Ethereum staking – All about Coinbase’s February market share of 11.4%

- Coinbase controlled 11.4% of Ethereum’s staking market share in February

- Ethereum educator Sassal noted that Coinbase may ve the largest node operator

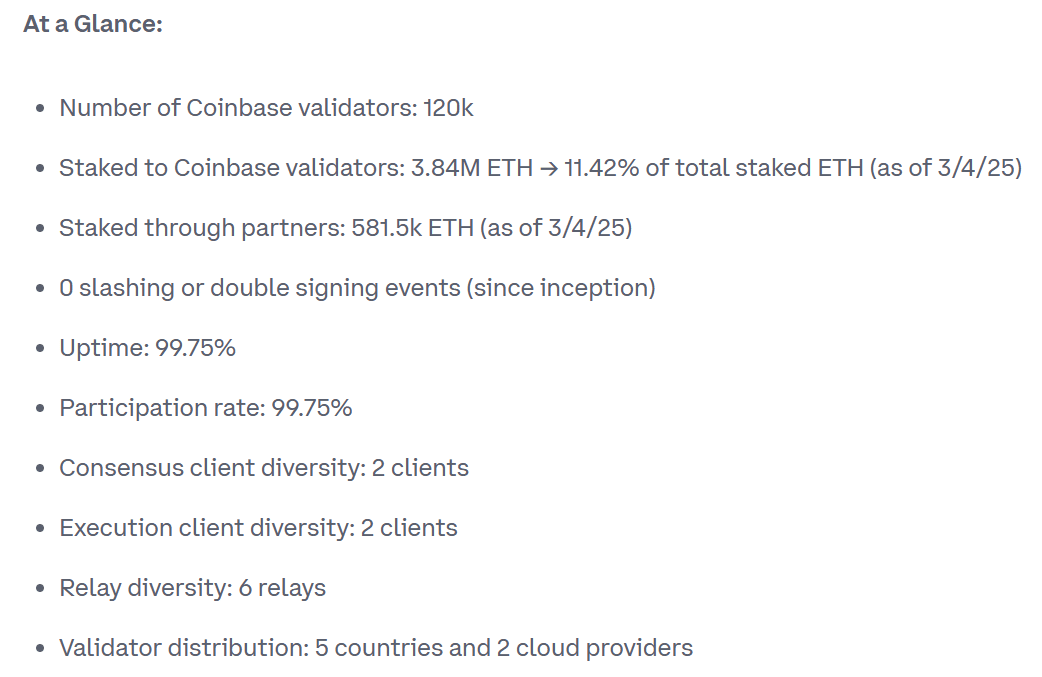

In February, Coinbase had 120k validator nodes and controlled 11.4% of the total Ethereum [ETH] staking market. According to a transparency report issued by the exchange, it had 3.84M ETH staked in its validators.

The validator nodes were located in Japan, Ireland, Singapore, Germany and Hong Kong. Additionally, Coinbase relied on two execution clients and cloud providers to ensure reliability.

Ethereum staking on an expansion spree

Reacting to the report, Ethereum educator Sassal acknowledged that the 11.4% market share made Coinbase the largest validator node operator.

“This, of course, makes Coinbase the single largest node operator on the network (Lido is bigger as a collective, but each node operator has a much smaller % share).”

