim at $1,644 or go above it. At press time, ETH was trading at $1,550, while BTC was trading below a short-term bearish order block at $20,956.

If BTC closes above $21K, ETH bulls could be incentivized to reclaim its November high.

Read Ethereum’s [ETH] Price Prediction

2023-24The November high of $1,680

ETH peaked at $1,680 before FTX implosion forced a wide-market crash, dropping it to a low of $1,100, a 35% plunge. However, a month and a half later, ETH seems on a path to recovering all the losses made after the November crash.

ETH was highly bullish on the daily chart and could retest or break above November’s bearish order block at $1,644.78 in the next few hours/days. Such a move will allow ETH holders to recover all the losses incurred after the November market crash.

Is your portfolio green? Check out the ETH Profit Calculator

However, if bears gain more influence in the market, ETH could drop to $1,514.17, invalidating the bullish bias described above. Therefore, short traders should only bet against ETH’s uptrend if it drops below $1,514 to minimize risk.

Short-term ETH holders made profits as trading volumes increased

According to Santiment, the 30-day market value to realized value (MVRV) ratio has been positive since 4 January and climbed even higher. This indicated that short-term traders saw incremental gains from January 4. However, long-term holders (365-day MVRV) were yet to cross above the neutral line; hence they were yet to post any gains.

ETH’s development activity also recorded a gradual increase in the past two weeks. This indicated that developers kept building the network in the same period. This could boost investors’ confidence and further prop up ETH’s value in the long run.

In addition, ETH’s trading volume increased in the same period but dropped sharply at press time. Although the drop could undermine uptrend momentum in the short run, ETH volumes could increase if BTC is bullish.

Therefore, investors should monitor BTC, especially if it moves above $21K. Such a move would set ETC to reclaim its November high.