Ethereum supply shift: 52% ETH now held by large investors

- Large ETH holders have added over 10% to their holdings in the past year.

- 52% of ETH is now concentrated with large holders.

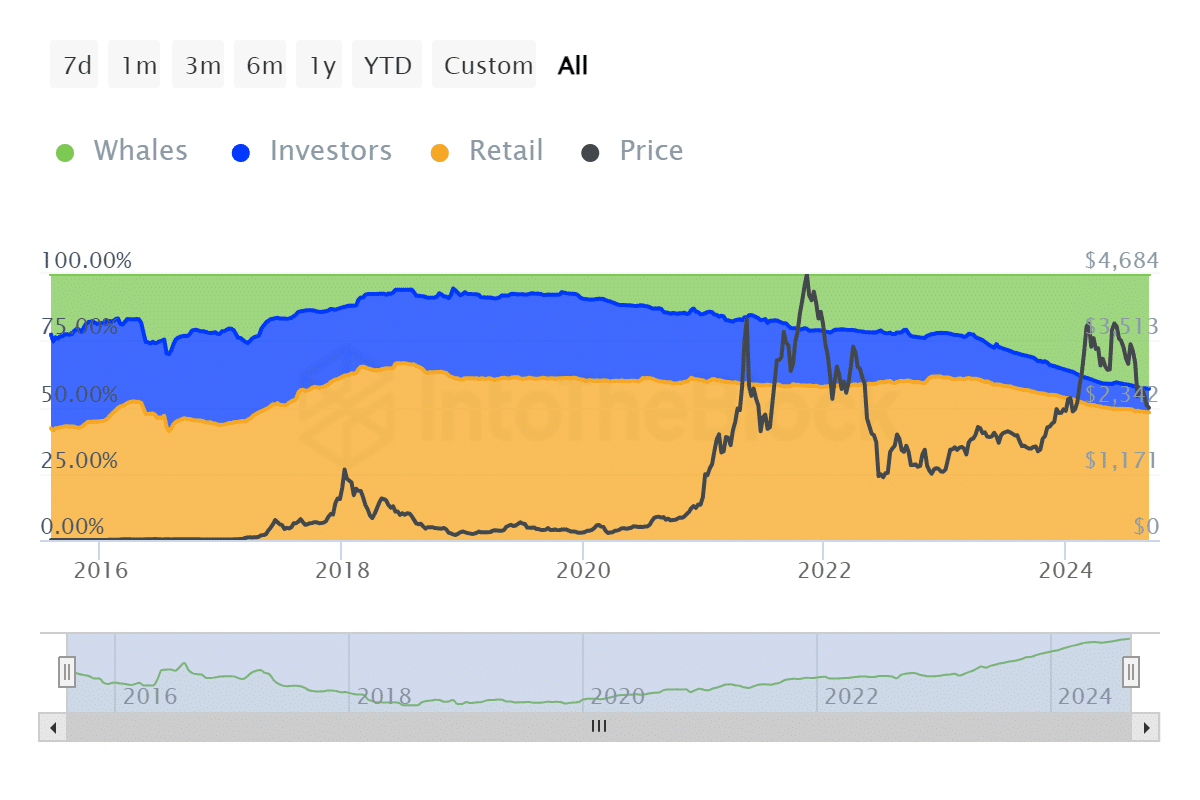

Ethereum [ETH] has experienced a significant growth in the number of its large holders, often referred to as whales. New data indicates that the percentage of ETH supply held by these whales was gradually catching up to the amount held by retail investors.

Large holders, including whales, control more than half of the total ETH supply.

Large holders get more Ethereum

According to data from IntoTheBlock, Ethereum whales now hold approximately 58.37 million ETH, representing over 43% of the total Ethereum supply.

This marks a significant increase from the 30% they held last year, suggesting that large holders have added more than 10% to their holdings over the past year.

The data also highlights that this accumulation accelerated notably after the Shanghai upgrade, which allowed Ethereum withdrawals for stakers.

The total supply held by whales was now approaching the 48% held by retail investors, showing that whales are catching up quickly.

Furthermore, more than 52% of Ethereum’s total supply is now concentrated among large holders, including both whales and institutional addresses.

Ethereum stakes increase with large accumulation

In early 2023, the accumulation of large Ethereum holders increased significantly, coinciding with the Shanghai upgrade. Retail investors held around 56% of the total ETH supply at that time.

However, as the holdings of large addresses grew, the supply held by retail investors gradually declined.

