Ethereum: Support or resistance, which level will break first?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH’s trend on lower timeframes differed from the market structure on higher timeframes.

- A steep decline in exchange supply could present bulls with a chance to rally past key resistance.

Ethereum [ETH] continued to present investors with differing on-chart narratives. On the higher timeframes such as the 12-hour and daily, ETH’s market structure remained bullish, as the upward trend stayed intact. However, on the lower timeframes such as six-hour and four-hour, the bears held sway due to the price rejection at the $2,128 resistance level.

Read Ethereum’s [ETH] Price Prediction 2023-24

This has left Ethereum stuck in a range for over a month, as its price action aligns closely with Bitcoin’s [BTC].

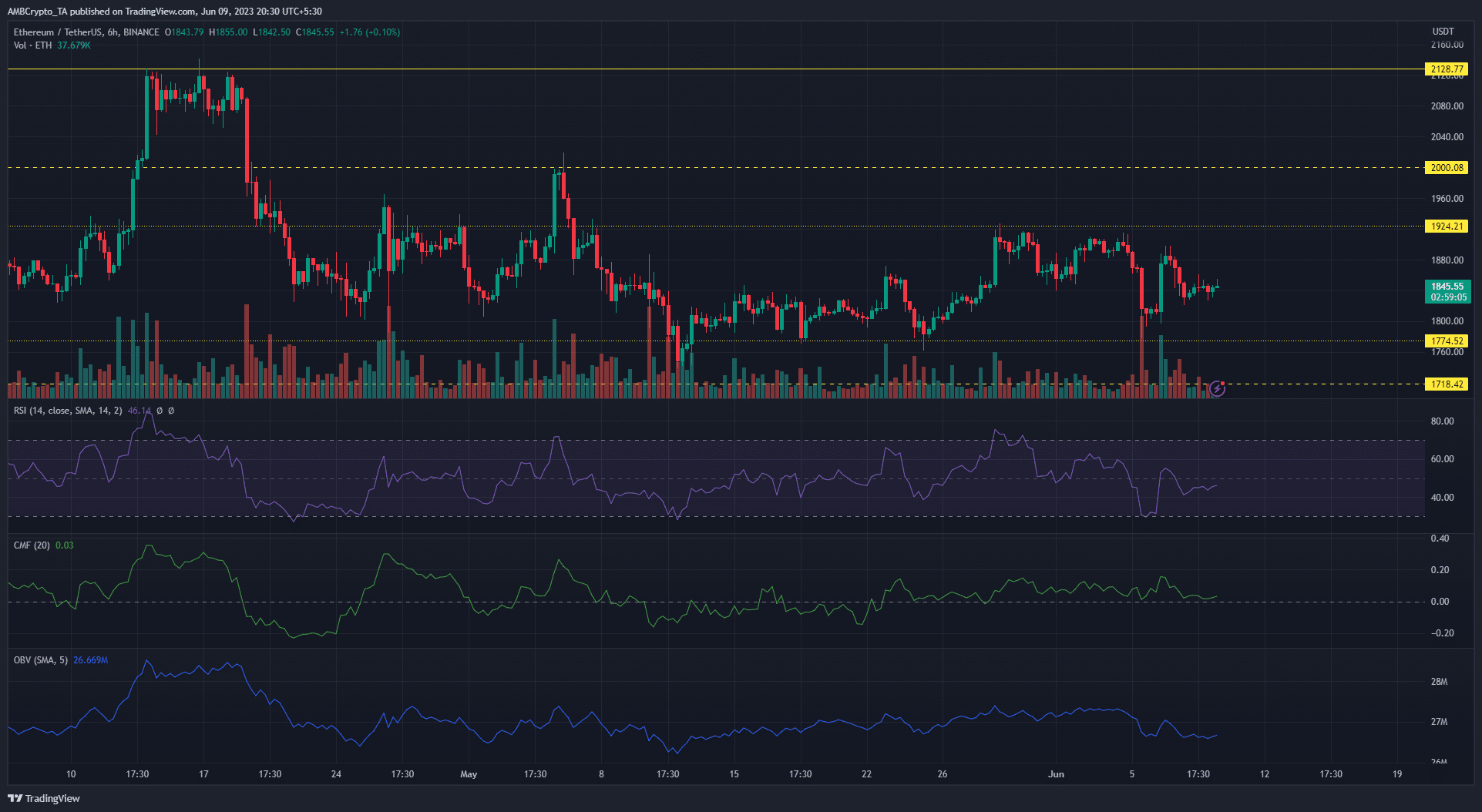

Bears and bulls evenly matched on lower timeframes

The price rejection at the $2,128 resistance level sank Ethereum to the $1,774 support level on 12 May, ushering a bearish trend on the lower timeframes. This subsequently saw ETH oscillate between the $1,774 support and $1,924 resistance levels with neither bears nor bulls possessing the required momentum to break either level.

