Ethereum: Still bullish on ETH’s price? Here’s why you might be right

- Ethereum outflows surged despite ETH’s price seeing volatility

- While traders got liquidated, long-term hodlers remain hopeful

Over the last few weeks, Ethereum [ETH] has remained stagnant around the $3,500-price range. However, a recent correction pulled down ETH’s price on the charts significantly, fueling a change in sentiment.

Outflows on the rise

Despite this correction, however, there have been significant outflows of approximately 1,000,000 ETH, equivalent to $3.41 billion, from exchanges since March. This trend persists despite macroeconomic challenges and apprehensions regarding a potential rejection of a spot ETH ETF by the SEC.

Such outflows indicate that individuals are actively engaging in real activities on the Ethereum network, such as transaction payments, staking, and restaking. This also means they are confident in holding ETH despite unfavorable market conditions, rather than solely engaging in speculative trading. Nevertheless, liquidity for spot ETH remains highly valued.

Traders bleed

At press time, ETH was trading at $3,254.80, with its price down by 2.68% over the last 24 hours. Due to the swift decline in ETH’s price, many traders’ positions got liquidated too. In fact, according to Coinglass’ data, $57.22 million worth of positions were liquidated over this period. Of this amount, approximately $41 million worth of long positions were liquidated.

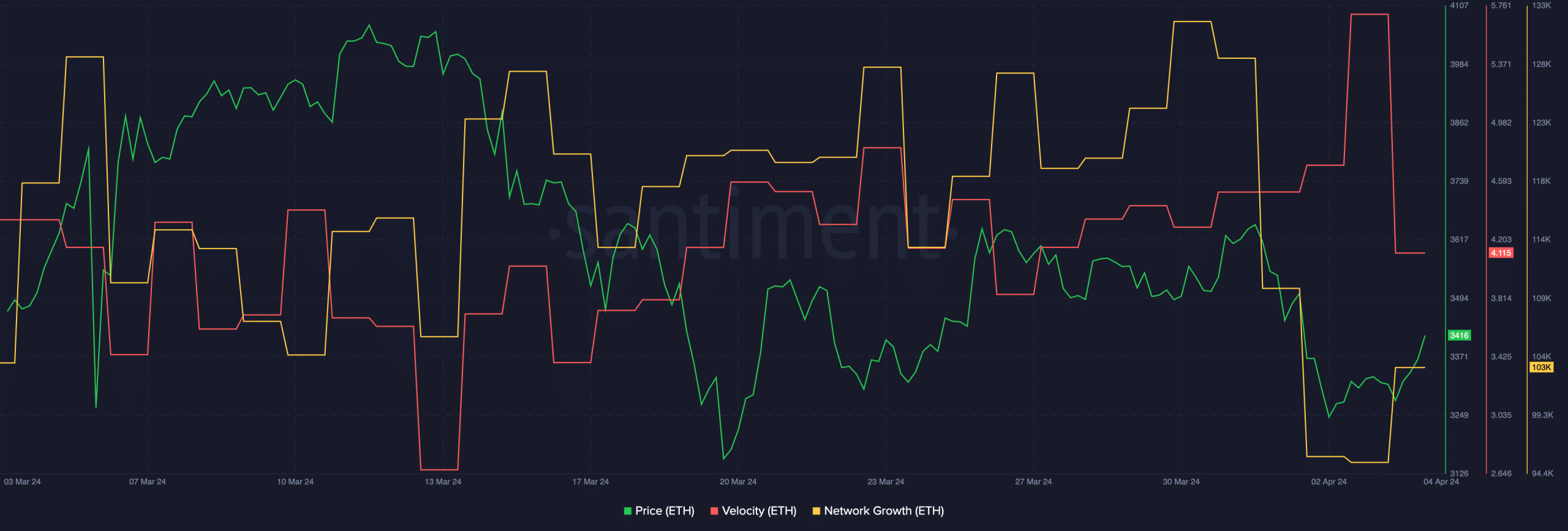

The velocity at which ETH was trading at also fell in the last few days. This implied that the rate at which ETH was being traded declined materially. Moreover, the network growth of ETH has also decreased considerably, indicating that new addresses have been losing interest in ETH.

A lack of interest from new addresses could affect buying pressure for ETH in the future and may impact its ability to climb back to the $3,500-level.

Long-term holders show faith

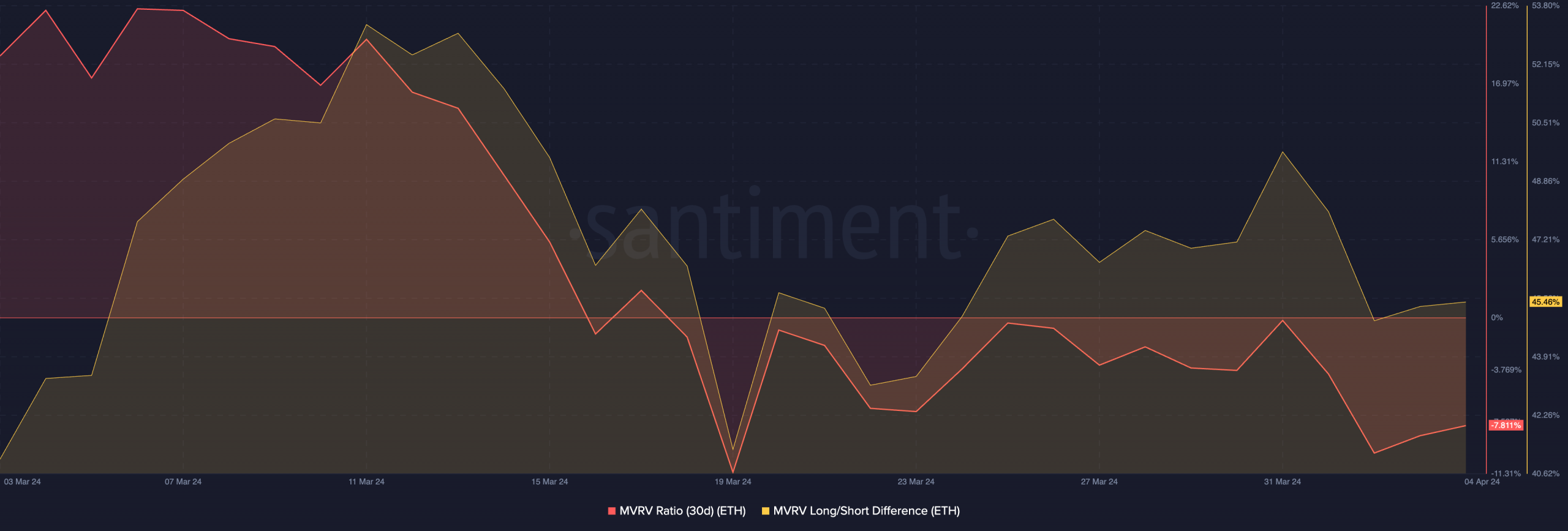

Due to the price correction, ETH’s MVRV ratio fell significantly. This indicated that most ETH holders were not profitable, at the time of writing. This could be interpreted positively as most of these holders don’t have any incentive to sell their holdings and the price of ETH could sustain its current levels going forward. Moreover, the Long/Short difference for ETH also spiked over the last few weeks.

Read Ethereum’s [ETH] Price Prediction 2024-25

A rising Long/Short difference means that long-term holders outnumber the short-term holders. These long-term holders are less likely to sell their holdings and don’t tend to react impulsively to price fluctuations.