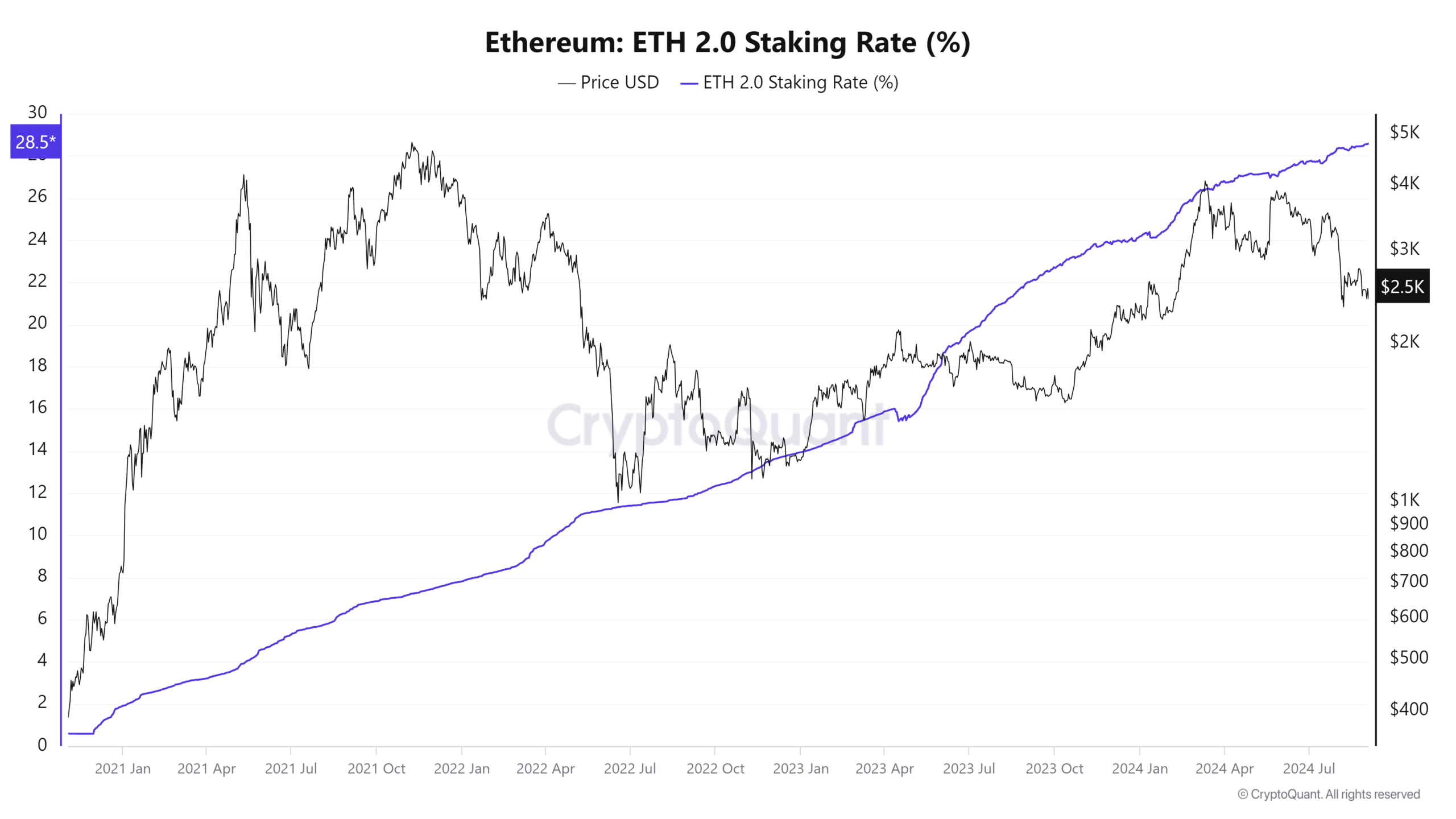

Interestingly, the analysis of exchange reserves showed that these reserves continued to decline during this period. This indicates that the ETH sold by retail investors and other groups was absorbed by large holders rather than ending up on exchanges.

This suggests that whales were actively buying up the ETH sold by smaller holders, reducing the available supply on exchanges and tightening liquidity.

Additionally, the percentage of staked ETH has continued to rise. As of this writing, more than 28% of the total Ethereum supply is currently staked. This indicates that a large portion of ETH sold off by retail and other holders has likely been staked rather than traded on exchanges.

The combination of staked ETH and whale accumulation supports a bullish outlook for Ethereum. A decreasing exchange supply and rising staked supply often lead to supply constraints, potentially driving up prices in the long term.

ETH remains bearish

As of this writing, Ethereum (ETH) is trading at around $2,340, following a 2.7% increase in the last trading session. This marks the third consecutive day of price increases for ETH.

However, despite this recent upward movement, more is needed to alter Ethereum’s overall trend, which remains bearish.

Read Ethereum (ETH) Price Prediction 2024-25

The ongoing bearish trend indicates that while short-term positive momentum exists, the broader market sentiment still leans toward caution.

Ethereum would need to break through key resistance levels and sustain a stronger uptrend for a more significant shift to occur.