Ethereum: THIS can majorly impact ETH’s $5K price prediction

- Exchange inflow reached January highs, putting the ETH’s price at risk.

- Though the reward ratio dropped, a key indicator suggested that ETH could rally above $4,700.

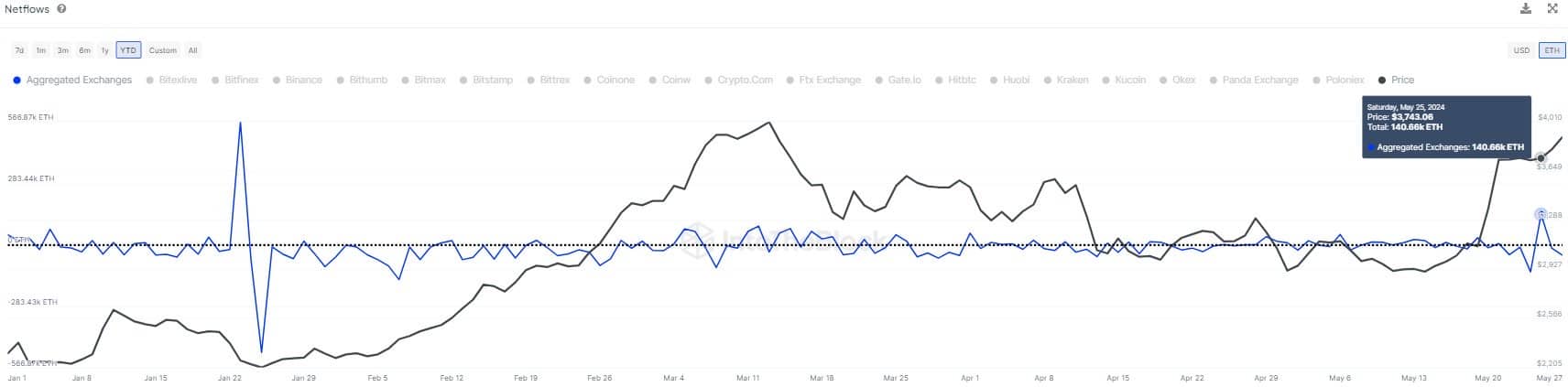

Almost six months since it last hit the highest exchange inflow, Ethereum [ETH] is back in the same situation, sparking speculations that the price could swing lower.

At press time, ETH’s price was $3,874. According to data from IntoTheBlock, the exchange inflow was as high as 140,660 on the 25th of May.

While the inflow has not shed much, AMBCrypto’s deep-dive into the rabbit suggested that the bullish prediction might not come as fast as market participants expected.

Is a new low coming?

This is because the high flow of cryptocurrencies into the exchange is a sign of increased selling pressure. As such, it might be challenging for Ethereum to hit a higher price unless the pressure slows down.

AMBCrypto’s investigation showed that the rise in the sale of the altcoin could be linked to its recent price increase. A few days ago, ETH’s value was over $3,900. This was a 16.82% rise in the last 30 days.

The approval of the Ethereum spot ETFs fueled this hike. But the asset was not trading live yet. However, many opinions suggested that ETH’s price could rally past $4,500 or hit $5,000 once the ETFs go live.

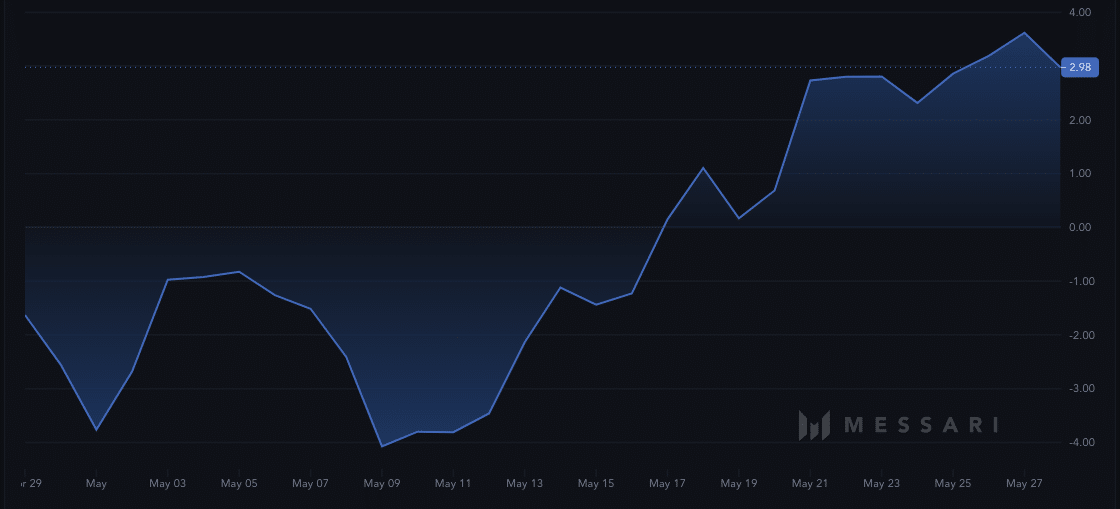

If selling does not stop by that time, this prediction could slip away from the heavyweight in the short term. To assess this, AMBCrypto looked at Ethereum’s Sharpe Ratio.

