Ethereum

Ethereum: The yin-yang of Merge and ETH’s negative price action

Ethereum [ETH], the largest altcoin, remained in a bearish zone as it stood below the $1,150 support zone, at press time. It suffered a fresh 2% correction as it traded closer to the $1,000 mark at the time of writing. ETH’s prices have been trading within a range for quite some time now.

But are investors making a profit in the current market structure as the highly anticipated Merge draws closer?

Whatever it takes

ETH has witnessed an ‘improved’ sentiment in the past three weeks given the inflows in the Ether-based products. Meanwhile, HODLers have taken this opportunity to understand the market better.

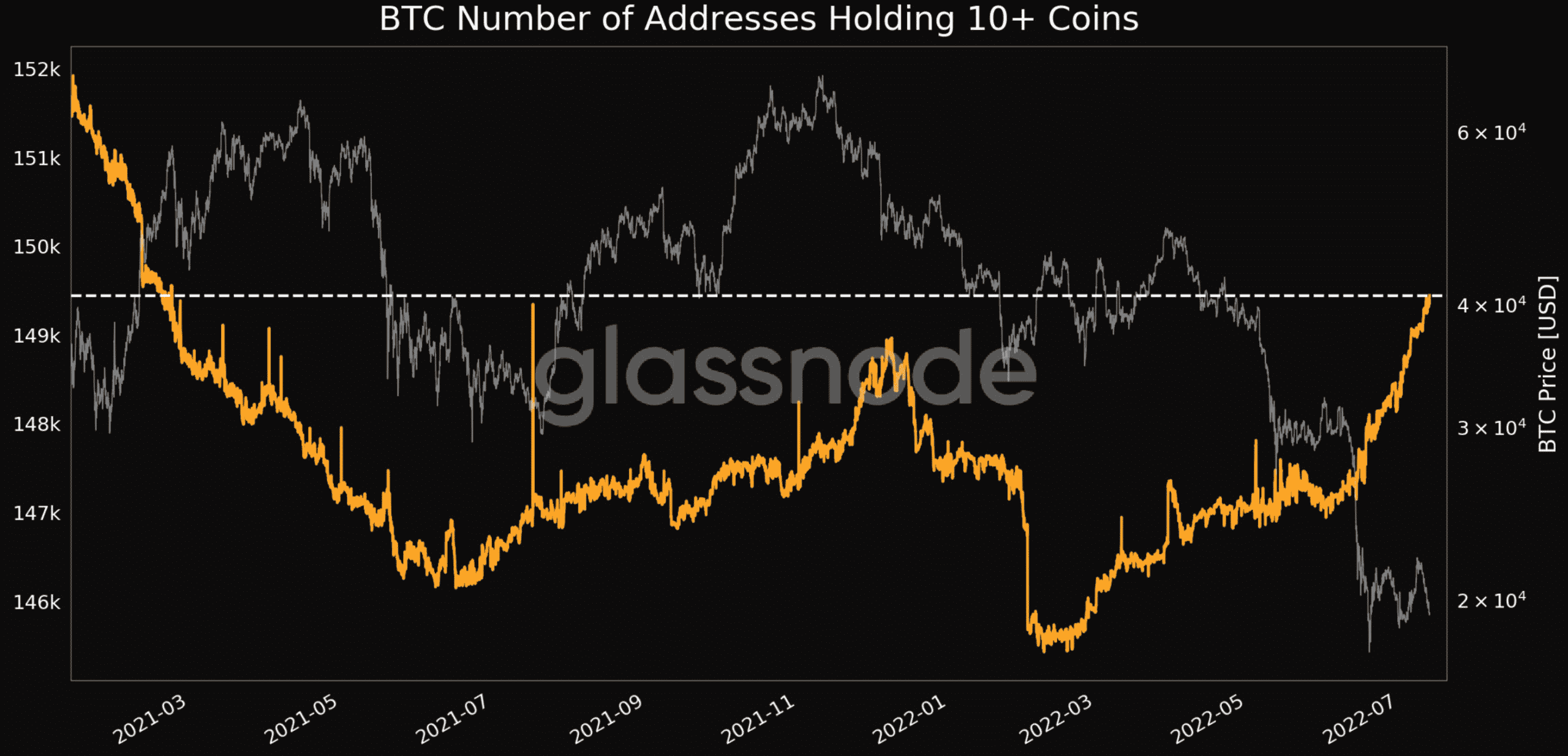

According to Glassnode data, the number of addresses holding 10+ Ethereum (ETH) has hit a 16-month high of 149,448.

This clearly shows the fact that despite the hiccup, HODLers continued to buy the dip. Not just this, but HODLers even chose to stake their holdings.

Consider the following scenario- Data from Glassnode suggests that the number of ETH addresses with over 32 ETH has surged to a 16-month high of 116,774. In order to be a validator on Ethereum 2.0, the proof of stake (PoS) version of the blockchain, an address needs to have at least 32 ETH.

That’s exactly the case here, HODLers are leaning towards staking their ETH.

This increase in address balances directly contributes to the amount on Ethereum 2.0. The ETH 2.0 deposit contract likewise painted a similar picture.

The total value locked in ETH 2.0 deposit contract continues to record new all-time highs. As of 13 July, the number of staking ETH 2.0 deposit contract addresses reached 13,024,853. Furthermore, the staking rate surpassed the 11.5% mark.

In fact, the new value-added to the ETH 2.0 Deposit Contract reached a one-month high of $21,722,571 (20,544 ETH) as per data from Glassnode.

Tit for tat

There’s no denying that ETH has witnessed some dark days in the past and continues to do so. Furthermore, indicators such as the massive decline in ETH’s DeFi dominance as well as the decrease in NFT sales do raise red flags about ETH’s positive price action.

While at one end ETH created headlines across the industry for its low gas fee, on the other, it suffered criticism from its investors for the negative price action.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)