Ethereum stalls at $2.7K, but THIS pattern could be a 2023 déjà vu

- Ethereum’s Average Order Size on Binance spiked for the first time since December 2023, signaling whale return.

- ETH remained locked in a range between $2.4K and $2.7K, with no breakout despite heavy buying pressure.

Ethereum [ETH] whales may be staging a quiet comeback, particularly on Binance.

After fading during weeks of sideways price action, fresh on-chain signals suggest large buyers are returning to the fold.

Earlier in May, when ETH started recovering, whale activity surged to 10,000 daily transactions. But as prices stagnated, those numbers faded, dropping as low as 3,000.

However, things now appear to be shifting.

According to CryptoQuant’s analyst Dark Frost, Ethereum whales have returned to Binance, as evidenced by Average Order Size.

This metric has lit up for the first time since December 2023, shortly before ETH surged from $2.2k to $4k.

Whale orders rise, netflows flip bullish

In fact, since the 19th of May, Whale Orders on Binance started to show up again, reflecting growing market confidence.

This is significant, especially since whales position themselves early when a macro trend starts to show signs of strength.

Therefore, the shift in this metric shows that large entities on Binance are currently buying Ethereum.

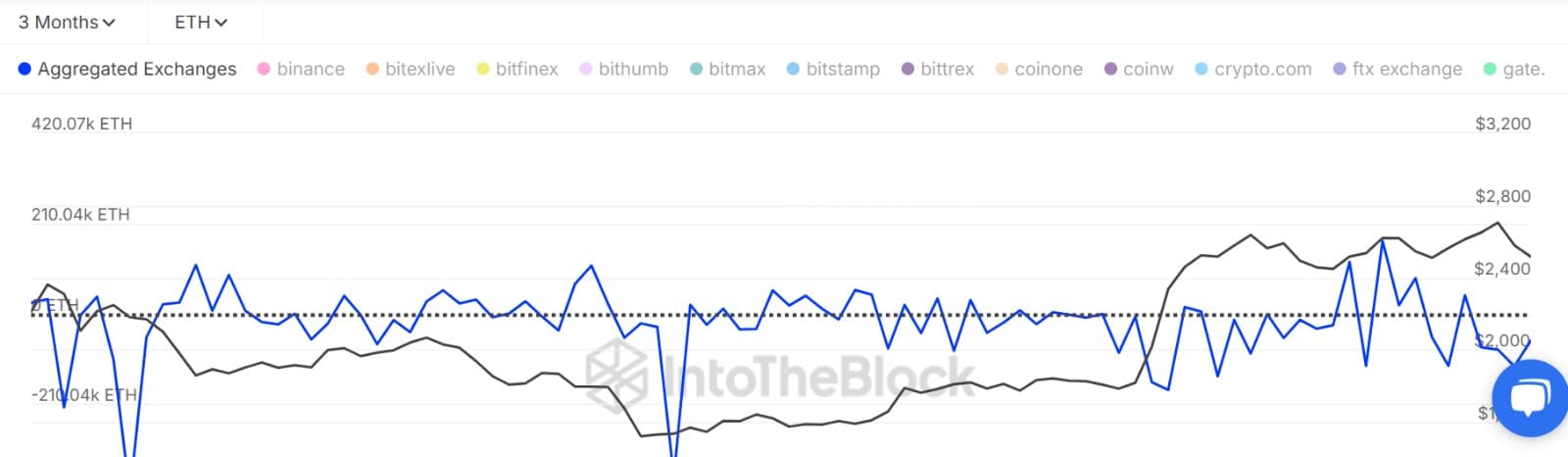

When we look at the overall capital inflow from whales, we see that Ethereum whales cumulatively bought 301k ETH tokens.

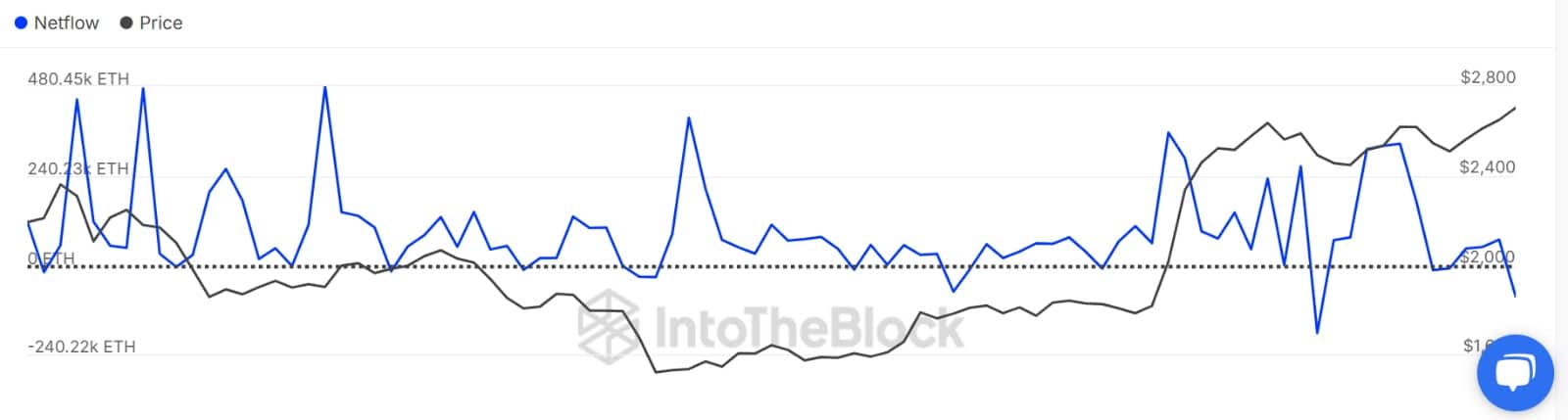

With the altcoin’s Large Holders Netflow spiking from a negative value to 108k ETH, it suggested that whales are buying more than they are selling.

Spot buyers dominate as retail joins the move

In addition to the whale buying spree, other market participants are also buying Ethereum.

In fact, smaller investors appear to be joining the momentum. Spot market activity showed a Cumulative Volume Delta of +6.35K ETH. Buyers scooped up 57.3K ETH, firmly dominating sellers.

Accompanied by a higher buying pressure from large holders, Ethereum Exchange Inflows have declined significantly.

Since hitting a positive value of 42k ETH four days ago, Exchange Netflow has dipped sustainably, holding within negative over this period. A negative netflow implies that even on exchanges, outflows are outpacing inflows, reflecting significant accumulation.

Impact on ETH?

Although Ethereum whales are back on Binance, whale activity is yet to positively impact ETH price movement.

As of press time, Ethereum traded at $2,512, down 0.38% on the day. This extended a four-day slide, showing that selling pressure still lingers.

This implies that Ethereum is still experiencing a strong battle between bulls and bears in the market.

In fact, the current consolidation between $2.4K and $2.7K shows the market is locked in a tug-of-war. Whale buys are absorbing exits, but not breaking resistance.

Thus, while buyers are active in the market, the same can be said for sellers. Therefore, until Ethereum buyers manage not only to absorb the selling pressure but also to outpace it, the market will remain stuck within this range.

If it happens so, a breakout above $2.7k will emerge.