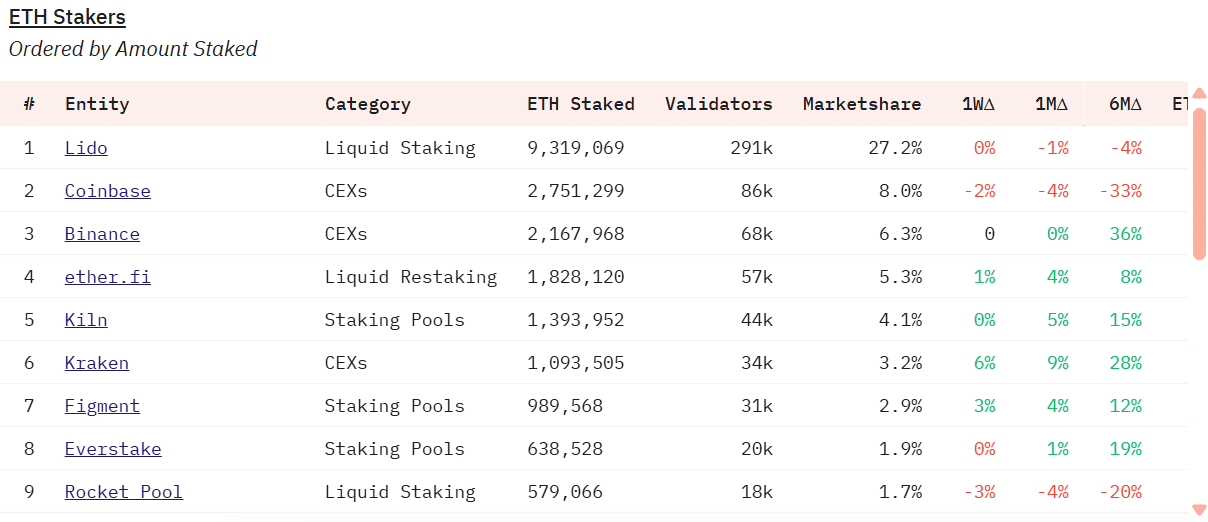

The report was issued after key industry players urged Coinbase to share its Ethereum staking operations, as most data were based on estimates. In fact, Dune Analytics estimated Coinbase’s market share at 8% with 2.7M ETH staked.

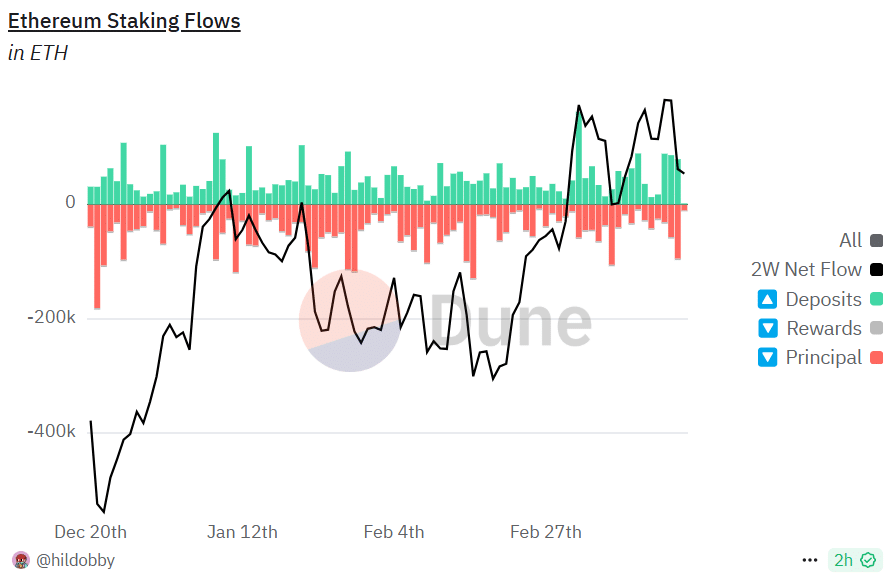

In terms of staked ETH, Lido seemed to maintain its lead with a whopping 9.3M staked ETH. Overall, 34.1M ETH has been staked or 27.7% of the total supply. After a slump in January 2025 that was marked by outflows, ETH staking rebounded from February.

Over the past two weeks, 54k ETH flowed into the staking system and reinforced confidence in the altcoin. This, despite a massive drawdown on the price charts.

According to Staking Rewards, ETH stakers are entitled to a 3% annualized reward, offering an extra yield for long-term investors.

However, despite the record interest in ETH staking, the altcoin’s price has lagged others on the price charts. It was valued at just over $2k, at the time of writing, down 54% from its recent highs.