Ethereum stablecoin supply hits record $132B—What’s fueling ETH’s demand?

- The stablecoin supply on Ethereum has reached a new all-time high, signaling strong growth on the network.

- Across Ethereum protocols, an additional $5 billion has been added as transaction activity surges to new levels.

After a sharp 26% decline in the past month, Ethereum [ETH] has taken a different path, rallying 8.44% in the past 24 hours. This upward movement is likely to continue, as increasing activity fuels further market interest.

At present, key metrics show significant growth, suggesting that market participants are accumulating ETH, which could drive prices higher in the coming weeks. AMBCrypto has analyzed several factors contributing to ETH’s potential rally.

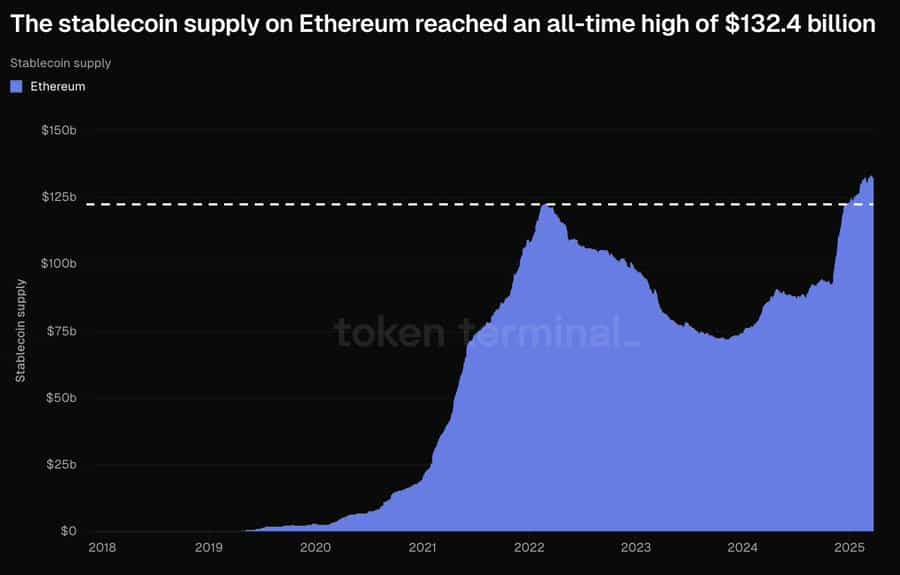

Stablecoin supply on Ethereum reaches a new high

Ethereum, known for its innovation-friendly ecosystem, continues to attract stablecoin deployment. Its total stablecoin supply recently hit an all-time high of $132.4 billion; the highest level since its inception.

Stablecoins are cryptocurrencies designed to maintain a 1:1 peg with assets like the U.S. dollar, offering traders and investors a hedge against market volatility. They have become a preferred option for storing assets and facilitating cryptocurrency transactions.

An increase in stablecoin supply on a blockchain often signals growing demand, as traders position themselves for higher buying activity. AMBCrypto explored additional factors to assess their potential impact on these assets.

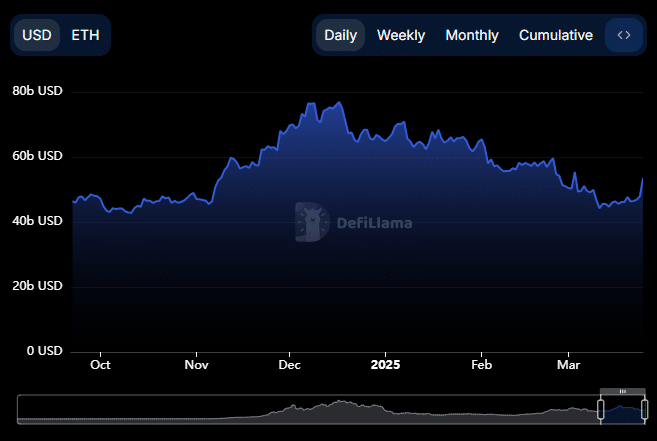

Liquidity inflows to Ethereum surge

Ethereum has seen a major surge in liquidity inflows following its stablecoin supply reaching a record high.

DeFiLlama’s Total Value Locked (TVL), which assesses ecosystem growth, shows that Ethereum’s TVL has risen to $53.448 billion in the past 24 hours, up from $47.92 billion, a $5.5 billion increase.

This growth suggests increased accumulation of Ethereum, with the asset being locked across multiple protocols, reflecting heightened investor interest.

AMBCrypto also noted a rise in Ethereum’s netflow, ranking it as the second-highest chain in liquidity inflows in the past 24 hours, just behind Berachain.

Data from Artemis shows that $22.2 million was added to the Ethereum network, reinforcing ongoing positive developments.

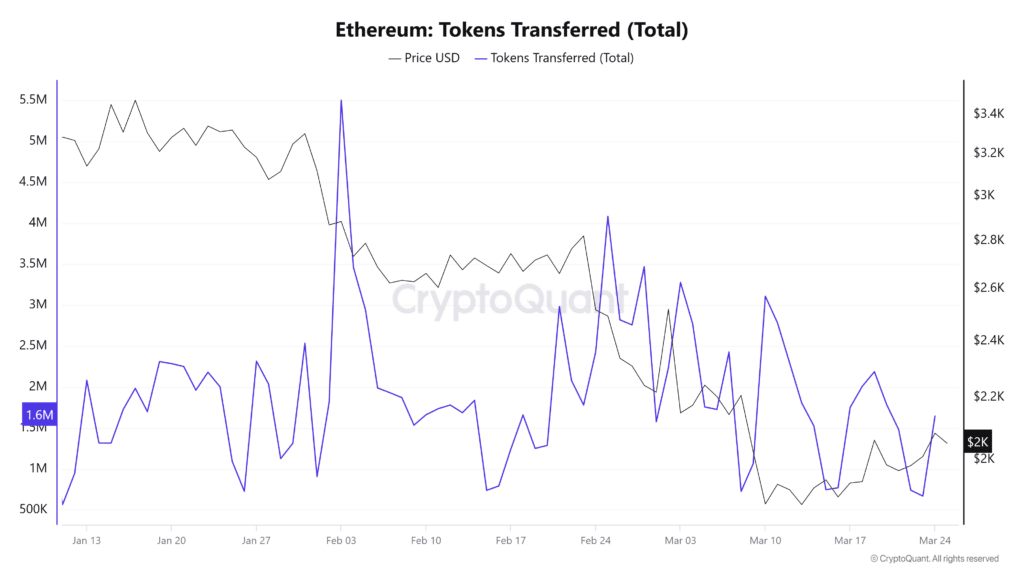

Long-term ETH holding on the rise

Ethereum’s total token transfers have surged by approximately 9.33% in the past 24 hours, pointing to increased market activity. This movement could indicate either buying or selling pressure.

To clarify, AMBCrypto analyzed Ethereum’s exchange reserves and concluded that recent transfers are supporting a positive price outlook for ETH.

Exchange reserves represent the amount of ETH available for trading. Higher reserves typically indicate increased selling pressure, whereas lower reserves suggest long-term holding.

The recent decline in ETH reserves implies that traders are transferring their assets to private wallets for long-term storage, which could have a favorable impact on ETH’s price over time.