ETH’s ranging activity could continue due to prevailing market conditions and price trading at the mid-range of $1,848, as of press time. The on-chart indicators showed neutrality, as buyers and sellers continued to evaluate their positions.

The Relative Strength Index (RSI) hovered above and below the neutral 50 mark, since 6 June. It stood at 47, as of press time to highlight the market’s neutral position. The On-Balance Volume (OBV) maintained its linear movement, while the Chaikin Money Flow (CMF) hovered just above the zero mark with a slightly positive reading of +0.03.

A retest of either support or resistance level could yield significant results for bears or bulls, as both levels have been tested multiple times. A break below $1,774 will see bears push for $1,718. On the flip side, a break above $1,924 will see bulls push for the key $2,000 level.

How much are 1,10,100 ETHs worth today?

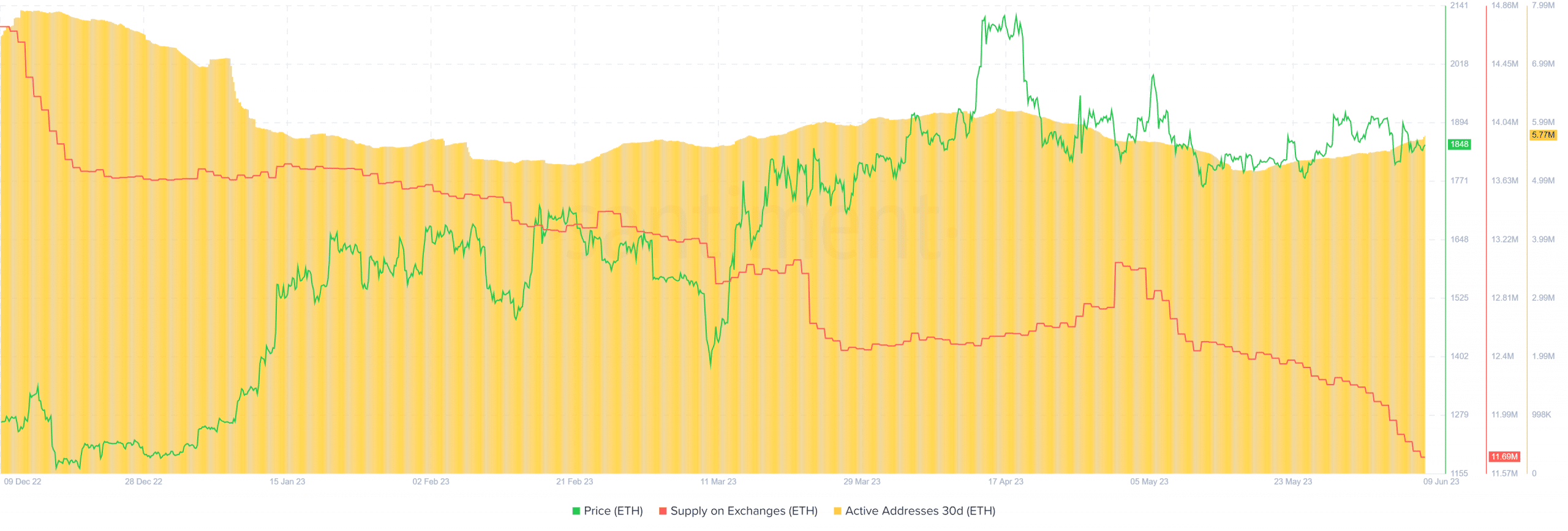

Bulls hold a slim advantage

Data from Santiment showed that ETH’s supply on exchanges had been on a steep decline since 1 May. This highlighted eased selling pressure which could give bulls an opportunity to rally.

Conversely, the rise in active addresses echoed rising bullish sentiment. Active addresses on Ethereum rose from 5.3M on 23 May to 5.77M, as of press time. With the funding rate remaining positive, a significant bullish charge could be on the horizon.