Ethereum

Why a hike in Ethereum staking is not without risks

ETH staking, which was originally thought to be a risky proposition owing to withdrawal ambiguity, got a boost after the Shapella Upgrade.

- The amount of ETH staked surged to nearly 23 million at the time of writing.

- Due to Coinbase’s legal troubles, the growth of ETH staking has stalled.

The much-awaited but delayed Shapella Upgrade, which went live on the Ethereum [ETH] mainnet about two months ago, has begun to progressively advance towards its goal of boosting ETH staking.

Is your portfolio green? Check out the Ethereum Profit Calculator

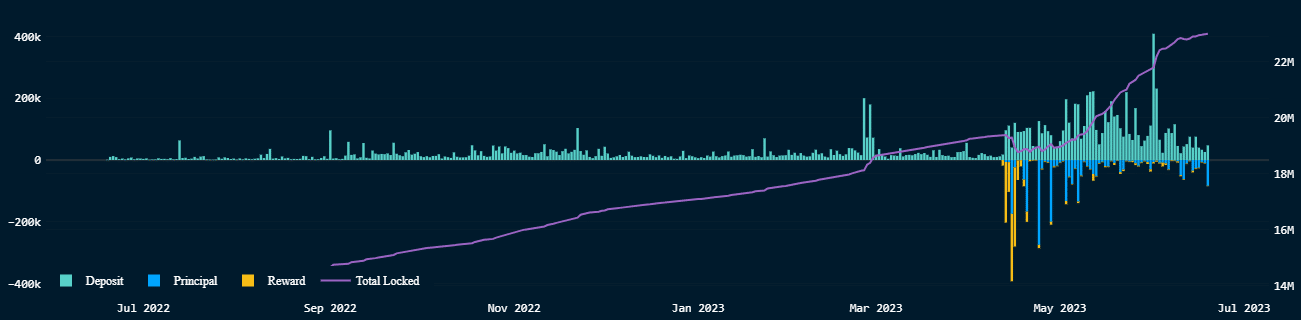

Data from on-chain analytics firm Nansen showed that the amount of ETH staked on the largest proof-of-stake (PoS) network surged to nearly 23 million at the time of writing. This amounted to an increase of 18% from what it was on 12 April, the day the Shapella Upgrade was executed.

Greater confidence in staking

Staking, which was originally thought to be a risky proposition owing to withdrawal ambiguity, got a boost after the Shapella Upgrade permitted users to unstake their ETH. This confidence led them to restake their ETH after an initial burst of withdrawals.

As per Nansen’s dashboard, deposits sent to the Beacon contract have consistently outpaced withdrawals over the last two months.

Though incidents like the U.S. Securities and Exchange Commission’s (SEC) lawsuit on crypto behemoth Coinbase over the latter’s staking program resulted in an increase in withdrawals in June, the overall sentiment has been in favor of staking and earning yields.

Worrisome developments

Amidst all the hype, there were some underlying concerns. As per Glassnode, the number of new addresses locking 32 ETH in Ethereum’s smart contract dipped steadily in June after spiking to an all-time high (ATH) value of 12.86k in the first week.

Thsi might have to do with the regulatory scrutiny of Coinbase, previously one of the biggest mediums for ETH staking. The FUD caused customers to withdraw their holdings from the exchange while also discouraging new users from participating in staking through centralized exchanges (CEXs).

Data from Dune lent credence to this observation. Notably, the contribution of CEXs to ETH staking plunged to 1.6% on 19 June, the lowest since ETH staking was introduced in December 2020.

Read Ethereum’s [ETH] Price Prediction 2023-24

Volatility plummets

At the time of writing, ETH, the second-largest cryptocurrency by market cap, exchanged hands at $1,725.52, according to CoinMarketCap

.ETH’s long-term volatility saw a threefold decline. It fell from a high of 150% in 2021 to 46% until 19 June. This implied that trading activity had considerably slowed down.

Volatility is perhaps the best lagging indicator of #crypto activity.

90D vol for #BTC and #ETH is at multi-year lows, a near identical trend line with trade volume. pic.twitter.com/CEBrGDTEcf

— Kaiko (@KaikoData) June 19, 2023