This ratio shows the risk-adjusted performance of an asset. If the reading of the Sharpe Ratio is negative, it means that the asset involved is producing bad returns for holders.

Between 1 and 1.99 is considered a good risk-to-reward ratio. Should the reading rise above 3, it means that the cryptocurrency is offering good returns relative to the risk of investment.

According to Messari, the metric hit a ceiling of 3.62 on the 27th of May. But at press time, the ratio has declined to 2.98, indicating the returns were no longer excellent but at a moderate pace.

The bull phase might start from $4,713

Should the reading continue to fall, so will ETH’s price. However, the long-term potential of the cryptocurrency remained extremely promising.

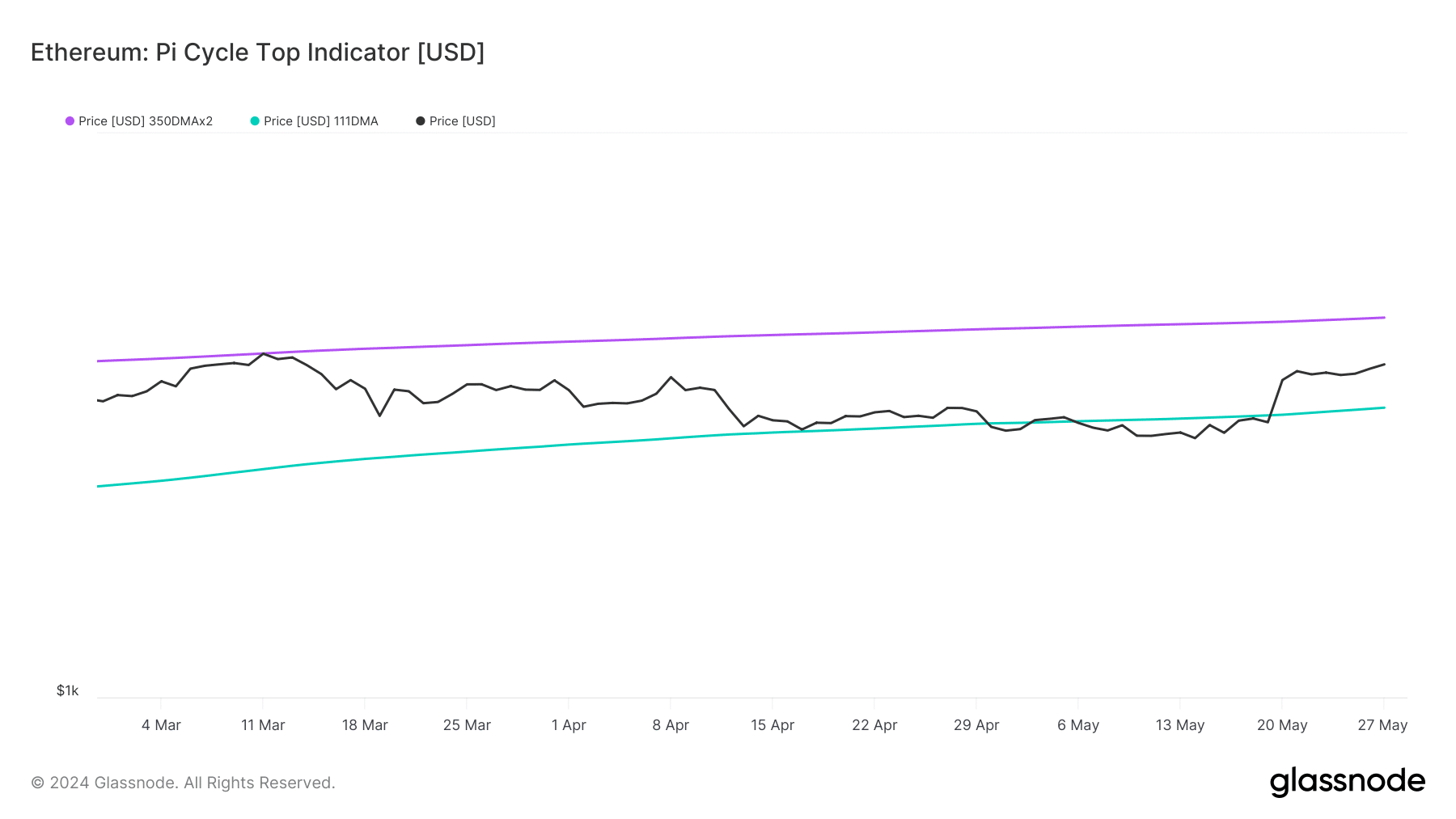

AMBCrypto gathered this after examining the Pi Cycle Top indicator. This metric uses the 111-day Simple Moving Average (SMA) and 350-day SMA to check if prices have hit an overheated point.

For Ethereum, using Glassnode’s data, the 111 SMA (green) was below the 350 SMA (purple). This suggests that the price has the potential to trade higher.

Is your portfolio green? Check the Ethereum Profit Calculator

Assuming a crossover of the shorter SMA over the longer one appeared, it would have spelled doom for ETH.

In addition, the indicator revealed that ETH’s price could hit $4,713 once the selling pressure fizzles out. Should this forecast come to pass, then the value could attempt testing $5,000.